Dave Ramsey Baby Steps (7): A Guide to Dave Ramsey Financial Plan

- Dave Ramsey’s 7 Baby Steps are designed to simplify financial planning.

- Mistakes are possible and could worsen your financial position.

- Learn what to avoid to succeed at Dave Ramsey’s 7 Baby Steps.

- Start your FREE debt assessment

Table of Contents

- What are Dave Ramsey's 7 Baby Steps?

- Who is Dave Ramsey?

- Baby Step 1: Ramsey’s first step is to save $1,000 for your starter emergency fund.

- Baby Step 2: Ramsey’s second step is to pay off all debt (except your mortgage) using the debt snowball method.

- Baby Step 3: Ramsey’s third step is to save three to six months of expenses in an emergency fund.

- Baby Step 4: The fourth step in Ramsey’s strategy is to invest 15% of your household income for retirement.

- Baby Step 5: The fifth step is saving for your children’s college fund

- Baby Step 6: Ramsey’s sixth step is to pay off your home early.

- Baby Step 7: Ramsey’s seventh and final step is to build wealth and give.

- Assessing the 7 Steps

- The Pros & Cons of Dave Ramsey Baby Steps

- Do Dave Ramsey Baby Steps Really Work?

- The Dave Ramsey Method Isn’t a One Size Fits All Plan Either

Feeling overwhelmed by money problems or hoping for a better financial future? Check out how Dave Ramsey's Baby Steps can give you a clear, doable plan for financial stability and growth. This plan covers it all – from smart budgeting and getting rid of debt to saving, investing, buying a house, and building wealth. From getting a handle on budgeting to living debt-free, learn how each step can get you closer to your money goals.

Personal finance personality Dave Ramsey is the author of the bestseller Total Money Makeover and proponent of a money management plan called the 7 Baby Steps. Countless consumers have used Dave Ramsey’s 7 Baby Steps to turn their finances around.

What are Dave Ramsey's 7 Baby Steps?

Dave Ramsey’s 7 Baby Steps are part of a program to help consumers save money, pay off debt, and build wealth. Dave Ramsey strongly advises avoiding debt and managing your

| Baby Step | Action to take |

|---|---|

| 1 | Save $1,000 for your starter emergency fund. |

| 2 | Pay off all debt (except your mortgage) using the debt snowball method. |

| 3 | Save three to six months of expenses in an emergency fund. |

| 4 | Invest 15% of your household income for retirement. |

| 5 | Save for your children’s college fund. |

| 6 | Pay off your home early. |

| 7 | Build wealth and give. |

Let’s jump in and explore the steps one at a time. Here are some dos and don’ts to follow when working through the 7 baby steps. This advice comes from personal finance specialists. money flow. Although the plan has a lot of sound advice, many experts think it isn't the best path to financial freedom. But first, let's take a quick look at who Dave Ramsey is.

Who is Dave Ramsey?

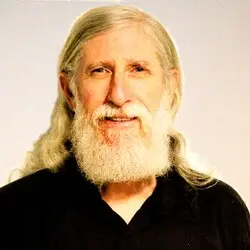

Dave Ramsey is an American businessman, author, radio host, and television personality. He is the host of The Dave Ramsey Show, a nationally syndicated radio program. His program offers financial advice to people from all walks of life. Ramsey is also the author of several books, including The Total Money Makeover and The Financial Peace Planner.

Ramsey was born on January 3, 1960, in Nashville, Tennessee and attended the University of Tennessee, where he studied financial planning and real estate. During Ramsey's early career, he worked as a financial advisor for a large corporation. However, in 1992, he left his job to start his own company, Ramsey Solutions. The company provides financial counseling and education to individuals and businesses.

The Dave Ramsey Show is a nationally syndicated radio program that offers financial advice to people from all walks of life. The program is hosted by Dave Ramsey. Ramsey's program offers practical advice for people who are looking to get their finances in order. The show is listened to by millions of people each week, and it has helped many people get out of debt and achieve financial stability.

The Financial Peace Planner is a book written by Dave Ramsey. The book offers practical advice for people who are looking to get their finances in order. The Financial Peace Planner helps people develop a plan for taking control of their money and achieving financial stability. The book has been praised by many readers, and it has helped many people get out of debt and achieve financial success.

