Reverse Mortgages: Move with Caution

- Reverse Mortgages are a complex financial product.

- Plan your retirement finances before taking a reverse mortgage.

- Take you time and avoid any quick or slick offer.

Reverse Mortgage - What Can Go Wrong?

You have read how easy it is to get a reverse mortgage. The only requirements are being at least 62, and having enough equity in your house. The older you are and the more equity you have in your property, the more money you can borrow. You can receive either in a lump sum payment, a monthly payment, or a combination of the two.

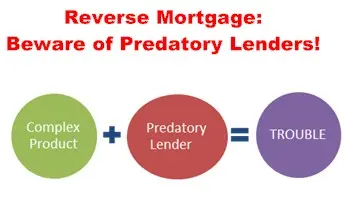

So far, so good. But things are not so simple. There are many reported problems with reverse mortgages. Some reverse mortgage borrowers or their spouses leave their homes and have no funds left to pay for new housing. Slick operators promote how easy it is to take a lump sum and go on vacation. Even worse, there are reverse mortgage scams and predatory lenders who offer this complicated mortgage product to borrowers who don’t know what they are getting into.

Reverse Mortgage and Predatory Lending?

Reverse mortgages are a complex mortgage product. Before you take out a reverse mortgage, you need to understand how the new reverse mortgage affects your future cash flow and their asset-liability position. You need a sound retirement plan and to understand how the new mortgage affects their equity stake in the future. After the 2008 housing crash we all know that you can’t just rely on ever-increasing property values.

The truth is that there are some very tragic scenarios that take place. Reverse mortgage borrowers, especially borrowers taking a lump-sum payment at an early age, may not have enough money to keep making the required property tax, homeowner’s insurance, and property maintenance payments. They can be forced out of their home with no equity left to finance future housing and medical costs. That is a very serious worst-case scenario!

The slick marketing tactics often used to sell reverse mortgages can spell trouble.

Unfortunately, many of the larger lenders have left the reverse mortgage market, leaving the field open to other lenders, some who unscrupulously take advantage of many senior citizens who don’t grasp how reverse mortgages work.

However, reverse mortgages are a unique product that can help the right borrower meet their financial obligations. Reverse mortgages are not sub-prime loans; but beware, there are sub-prime lenders offering reverse mortgages. Reverse mortgages require careful planning.

Reverse Mortgages - 5 Things That Can Go Wrong

Here are five key things that can go wrong with a reverse mortgage:

- You can’t afford your property tax, homeowners insurance and property maintenance fees.

- You have to leave the house due to health reasons, but you don’t have equity left.

- You want to move to another area (for health reasons or to get closer to family), but you don’t have equity left in the house.

- You paid so many upfront fees, that the loan was an unwise financial decision.

- An inheriting spouse is left with nothing, and sometimes no right to live in the house.

Quick Tip #1

Bills.com offers information about what is a reverse mortgage, pros and cons of a reverse mortgage, and how to choose a reverse mortgage.

Reverse Mortgages - Learn, Prepare, and GO SLOW

Most reverse mortgages are government-backed loans (by the FHA) and called HECM or Home Equity Conversion Mortgages. According to current regulations, a borrower must undergo a reverse mortgage counseling session before taking a HECM.

However, counseling has not stopped some borrowers from taking a reverse mortgage for the wrong reasons, and finding themselves in trouble. The Consumer Financial Protection Bureau (CFPB) did in-depth research about the reverse mortgage market. They CFPB published a Reverse Mortgage Report in August 2012. Here are five key findings, which help to illustrate the complexity of the problem and the sometimes inadequate regulation and enforcement:

- "Reverse mortgages are complex products and difficult for consumers to understand.

- "Reverse mortgage borrowers are using the loans in different ways than in the past, which increase risks to consumers.

- "Product features, market dynamics, and industry practices also create risks for consumers.

- "Counseling, while designed to help consumers understand the risks associated with reverse mortgages, needs improvement in order to be able to meet these challenges.

- "Some risks to consumers appear to have been adequately addressed by regulation, but remain a matter for supervision and enforcement, while other risks still require regulatory attention."

It is not enough to rely on government regulation or government enforcement to make sure that you make a sound financial decision. Regulation helps prevent some fraudulent and unscrupulous lenders, although others will slip through the cracks.

A reverse mortgage can be a great tool to help senior citizens use hard-earned equity improve their quality of life and stay in their home without making another monthly mortgage payment. Don't take a reverse mortgage lightly. It should not generally be used to pay off credit card debt, or spend casually.

My recommendation is before taking a reverse mortgage:

- Prepare and plan your retirement budget. Create and maintain a personal budget and speak to a professional retirement counselor. Consider how you can best use your assets, especially your home to your best advantage. Before you take a reverse mortgage, consider downsizing or taking out a home equity loan.

- Learn how reverse mortgages work and the pros and cons of reverse mortgages.

- Go Slow and don’t rush into a reverse mortgage. If a sales representative tells you to sign quickly, then walk away. Take the time to get good counseling. Prepare yourself before the meeting so you have a list of tough questions. Don’t be afraid to ask the same question more then once, if necessary, to get a clear answer you understand. Consult with several lenders to ensure you get the best quotes on rates and fees.

Quick Tip #2

When you are ready to shop around for your reverse mortgage, get a mortgage quote from a Bills.com reverse mortgage provider.