Can you Negotiate Debt?

- Creditors will sometimes negotiate your debt.

- Review your financial situation and see if debt settlement is an option.

- Choose between a DIY approach and a Professional Debt Negotiation Company

Table of Contents

Is Debt Negotiation an Option?

Is it possible to negotiate a temporary payment plan or even partial payment of your debt

If you are falling behind in your payments and are struggling to make your minimum payments, then it is time to start looking for a solution to your debt problems.

If you are falling behind in your payments and are struggling to make your minimum payments, then it is time to start looking for a debt solution. Depending on the severity of your situation, it might be

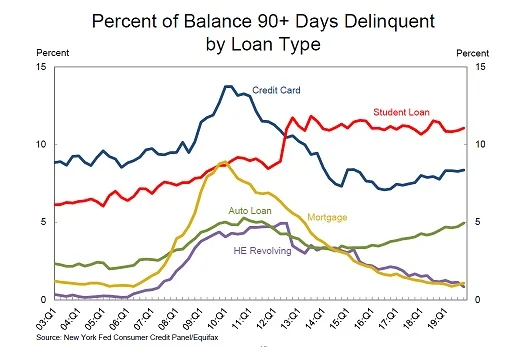

Delinquent? You are not alone! Check out the Percent of balances 90+ days delinquent by type of credit. Based on the NY Federal Reserve Household Debt and Credit Report for Q4 2019, credit cards were the second highest at 8.36%

However, negotiating your debt is not always so simple. Credit card companies are interested in getting their money back. Often, If you reach out soon enough and just need some fine-tuning in your budget and payment planning, then they can be helpful in a temporary payment plan.

However, if you fall far behind in your payments, then they often turn to either in-house debt collectors or third-party debt collectors. If you have sufficient assets or income, then they will often seek a court judgment, which can lead to wage garnishments, bank levies, and liens on your personal property.

One solution for people in financial hardship is debt settlement, which allows you to negotiate a partial payoff of your debts. Here are three steps to decide if debt negotiation is right for you:

- Analyze your finances

- Analyze your creditor’s options

- Choose the best debt negotiation strategy

Debt Negotiation: Check Your Options

The first thing to consider is how much you can afford to pay each month. You will need to carefully look at both your monthly budget and your overall asset portfolio.

Before you look for a debt negotiation strategy, review your finances and debt situation. Are you mismanaging your budget? Can you afford to make more than minimum payments? Do you have assets to protect or that can be used to pay off your debt? How is your credit? How old is your debt?

Here are some general rules to take into consideration:

- If you have good credit and equity in your home, then a cash-out refinance can help lower your payments.

- If you have good credit and can afford more than minimum payments, then a debt consolidation loan can help you get out of debt faster and cheaper.

- If you can make a flat payment, but lower interest rates will help you pay off your debt, then check out a debt consolidation and debt management program.

If none of those seem like realistic solutions, then it is time to consider either a debt negotiation solution or perhaps bankruptcy. For those in financial hardship, debt negotiation is a real program that can help eliminate your debt.

Debt Negotiation - Need Help?

Debt Negotiation? Consider the Creditor’s Options

Credit card companies, and other creditors that offered unsecured debt rely on your personal guarantee. They offer different rates of interest depending on your credit score and overall financial situation.

They realize that some people suffer a hardship and are not able to make their payments, nor fulfill their contractual obligations. However, they do have means to collect, either directly, or through a third-party debt collector.

Here are a few things to keep in mind when considering a debt negotiation with your creditor:

- How old is your debt? Did the statute of limitation expire, making it hard for the creditor to collect. (Don’t mix this up with the amount of time your negative credit stays on your credit report).

- Do you have garnishable income? If for example, you have social security income, and some types of pension income, then your creditor will find it hard to collect.

If you are in a sufficient financial hardship, then many creditors will consider a debt negotiation settlement.

Debt Negotiation: DIY or Professional Debt Negotiation

If you have decided that debt negotiation is the right debt relief option, then your next step is to determine if you should do it yourself, or seek out a professional debt settlement company. If you are having trouble making your payments, then get in touch with your creditor as soon as possible. Once you miss your payments, then you will hurt your credit. The earlier that you deal with the problem, the more likely you will find a solution.

Like many other products, it may be possible to do debt negotiations on your own. However, it pays to have a professional deal with the situation. No one would expect a person to go to a professional mechanic to fill up the gas tank, but to do major repairs on your engine; it would be foolish for the layman to do those repairs on their own. A professional has both the skills and experience to get the negotiations to the finish line. Even more importantly, they will be able to evaluate if you fit the program.

However, before you seek out professional help, make sure that you choose a reputable debt settlement company. Rember to avoid advanced fees. You should only pay when a settlement has been reached.

Struggling with Debt: Get Professional Debt Negotiation Help

If you are struggling with debt and in a financial hardship then get a no-cost, no obligation analysis of your debt options from a pre-screened debt relief provider.

Did you know?

Mortgages, credit cards, student loans, personal loans, and auto loans are common types of debts. According to the NY Federal Reserve total household debt as of Q4 2023 was $17.503 trillion. Housing debt totaled $12.612 trillion and non-housing debt was $4.891 trillion.

A significant percentage of people in the US are struggling with monthly payments and about 26% of households in the United States have debt in collections. According to data gathered by Urban.org from a sample of credit reports, the median debt in collections is $1,739. Credit card debt is prevalent and 3% have delinquent or derogatory card debt. The median debt in collections is $422.

The amount of debt and debt in collections vary by state. For example, in Colorado, 21% have any kind of debt in collections and the median debt in collections is $1682. Medical debt is common and 11% have that in collections. The median medical debt in collections is $693.

To maintain an excellent credit score it is vital to make timely payments. However, there are many circumstances that lead to late payments or debt in collections. The good news is that there are a lot of ways to deal with debt including debt consolidation and debt relief solutions.