- Learn more about mortgage basics and Your Creditworthiness.

- Lenders evaluate your willingness to pay - credit score and credit history.

- Lenders also evaluate your ability to pay - income and DTI

Getting a Mortgage Loan - Understanding Your Creditworthiness

Editor’s Note

In order to help you become a better shopper, take the time to read a few articles about mortgage basics. This is the second article in a three-part series. Make sure to read them all!

- The Basic Terms: Payment Schedules, Interest Rates and Fees.

- Credit Criteria: Credit Scores, Credit History, and Income Criteria

- House Value and LTV: Down-payment and Equity

Your mortgage lender will evaluate you based on your willingness to pay (your credit history) and your ability to pay (your income and debt). Mortgage lenders follow very complicated underwriting guidelines, to determine whether you qualify for a loan or not.

Some of the more common underwriting guidelines are written by the big companies and government institutions that buy or guarantee loans, such as Fannie Mae, Freddie Mac and HUD. However, big banks and mortgage lenders have their own rules and often apply stricter rules, called overlays.

Tip: The mortgage market is facing big changes in 2013 as the Consumer Financial Protection Bureau issues new rules. Read the Bills.com article about an important new rule, the Qualified Mortgage Rule (and the Ability to Repay Rule).

Although it is impossible to know all the rules, it is important that you understand the basic terms that deal with taking a mortgage and your creditworthiness. You're probably aware that your credit score is very important when applying for a loan. The most common credit scores are your FICO (Fair Isaac Company) scores. But, a mortgage lender looks at a whole range of credit issues, not just your FICO scores, to determine if you qualify for a loan.

Your lender reviews your overall credit to determine how risky it is to offer you a loan. Your lender examine things your:

- Willingness to Pay: Your lender focuses on your credit history and credit scores to gauge your willingness to pay.

- Ability to Pay: Your lender examines your monthly income and required debt payments and calculates your DTI (debt-to-income ratio) to see if you can afford to make your payments.

Willingness to Pay: Credit History and Credit Score

Do you pay on time or late? Do you have any collection accounts or public judgments? A mortgage lender judges your payment history on loans and credit you've taken out, to determine if you're likely to pay back your new loan.

Your Credit Score: A Gauge

In order to gauge your willingness to pay, a mortgage lender reviews your credit report and your credit score. Your credit score is an indicator of how you managed your credit accounts. The FICO score takes into account five main criteria as follows:

- Payment History: Do you make your payments on time?

- Amounts Owed and Credit Utilization: How much credit do you have available? How much are you using?

- Length of Credit: How long have you had your credit accounts open?

- Credit Mix: How many different types of credit do you have?

- New Credit: How much new credit have you applied for and how many recent credit inquiries do you have?

FICO scores range between 300-850. Most mortgage lenders require a credit score over 620. Some only offer loans to borrowers with scores over 720. There are some loans available to borrowers with scores below 620, including FHA loans.

Here is a sample ranking of scores. Keep in mind that you have a different FICO score from each of the three main credit bureaus- Experian, Equifax, and TransUnion. Most mortgage lenders qualify you for a loan based on your "middle score," the one that is neither the highest or lowest.

| Ranking | FICO score |

|---|---|

| Excellent | > 740 |

| Very Good | 700-740 |

| Good | 650-700 |

| Fair | 550-650 |

| Poor | <550 |

Example of Different Mortgage Rates for Varying Credit Scores

Your credit score affects how much you will pay.

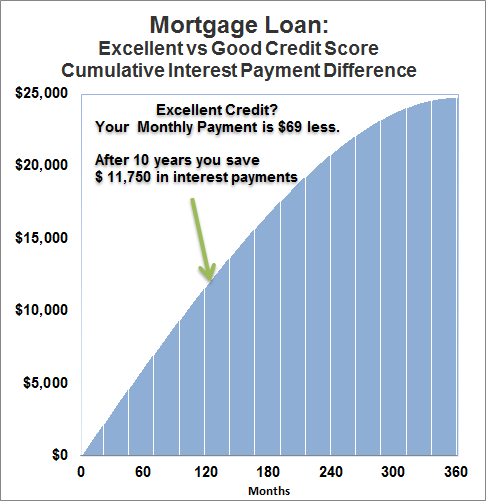

Depending on your FICO score, you interest rate will vary. A 750 FICO score will bring you best rates and save thousands of dollars.

Here is an example of a 30-year mortgage loan for $250,000:

| FICO Score | Interest Rate | Monthly Payment |

|---|---|---|

| 750 (Excellent) | 3.0% | $1,054 |

| 640 (Good) | 3.5% | $1,122 |

If you have excellent vs good credit, then your monthly payment would be $69 less. After 10-years you would owe $3,518 less. The graph below illustrates the cumulative savings in interest payments over the life of the loan. At the end of 10-years you would save $11,750 in interest.

Quick tip #1

Keep abreast of mortgage rates by checking out Bills.com mortgage rates table.

Your Credit Report: A Record of your Credit History

Lenders and creditors report your credit activity to the major Credit Reporting Agencies (CRAs), Equifax, Experian, and TransUnion. This includes your credit cards, retail installment credit, auto loans, student loans, and mortgages. There are other creditors, such as landlords, who may or may not report to CRAs. Some creditors such as your cell-phone carrier and your utilities generally do not report to the CRAs. However, if you have an account that goes to collections, then it will likely appear on your report and greatly harm your score. In addition, public records such as court judgments and liens are also recorded on your credit report.

Divide your accounts into positive accounts and negative accounts. An open positive account will stay on your report indefinitely and a closed account remains for 10 years from the date of the last activity.

