Minimum Credit Scores and Your Personal Financial Situation

- Credit scores vary between the big three Credit Reporting Agencies.

- There is no absolute minimum credit score. Mortgages, auto loans and credit cards have different requirements.

- Minimum credit score requirements vary between lenders.

My credit score is not so good but improving. Do lenders require a minimum credit score?

I am considering buying a home in a number of years. In the meantime I am trying to improve my credit by taking out a mix of credit cards, auto loans, and personal loans. I plan on taking amounts that I can easily afford. I am wondering if there is such a thing as a minimum credit score requirement?

Thank you for your question about credit and minimum credit scores.

If you are looking for a mortgage, auto loan, or credit card, then you know that credit scores matter. In fact credit scores are also used by landlords, some employers, and utility companies.

Credit Scores are important

They are used to help lenders determine if you qualify for many financial products. Many products have minimum credit scores. Even if you do qualify, credit scores are an important factor in determining your interest rate and fees. In general a low credit score means either not qualifying or paying a higher price for your loan.

What is a minimum credit score?

Credit scores are based on your credit history, as reported by the consumer credit reporting agencies — Equifax, Experian, and TransUnion. There are a number of different credit models for different types of loans (mortgages, auto loans, personal loans).

Here are the top three five factors based on the level of their importance of your FICO score:

- 35% on your payment history

- 30% on the amount you currently owe lenders

- 15% on the length of your credit history

- 10% on the number of new credit accounts you've opened or applied for

- 10% on the mix of credit accounts you have (mortgages, credit cards, installment loans, etc.)

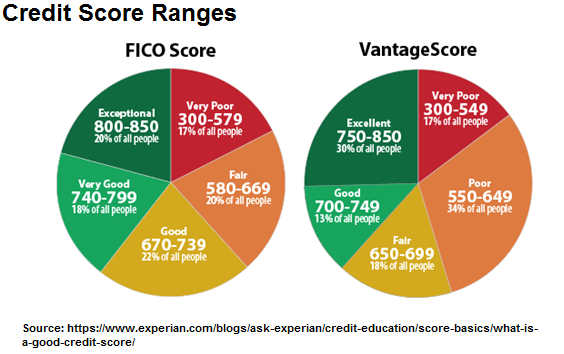

The most popular credit score is the Fair Isaac & Co. (FICO) Credit Score, although the Vantage score is becoming more popular. The FICO (and most Vantage) credit score ranges from a low of 300 to a high of 850. Keep in mind that you can purchase Credit Scores and even FICO scores, they are not always the same as the one used by the lender.

Credit Score Ranges:

The range of FICO scores vary between 350-800. Different sites translate those into different categories ranging from bad to excellent. Experian classified the different score by categories and the amount of people estimated to be in those groups:

However, you will most likely come across different categories among lenders and online shopping sites. For example Bills.com uses these categories for people looking for a debt relief product:

- Excellent: 740+

- Very Good: 700-739

- Good: 670-699

- Fair: 640-699

- Poor: 600-639

- Very Poor: <600

Improve Your Credit Score

If your credit score is low, then follow these steps:

- Inaccurate Items: Read the Bills.com article about credit repair and learn how to dispute any inaccurate items that appear on your credit report.

- Overall Poor Credit: Read the Bills.com article for tips on how to improve your credit score. If your score is low, then you might start with a secured card. Make sure that you set up a budget and make all of your payments on time.

Minimum FICO Scores: Different Loan Types

You can find much information about minimum credit score requirements for different mortgage products, such as a FHA loan or a Conventional loan. Even so, the minimum score required will vary between lenders and also be affected by your overall personal situation.

Other loan products such as auto loan or personal loans vary greatly between lenders. One thing to keep in mind is that a lower credit score will affect the rates and fees that you pay. If you have a poor or bad credit score then the chances are very high that you will not qualify for a loan, or pay a very expensive prices.

The New York Federal Reserve publishes quarterly data about Household Debt and Credit. According to their 2017 Quarter 4 published in February 2018:

The median credit score of newly originating borrowers declined slightly for mortgages, to 755 from 760. For auto loan originators, the median score increased to 707 from 705.

Minimum Credit Score Mortgage:

Based on their data the median credit score for mortgage increase from 707 in Q4 2006 to 781 in Q1 2011. The median score dropped somewhat but is still high at 755. As far as minimum credit scores, only 10% of the population had a credit score of 645 or less. This is 67points greater than the 578 credit score in Q4 2006.

Monitor Your Credit Report.

Make sure that you monitor your credit report by getting one free report each year from each CRA at AnnualCreditReport.com. If you want to more closely monitor your credit report, and also see your credit score, then sign up, for a free trial period, for a credit report with credit score.

Minimum Credit Score Auto Loans:

Based on their data the median credit score for auto loans is much less. Overall credit score distribution for auto loans has been much less volitale. The median score for Q4 2017 was 707, 48 points higher than that for mortgages. At the lower end 10% of the population had a credit score of 575 or less compared to the 645 score for mortgages.

Minimum Credit Score Credit Cards:

One of the most popular financial products is a credit card. In most cases the type of card you can get is affected by your credit score. It is possible to build your bad credit by taking out a secured credit card by using a cash deposit.

The CFPB publishes data regarding Credit Card origination. They divide credit scores into five levels:

- Deep subprime (credit scores below 580)

- Subprime (credit scores of 580-619)

- Near-prime (credit scores of 620-659)

- Prime (credit scores of 660-719)

- Super-prime (credit scores of 720 or above)

Based on their data it is possible to get a card, even with very poor credit (below 580)/ However deep subprime credit origination accounted for only about 1% of the total dollar volume originated each month. Subprime credit card dollar volume is about 7% of total volume and projected to be about $834 million.

Struggling with credit card debt?

Get a free consultation with a Bills.com pre-screened debt provider.

Minimum Credit Scores: Only Part of Your Financial Picture

By correctly preparing your finances, you will qualify for a credit card, auto loan, personal loan or a mortgage that best suits your needs, at the best rates possible.

Learning about your credit score is an important step in the mortgage qualification process. Although you will need a minimum credit score to qualify for a loan, it is not the only criteria.Your idea of building a better credit score by taking out other financial products such as credit cards, auto loan, and personal loans is a great idea. By mixing your credit, making your payments on time, and keeping your credit limits low, you will put yourself in a better position to be approved for a mortgage at the best rates.

In addition, don't forget that lenders often look at:

- Debt to Income ratio (DTI): controlling your overall debts will help you qualify for a mortgage loan and make your payments more affordable.

- Loan to Value ratio: by saving money and having at least a 20% down-payment, you will be able to avoid mortgage insurance. in general, you will be able to qualify for a mortgage with a lower credit score.

Always remember, whenever you are looking for a financial product, shop around.

i hope this information helps you find. learn & save.

Best,

Bill