Check your debt relief options

You have three (or more) options to handle overwhelming debt. Talk to a Bills.com debt resolution partner to discuss your debt solution options.

Start nowBaby Step 1: Ramsey’s first step is to save $1,000 for your starter emergency fund.

Ramsey’s first step is to save $1,000 for your starter emergency fund. This amount can cover most emergencies, providing a financial cushion. George Kamel is a personal finance expert for Ramsey Solutions. He notes, "The reason for $1,000 is that it can cover most emergencies. Consider that only 36% of Americans say they can pay cash for a $400 emergency – that means most people are borrowing, selling, or going into debt when life happens."

Practical Tips for Building Your Emergency Fund:

- Automate Your Savings: Robert Johnson is a finance professor at Creighton University. He suggests, "Have an amount taken from each paycheck and put into an emergency savings fund. It should be a very low-risk account, like a bank savings account or money market fund. Setting up an automatic transfer ensures that you save part of your income. And, you do it without thinking".

- Cut Unnecessary Expenses: Review your monthly expenses. Find areas to cut. For example, cancel unused subscriptions. Cook meals at home instead of eating out. And reduce impulse purchases.

- Sell Unused Items: Look around your home for items you no longer need or use. Sell these items on platforms like eBay, Craigslist, or Facebook Marketplace. This not only declutters your home but also provides extra cash for your emergency fund.

- Consider taking on a part-time job or freelance work. It will boost your income for a while. Websites like Upwork, Fiverr, and local job boards can help you find gigs that match your skills.

- Set Specific Goals: Break down the $1,000 goal into smaller, more manageable targets. For instance, aim to save $250 per month over four months. Tracking your progress can help keep you motivated.

Melanie Hanson is the editor-in-chief of EDI Refinance. She advises, "If you must stretch your budget to save this $1,000 as quickly as possible, it may not last. It may be better to contribute what you can comfortably manage and get there slower than to overstretch."

Get Out Of Debt faster

See where your money’s going, make a smarter debt payoff plan, and get debt-free faster with the free Achieve GOOD™ app.

Learn moreBaby Step 2: Ramsey’s second step is to pay off all debt (except your mortgage) using the debt snowball method.

This method calls for paying off your tiniest debts first so that you get them out of the way; then, you can work off bigger debts in ascending order.

“Start by listing on paper all your debts, from smallest to largest, regardless of interest rate – except your house. Then, start tackling the smallest at first,” advises Kamel. “You should make the minimum payments on every other debt. But for your smallest debt, pay as much as possible toward paying it off in full until it is gone. The snowball method works because it’s all about changing your behavior. Once your smallest debt is paid off, all that money rolls into the second debt, and more money means more snow.”

Keep in mind that you’ll need more financial wiggle room to pay extra on a single debt every month, as the more you can pay, the faster that debt will shrink.

“This method only works if you are not taking on more debts. Try to avoid major purchases that require financing, if possible,” Hanson adds. “It’s also important to consider things like interest rates and early payoff penalties with some debts.”

Alternatively, consider applying the avalanche method, which recommends making minimum payments on all of your outstanding debts each month, after which you can apply any leftover money toward paying off debts with the highest interest rates. This will ultimately save more money otherwise paid toward interest.

Betsalel Cohen

Bills.com financial expert

What our expert says...

While the snowball debt method can be a viable solution, it is not the only way to become debt-free. As an expert, I recommend exploring all possible options, including using a personal loan to pay off debt. Contrary to Dave Ramsey's advice, a personal loan can be a more cost-effective choice when carefully considering one's financial situation and running the numbers. To ensure success, it is important to avoid falling back into debt and to develop responsible financial habits, regardless of the chosen method.

Baby Step 3: Ramsey’s third step is to save three to six months of expenses in an emergency fund.

The goal here is to beef up your savings so that you can withstand unexpected events that may come your way – such as a job loss, per Kamel.

“The general rule of thumb is you want to figure out how much money you would need if your regular income went away,” Kamel continues. “For single-income households, aim for six months of expenses. Two-income households can aim for at least three months.”