Negative accounts remain for varying amount of times. A negative credit account remains for 7 years after the initial delinquency period of 180 days. You begin counting from the last day of activity. Some examples of negative accounts are accounts with a history of late payments - a late payment does not show on a credit report unless it reaches 30-days late) and accounts that went severely delinquent or were "charged-off." Other information such as a public judgments, bankruptcies, short sales, and foreclosures remain for a longer period of time, up to 10 years. Federal student loans are not erased from your report for as long as they remain delinquent. While some negative information will hurt your credit score, others can make it impossible to get a mortgage, until you rebuild your score and a certain amount of time has passed since the negative event.

Managing your Credit History and Credit Score

Before applying for a loan to purchase a home or to refinance your mortgage, make sure that you monitor your credit score and credit report. Here are some preliminary steps to take:

- Order your credit report at least once a year from each of the CRAs. You can order one free credit report from each of the CRAs every 12 months at annualcreditreport.com. If you stagger your requests, then you can get one free report every 4 months.

- Check to see that all the information is accurate. If not, dispute incorrect items to have them removed.

- Take steps to establish new credit and improve your credit score.

Quick tip #2

Your free report does not have your credit score. Get a credit report with your score for free, for a trial period, from a Bills.com provider.

Ability to Pay: Your DTI and Income Stability

What can you afford to pay? A mortgage loan is a long-term commitment with steady monthly payments. The most common type of mortgage loan is a fixed loan payment, based on a fixed interest rate. If you take an Adjustable Rate Mortgage(ARM) or a loan with a special payment schedule, such as one with interest-only payments, then you're taking on additional risks.

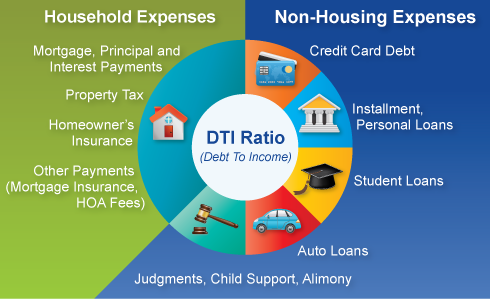

A mortgage lender looks at your income sources and their reliability. The underwriting rules for income qualification are complicated, especially for self-employed borrowers. The most basic criteria mortgage lenders will look at are your DTI ratio. You DTI ratio is calculated as follows:

- Total income: Your total monthly gross income based on all of your steady sources of income including wages, investment income, pension income, and rental property income.

- Total mortgage or housing payments: This includes your mortgage principal and interest payments, mortgage insurance, property insurance, property tax and if applicable HOA fees.

- Total non-housing debt payments: This includes many of your monthly reoccurring debt payments, including student loans, auto loans, installment loans, and your required monthly minimum credit card payments.

DTI: Two Types of Expense Categories

Mortgage lenders use different DTI ratios as follows:

- DTI (sometimes called back-end DTI): This you your total monthly housing and debt payments divided by your total gross income. FHA loans allow a 43% DTI, and conventional loans allow between 36-45%.

- Front-end DTI: This is your Monthly Housing payments divided by your Total Monthly Gross income. A basic financial rule of thumb ratio is that no more than 25% of your income should be used toward your housing payments. FHA loans require a front-end DTI of no more than 31%.

The graph below shows the different required DTIs based on a monthly income of $6000. In order to see how much mortgage you can qualify for check out Bills.com mortgage affordability calculator.

Summary: Mortgage Basics and Your Credit

Understanding a lender’s credit requirements is an important step to take before you apply for a mortgage loan. A mortgage lender wants to see proof that you have the ability to pay and the willingness to pay. That means you need to:

- Monitor your Credit Report and Credit score.

- Keep track of your budget and your monthly expenses. Pay close attention to the amount of debt that you have and make sure that your DTI is below the acceptable level.

- Account for savings in your budget, so that you will have a enough money to cover emergency expenses, reserves, and your down-payment and closing costs. Keeping your LTV (loan to value ratio) below 80% will save you money, because you can avoid mortgage insurance.

- Don’t make any big changes before taking out your mortgage. A change in job, missing a payment on a bill, or applying for new credit may affect your ability to get a mortgage loan.

Quick tip

#3: When you are ready to shop for a mortgage, then get a mortgage quote from a bills.com mortgage provider.

Mortgage market update: the latest

Mortgage rate fluctuations should come as no surprise. If you are buying a home or refinancing your existing mortgage, it is important to stay informed about the current mortgage rates.

Mortgage rates April 10, 2024

According to Freddie Mac, the 30-year mortgage rate for the week of April 10, 2024 stands at 6.88%. This 6 basis points increase from the previous week's rate.

Additionally, Freddie Mac reports that the 15-year mortgage rate for April 10, 2024 is 6.16%, indicating a 10 basis points increase from previous week’s rates.

Note: A basis point is equal to one-hundredth of one percent (0.01%). In numerical terms, if the mortgage rate changes by 20 basis points, it means the rate has changed by 0.20%.

What does the mortgage rate mean for you?

Mortgage rates play a vital role in determining your monthly payment. Let's take a look at the avergage interest rates (APR) for April 14, 2024 based on Zillow data for borrowers with a high credit score (680-740) in the United States:

- For a 30-year conventional loan, the interest rate is 7.09%.

- If you opt for a 15-year conventional loan, the interest rate stands at 6.29%.

Using the rates mentioned above, a $279,082 30-year-year mortgage would result in a monthly payment of $1,874. On the other hand, a 15-year mortgage would require a monthly payment of approximately $2,399.

Simplify your mortgage journey: Shop around and get pre-approved today!

To make the home-buying or refinancing process a breeze, we highly recommend shopping around for mortgages and getting pre-approved. So, why not Check Out mortgage rates now for the best options available.

Great article on explaining creditworthiness! Too many people, especially those with bad credit do not understand how their credit score affects their lives.