Measure Your Financial Health

At Bills.com, we strive to help you make financial decisions with confidence. While many of the products reviewed are from our Service Providers, including those with which we are affiliated and those that compensate us, our evaluations are never influenced by them.

Are you concerned about your financial situation?

Take the Financial Health Survey, get your scores, and make the right choices to improve your finances!

Why Measure Your Financial Health?

When it comes to your physical health, you know it is smart to get regular check-ups. They help you keep in shape and alert you to developing problems. The earlier you are aware of a problem, the sooner you can take action and work to prevent illness.

Financial health works the same. You want to measure your financial health regularly. It will show problems that are starting to develop, so you take action before harm occurs; cure something bad going on in your financial life, or reinforce that you have a clean financial bill of health.

Your goals could be getting out of debt, saving money for a vacation, buying a car, purchasing a home, or saving for college. All are important financial goals. For some, just paying the bills on time each month is the main goal, and can be a struggle.

Bills.com can help you improve your financial situation. That's why we are providing you with a free Financial Health Survey. Your score will show you your financial strengths and weaknesses, so you can use your time, money, and energy strategically and effectively. Take advantage of Bills.com's expert advice, tools, and tips to improve your financial health.

Get Your Financial Health Score

Measuring Your Financial Health - The Survey

- Your Scores To help you measure your financial health, Bills.com provides you with a free tool. Our Financial Health tool uses the Center for Financial Services Institute (CSFI) thoroughly researched methodology to help you assess your overall financial health.It is essential to measure your financial health by carefully analyzing your budget, debt level, and assets. Your needs and goals change over time, related to your age, whether you have children or not, your feelings about your current financial situation and your outlook for the future. However, the CSFI designed the survey to measure your financial health by asking your eight questions. We added a few more general questions to help refine recommendations.We do this by asking eight simple questions, two each focusing on critical areas of your finances. The four categories are: Spend, Save, Borrow, and Plan.You will get a score in each area and an overall score. This score is a starting point. Your scores indicate the areas of your financial health that need improvement, are currently on the right track, or if you are heading towards financial catastrophe.

- Measuring Your Spending The first area we measure is Spending. We ask you the following two questions:Spend less than income? Which of the following statements best describes how your household’s total spending compared to total income, over the last 12 months?Pay bills on time and in full? Which of the following statements best describes how your household has paid its bills over the last 12 months?Your spending habits are a fundamental building block in your financial health. Keeping a budget and tracking your spending will help you plan your savings, decide if you can afford to borrow money, and pay for essential insurance.

- Measure Your Savings The second area we measure is Saving. Building savings is an important component of both short-term and long-term financial health. Do you have an emergency fund? What happens if your car breaks down, or you need to do some home improvements? Do you have insurance and savings for health care?We ask you the following two questions:Have sufficient liquid savings? At your current level of spending, how long could you and your household afford to cover expenses, if you had to live only off the money you have readily available, without withdrawing money from retirement accounts or borrowing?Have sufficient long-term savings or assets? Thinking about your household’s longer-term financial goals such as saving for a vacation, starting a business, buying or paying off a home, saving up for education, putting money away for retirement, or making retirement funds last... It is important to build your savings plans with a firm base. Start by building a liquid emergency fund that can support you for six months. Then work on building your retirement accounts and investment accounts.

- Measure Your Borrowing The third area we measure is Borrowing. Most households borrow money at some time, including credit card debt, personal loans, mortgage loans, auto loans, and student loans. You need to consider both your overall debt level and how you handle your monthly payments. We ask you the following two questions:Have a sustainable debt load?? Thinking about all of your household’s current debts, including mortgages, bank loans, student loans, money owed to people, medical debt, past-due bills, and credit card balances that are carried over from prior months...Have a prime credit score?? How would you rate your credit score? Your credit score is a number that tells lenders how risky or safe you are as a borrower.Your debt to income ratio and credit score and two key elements that lenders look at when deciding if you qualify for a loan. We recommend that you measure your debt-to-income ratio using a calculator and keep track of your progress.

- Measure Your Planning The fourth area we measure is Planning. The type of planning varies greatly on your age, family status, and overall net worth. A key part of planning is setting goals. Just as there is no one best diet or physical fitness plan, there isn't one best financial health plan. Is planning important? In CFSI’s Consumer Financial Health Study, planning ahead behavior was highly correlated with financial health.We ask you the following two questions:Have appropriate insurance? Thinking about all of the types of insurance you and others in your household currently might have, including health insurance, vehicle insurance, home or rental insurance, life insurance, and disability insurance... Plan ahead for expenses? To what extent do you agree or disagree with the following statement: “My household plans ahead financially.”We believe that setting goals, and tracking your progress are crucial to improving your financial health.

- Additional Survey Questions In addition to the eight questions developed by the CSFI, we ask the following questions:Have you ever filed for bankruptcy?How much total credit card debt do you have?How much total credit card debt do you have?What is your age?These questions help us to understand your overall situation and provide insights and recommendations to help you improve your financial health.

Get Your Financial Health Score

Key Findings from CFSI Survey

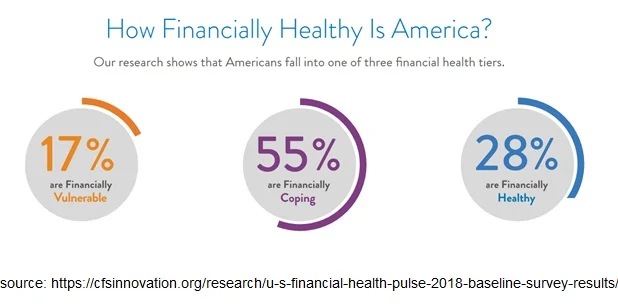

The CSFI ran an extensive survey on Financial Health and the American Household. One amazing result is that only 28% of households are financially healthy.

Here are some of the top results. For more results, click here:

Spending: 47% of Americans are spending more than they are saving

Savings: 45% of Americans do not have enough savings to cover three months of living expenses

Borrowing: 30% of Americans say they have more debt than they can handle.

Planning: 40% of Americans do not plan ahead financially.