“Most financial advisors prescribe putting aside at least six months’ worth of expenses toward emergency savings,” explains Johnson. “These funds should probably be very conservatively invested, such as in a bank savings account or money market fund account.”

Three to six months’ worth of expenses saved “can yield a significant rate of return if you put it into a higher-yielding savings account of some sort,” Hanson agrees.

Don’t beat yourself up if you can’t save three months’ worth of expenses; save what you can, as something is better than nothing.

Baby Step 4: The fourth step in Ramsey’s strategy is to invest 15% of your household income for retirement.

“Investing in retirement accounts is something people should do as soon as they start working. The biggest mistake many people make is not taking enough risk,” Johnson suggests. “The surest way to build true long-term wealth for retirement is to invest in the stock market.”

If you have access to a 401(k) and matching funds at work, don’t defer saving for retirement while you aim to get six months of emergency funds together. You’re forgoing free money if you do that.

“You definitely want to be using tax-deferred accounts like an IRA and a 401(k) if your employer offers them. The money in these accounts should be invested in mutual funds, ETF’s, or index funds for the most part,” recommends Hanson. “Choosing the right investment mix and tax savings are important here. Ramsey’s previous steps focused primarily on your ability to save a little money each month. Now you have to make informed decisions on what to do with those savings.”

Just be aware that you may have to pay third-party fees for any actively-managed retirement accounts.

Baby Step 5: The fifth step is saving for your children’s college fund

This step can be skipped if you don’t have any offspring. “Otherwise, it’s time to start researching and stash money away for your kids’ education,” says Kamel. “Look at opening an educational savings account or a 529 college savings fund. Have early conversations with your kids about college so that you can better ensure these funds go to good use.”

Be careful that you don’t overinvest in your child’s future education to the detriment of your retirement savings. You should prioritize the latter more than the former.

“Your kids may or may not go to college, but you will absolutely want to retire. You are not a bad or selfish parent to put your retirement first – it’s a wise move,” Kamel adds.

Hanson cautions that the steeply-rising cost of college tuition as well as the chance that your child might not necessarily be college-bound can make this a slightly riskier investment.

“If you are not certain about your child’s future plans, avoid putting money into a 529 plan, as this can only be used to pay for education costs. Instead, consider mutual funds.”

Baby Step 6: Ramsey’s sixth step is to pay off your home early.

“By this point, you should be more comfortable with the power of the snowball method, as used in step 2. This is just putting that money to different use by making accelerated mortgage payments or paying extra on your mortgage each month – the more the better,” says Hanson. “You may even want to look into refinancing or other ways of changing the terms of your mortgage in order to pay it off even faster.”

One primary advantage of paying off your mortgage early is the peace of mind and financial freedom it will bring.

“You’ll have more flexibility to weather life’s setbacks. It also gives you the flexibility to fund other life needs and wants,” Johnson says. “The drawbacks of paying off your mortgage early is that your payments will be higher and may crowd out other investments – such as contributing to a retirement plan or funding a child’s college savings.”

Also, the opportunity cost of paying off a mortgage with a relatively low fixed interest rate (likely under 4%) when you can be earning around 10% by investing in mutual funds, stocks, and other equities, may not be a good decision for everyone.

“If the inflation rate is higher than the interest rate on your mortgage, you can actually make money by skipping to the next baby step,” Hanson advises. “If you are determined to pay down your mortgage early, be sure to look into early payoff penalties; they are more common on mortgages than on other forms of debt.”

Baby Step 7: Ramsey’s seventh and final step is to build wealth and give.

“Once you reach this step, you should be debt-free. All of your money is yours, and now you get to bless people in return by contributing to your favorite charities and worthy causes,” says Kamel.

Giving is a good idea but make sure you take care of things like medical, disability, and long-term-care insurance first, the experts suggest.

“Also, carefully investigate the charities, political groups, or other worthy causes you have targeted so that you know where your contributions are going to end up,” adds Hanson. “Inexperienced donors can be the easiest to take advantage of. Avoid any groups that appear suspicious or offers that feel too good to be true.”

Assessing the 7 Steps

Dave Ramsey’s baby steps can be worthwhile financial planning tactics that can help you live a debt-free life and position you to build wealth more quickly. But they aren’t foolproof.

