Debt Relief Options: Choosing the Right Option

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 4 min read

- If you live paycheck to paycheck, the size of your monthly payment for your debt relief options is key.

- Among non-bankruptcy debt relief options, debt settlement programs generally offer the lowest monthly payment.

- Compare the total costs of each debt relief option.

- Start your FREE debt assessment

Table of Contents

Because many consumers already live paycheck to paycheck, the monthly funding requirements of various debt relief options are a key consideration for many consumers struggling with excessive debt.

Debt Settlement for low monthly payments

Among non-bankruptcy debt relief options, debt settlement programs generally offer the lowest monthly payments, largely because these programs negotiate to reduce their customers' principal debt balances, not just their interest rates. For example, a consumer with $20,000 in debt may be able to settle that debt with monthly program payments of approximately $300 to $375 per month for three years (36 months), compared to the minimum payments on $20,000 of debt would likely be up to $600 each month.

Consumer credit counseling services who can make substantial monthly payments

Consumer credit counseling services (CCCS) are generally best for consumers who are currently able to make substantial monthly minimum payments, but who are frustrated with the time it will take to pay off their debts only paying the minimums. CCCS can also be a good choice for individuals who are expecting a reduction in income, such as an upcoming retirement, and need to pay off their debts before their income drops.

Bankruptcy for those can don't have other options

For those consumers who cannot afford either option, bankruptcy may be the only viable option remaining. Consumers who think they need professional assistance in resolving their debts should explore their options by consulting with several debt relief providers and frequently with a bankruptcy attorney. Consumers considering bankruptcy should speak with a local attorney experienced in bankruptcy law. By exploring the available options, a consumer can make an informed decision as to which debt relief option is the best choice for his or her needs.

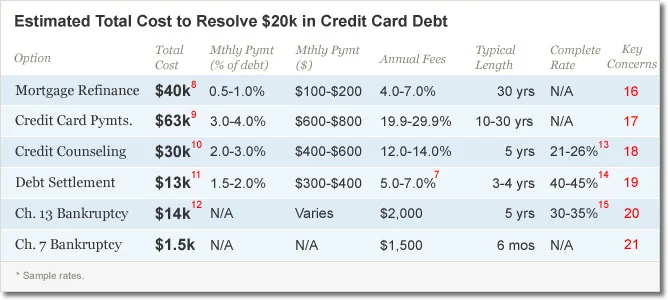

Comparison of debt relief options: costs and time to pay off debt

The table below takes published information about the costs of resolving debt for six options, and applies those costs to a $20,000 credit card debt. The first column contains the six options for resolving a debt. The second column indicates the total lifetime cost of each of the six options. The rule of thumb is the costliest option is the one that takes the longest to complete.

As seen below, making minimum monthly payments to the credit card issuer to resolve the debt results in the highest total cost. This is due to two factors. First, the APR a consumer pays may be as high as 29.9%. Second, the time to debt retirement may stretch into decades. Making minimum payments may be good for the credit card issuer, but is costly to the consumer. Refinancing a mortgage with a cash-out option and using the cash to pay-off a credit card debt results in the second-highest total cost, but the lowest monthly out-of-pocket cost (as seen in column 4). Credit counseling offers the third-highest total cost because, like the previous two options, the consumer is repaying the entire principal. The advantage over making credit card payments is that the consumer is given a break on interest rates. The monthly cost, however, is high.

Debt settlement is a lower-cost alternative to credit counseling because the consumer is not repaying the entire principal. The lifetime cost is lower, as well as the monthly payments in a debt settlement program. Bankruptcy may be an option for some consumers, and depending on which chapter of the bankruptcy the consumer qualifies for, the costs may be equivalent to debt settlement, or significantly less.

Back: Debt Relief Alternatives

| 7. | Based on 21% total fee, and a typical program length of 3-4 years. |

| 8. | Assumes 6% interest amortized over a 30 year fixed mortgage. |

| 9. | Assumes credit card interest rate of 24.9% and minimum payment that is the higher of 3.0% of debt balance and $25. |

| 10. | Assumes credit card rates are reduced to 11.9%, and adds debt management program fee of $50 per month. Payment is fixed at $500 or 2.5% of starting debt. |

| 11. | Assumes average settlements of 50% and total fee of 21% of debt. |

| 12. | Assumes 60% of debt paid, plus $2,000 filing fee. |

| 13. | "Credit Counseling in Crisis: The Impact on Consumers of Funding Cuts, Higher Fees and Aggressive New Market Entrants," Consumer Federation of America and National Consumer Law Center, April 2003. |

| 14. | TASC survey of member companies, 2008. |

| 15. | "Bankruptcy by the Numbers: Measuring Performance in Chapter 13," by Gordon Bermant and Ed Flynn, Executive Office for the U.S. Trustees. |

| 16. | Must own home with equity and have a good credit rating. Potential to get stuck in a mortgage you cannot afford. Debt becomes secured putting home at risk if payments cannot be met. |

| 17. | Monthly payment obligation is significant. Late fees and high default interest rates kick in if payment is missed. |

| 18. | Certain creditors may not agree to concession rate. IRS audit of industry has resulted in revocation of non-profit status from many companies. Minimal impact on credit score. May be viewed by credit issuers negatively. |

| 19. | Payments are not made to creditors — credit rating is impaired. Collection calls and potential legal action on delinquent accounts. |

| 20. | Severe credit rating impact. Bankruptcy reform in 2005 requires means test, making it harder to qualify. |

| 21. | Severe credit rating impact. Bankruptcy reform in 2005 requires means test, making it harder to qualify. |

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836