Three Tips to Choose a Debt Relief Program

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 5 min read

- Check the monthly payment and affordability of the debt relief program.

- Check your credit and how the debt relief program will affect it.

- Check to see if you can stick to the debt relief program till the end.

- Start your FREE debt assessment

Table of Contents

- Debt Relief Programs - Pick and Choose

- Affordable: Is the Debt Relief Program Affordable?

- Credit Match: Is your Credit a good match to the Debt Relief Program?

- Completable: Can you Stick to the Debt Relief Program?

- Check out Bills.com Debt Naviagtor to find a Debt relief program that meets you personal needs.

Debt Relief Programs - Pick and Choose

Almost all of of us have some kind of debt, whether it be a mortgage, credit card debt, personal loan, student loan, or auto loan. Many households are struggling with their debt and juggling their bills. Wouldn’t it be nice to find an easy solution to get rid of debt?

Sure, there are a number of different debt relief programs. Just about anyone who surfs the web has come across an ad touting a great way to get in shape, get thin, or get out of debt. All of those topics have at least one thing in common. They appeal to an urgent need to deal with a pressing problem, at least for those suffering from one or more of those problems.

However, as we all know, there are really no miracle solutions. There is also no universal solution. The important thing to keep in mind when looking for a debt relief program is to match your personal financial solution and goals to the various programs.

Here are three tips to help you choose the right debt relief program:

- Check Affordability

- Review Your Credit

- See if you can stick to the program

Struggling with Debt and looking for Debt Relief Program?

Get a no-cost, no obligation analysis of your debt options from a Bills.com pre-screened debt relief provider.

Affordable: Is the Debt Relief Program Affordable?

The first thing to consider is what can you afford to pay each month. The right Debt Relief program will vary depending on your financial shape (or hardship). Note: this isn’t the only consideration, but a good one to start with.

In order to choose the right debt relief solution you need to know just how much you are making, how much you are spending, and how much of that money goes to service your debt.

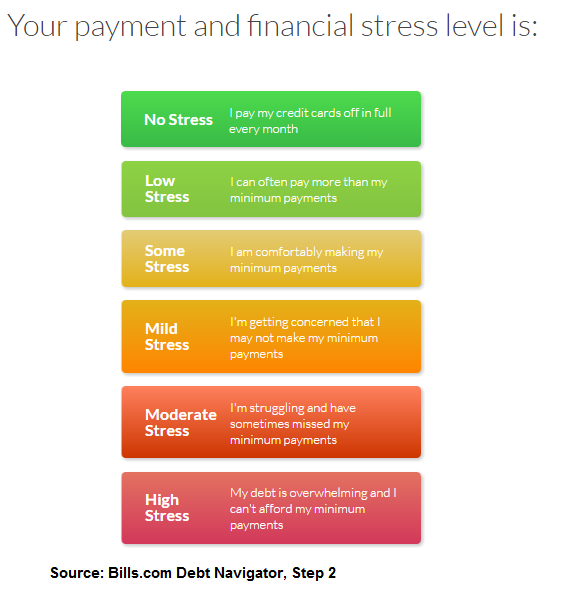

A great start, if you haven’t already done so, is to create and maintain a budget. Based on your monthly affordability and stress scale you can consider if one of these programs are right for you:

- No stress - Low Stress (have extra money): Set a fixed amount of money to pay each month, more than your current minimum payment and build an optimized payment schedule based on an avalanche or snowball program. Or, if you can qualify, get a debt consolidation loan at a lower interest rate and affordable monthly payments. If you are really good at managing your finances, then consider a credit card balance transfer.

- Some - Mild Stress: If you are starting to struggle with your minimum payments, then consider a credit counseling program that can help you set up and fine tune your budget. If you have high rates, then a Debt Management Program might help you get lower interest rates and set up one affordable monthly payment.

- Moderate - High Stress: If you are in a serious financial hardship, then you are most likely going to need a debt relief program that offers some professional help. Two programs that offer debt relief are a debt settlement program and bankruptcy. In the case of a debt settlement program you stop making payments to your creditors and at the same time make monthly payments into a designated account that will be used in the debt negotiations. Chapter 13 bankruptcy involves a court ordered plan where you make monthly payments. Chapter 7, which is hard to qualify for, allows for the elimination of debt without payments.

Credit Match: Is your Credit a good match to the Debt Relief Program?

Whenever you consider a debt relief program you need to consider how the program will affect your credit and whether you are interested in protecting your credit.

If you have good credit, then it may be possible to get a personal debt consolidation loan, or a cash out mortgage. If you do decide to consolidate your debt with a loan, then this will over time improve your credit score.

f you are struggling with high interest debt, but your credit or other personal financial factors don’t let you qualify for a personal loan, then a debt management program (DMP) might offer you debt relief. However, the DMP will have some negative effects on your credit, especially during the time of the program, which lasts about 3-5 years. This is due to any late payments around the time starting the program, the negative mark on your credit reports relating to the credit in the program, and possibly closing down credit cards, meaning a loss in credit utilization. However, over time, and at the completion of the program, your track record of on time payments, should help you rebuild your credit.

If you are missing payments, or on the verge of being seriously delinquent, then credit should not be a major factor in your choice for a debt relief program. A debt settlement program will have a negative impact on your credit because you stop making payments to your creditors. If a debt isn’t settled, It is also possible that you will have a public judgement. However, if you are in a serious financial hardship, then credit should not be an issue. Any subsequent damage to enrolling in a debt settlement program should be secondary to the goal of getting debt free. The same is true for bankruptcy, which probably has the longest term credit damage.

Completable: Can you Stick to the Debt Relief Program?

The third factor to consider when choosing a debt relief program is whether you can actually complete the program.

In general a person taking out a personal loan will be able to complete the payments; however, those suffering a hardship will more likely find it harder to complete the program.

Although this may sound trivial, many people who begin a Chapter 13 actually don’t complete it. According to the official website for the United States Bankruptcy Court for the District of South Carolina:

The national completion rate of chapter 13 plans is up to 51 percent over last year’s 45 percent.

It is harder to estimate the completion rates of a debt settlement program, however it is important to consider whether the affordability is sustainable. Of course, when considering the alternatives, many people will still choose to start a program with the hopes that they can hold things together in order to complete the process.

Check out Bills.com Debt Naviagtor to find a Debt relief program that meets you personal needs.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836