“What I really like about Dave Ramsey’s 7 baby steps is how any individual can use them as a blueprint. The pace at which you achieve them will vary, depending on your circumstances. But each step is sound financial advice that you’ll be better off following,” says Nate Tsang, founder/CEO of WallStreetZen.

Johnson agrees that many of these baby steps have merit but cautions that tackling them one at a time may not work for everyone.

“These steps are overly simplistic. Taken individually, they are all sound ideas, but the way they are presented makes it appear that you complete one step at a time before taking the next step,” he says. “Unfortunately, this isn’t how financial planning often works. One simply can’t focus on one goal at a time, but instead one must juggle many goals and priorities.”

Kamel, however, is a true believer who claims that the 7 baby steps worked for him personally.

“I had about $40,000 in consumer debt in 2013; $36,000 of it was student loan debt and the rest was credit card debt. I decided I had to take control, so I started applying these baby steps,” he says. “I paid off all my consumer debt in 18 months and recently paid off my house. I can testify that the baby steps are successful for people if they follow the plan, get intense, and stay hopeful.”

The Pros & Cons of Dave Ramsey Baby Steps

Are you considering following the financial advice of personal finance guru Dave Ramsey? Here's a look at the pros and cons of his approach.

- There are many advantages to following Dave Ramsey’s Baby Steps plan for personal finance. Perhaps the most obvious benefit is that it provides a clear, step-by-step path to becoming debt-free and building wealth.

- Another key advantage is that it helps you get organized and stay on track. Ramsey’s philosophy is that if you make small changes in your spending habits and save money each month, you can gradually accumulate wealth over time.

- Ramsey also stresses the importance of being proactive about your finances. He encourages people to take control of their money and make informed financial decisions, instead of relying on others (like banks or brokers) to manage their money for them.

- Finally, following Ramsey’s plan can help you develop healthy financial habits that will benefit you for years to come. These habits include budgeting, saving for emergencies, and investing for the future.

- There are a few potential downsides to following Ramsey’s Baby Steps plan. First, it can be tough to stick to a budget and save money each month when you’re struggling to make ends meet.

- Second, some of Ramsey’s recommendations (like investing in stocks) may be too risky for some people. And finally, it can be hard to follow Ramsey’s advice when you don’t have a lot of money to start with.

- Overall, however, the pros of following Dave Ramsey’s Baby Steps plan outweigh the cons. If you’re looking for a clear, step-by-step plan to get your finances in order, Ramsey’s Baby Steps is a good option to consider.

- His approach is particularly helpful for people who are struggling to get out of debt or build wealth. But even if you’re not in a difficult financial situation, Ramsey’s advice can help you develop healthy financial habits that will benefit you for years to come.

Do Dave Ramsey Baby Steps Really Work?

Dave Ramsey's Baby Steps are designed to help you get out of debt, save for the future, and build wealth. Ramsey's Baby Steps are based on common-sense principles that have helped millions of people achieve financial success. Millions of people have followed Ramsey's plan and have reaped the benefits. If you're willing to stick to a plan and make some sacrifices, the Baby Steps can not only help you get your finances in order, but can also help you achieve your financial goal.

The Dave Ramsey Method Isn’t a One Size Fits All Plan Either

Ramsey’s plan has helped many people get their finances in order, but it’s not the right solution for everyone.

Ramsey’s plan focuses on paying off debts as quickly as possible. While this approach can be effective for some people, others may find it difficult to adhere to. For example, someone who has a lot of debt may not be able to afford to make extra payments, especially if they have a low income. In this case, Ramsey’s plan may not be the best solution.

Ramsey’s plan also focuses on saving for emergencies. While this is a smart move, some people may not be able to save up enough money to cover a large expense. For example, someone who is unemployed or has a low income may not be able to save up enough money to cover a large emergency expense. In this case, Ramsey’s plan may not be the best solution.

Ramsey’s plan also recommends investing for the future. While this is a good idea, some people may not be able to afford to invest. For example, someone who is unemployed or has a low income may not have enough money to invest. In this case, Ramsey’s plan may not be the best solution.

Overall, Ramsey’s plan is a good approach for some people, but it may not be the best solution for everyone.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836