Debt Negotiators to the Rescue

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 3 min read

Need Debt Relief, Help!

Are you struggling with debt? Can you relate to any of these debt symptoms?

- Struggling to make Minimum Payment on credit cards ?

- Medical Bills piling up?

- Already late on credit card payments and bills ?

- Stressed out over financial matters?

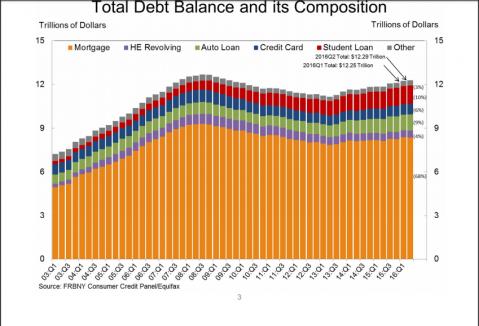

If you are overwhelmed by debt You are not alone. According to the New York Federal Reserve Household and Debt Report for Quarter 2, 2016, American Households carried more than $12 trillion in debt.

Of that debt, many borrowers were struggling with both student loans and credit card debts. In fact, according to the report:

"Credit card balances increased by $17 billion, to $729 billion, while credit card delinquency rates improved, to 7.2% in the second quarter of 2016 down from 7.6% in the previous quarter".

Dealing with debt is difficult. The good news is that you don't have to do it alone.

Debt Relief with a Professional Debt Negotiator

If you are falling behind in your payments, or even worse, already delinquent, then you are sitting on top of a very dangerous situation. At any time, your creditor may decide to sue you and seek a public judgement. The consequences can include a wage garnishment, bank levy, or lien on personal property.

Late payments lead to bad credit, which precludes a consumer from obtaining a debt consolidation loan, or a cash-out mortgage.A negative cash-flow means that you can't afford even minimum payments. While bankruptcy is a possible solution, many consumers seek to avoid the very negative consequences and look for other solutions.

Dealing with multiple creditors and trying to reach an agreement is a daunting task. Not only do you need to find the right people to talk to, you also need to convince them that they should reach a settlement that allows you to pay back less than the full principal and also forgo charging you more interest.

Fortunately, there are professional debt negotiators that can help you get debt free.

Get the Right Type of Debt Relief

If you aren't sure what is the best debt relief option for your situation, then check out Bills.com Debt Navigator.

Why Use a Professional Debt Negotiator

Just like many things in life, you can choose between a DIY approach and professional help. In many cases, professional debt negotiators can achieve better results due to their experience and skills.

Here are a few reasons that consumers look for a debt settlement firm with professional debt negotiators:

- Connections: A debt negotiator isn't just negotiating your case. They establish on-going relationships with creditors that allow them to reach great deals.

- While you are working hard on your account, a debt negotiator and their team are working on many accounts. They are able to bundle together deals that create cost efficiencies for the creditors. That is a big advantage in reaching a better deal.

- Experience: When looking for a debt negotiator, look for one with experience. A professional keeps track of their settlements and knows which cards to settle first and the type of deals each creditor is offering.

Let a Professional Debt Negotiator Help You Get Out of Debt

Do you need professional help? Contact one of Bills.com's pre-screened debt providers for a free, no-hassle debt relief quote.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836