Fair Credit Reporting Act

- Understand that it is your responsibility to monitor the information in your credit reports.

- Dispute any inaccurate or incomplete information.

- Take the right steps to act on any violations of your rights under the FCRA, including seeking legal help.

- Start your FREE debt assessment

Protect Yourself: 13 Facts to Know About the FCRA

Your credit score is an important part of your financial life. A good credit score can open up opportunities to borrow money at the lowest rates, while a poor score can close off your chances to borrow altogether and even affect your ability to find or keep a job, qualify for insurance you want to purchase, or your ability to rent an apartment.

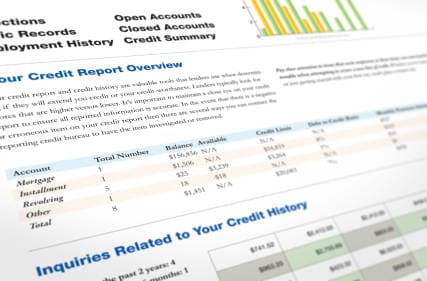

Your credit score is figured by the various credit reporting agencies in a very complex way. They examine the amount of your debt, the size of your debt compared to your maximum credit limits, how long you have had your accounts open, and your payment history, among other factors. Because so much depends on the information in your credit report, it is important for you to make sure it is accurate. If you do not protect your credit information, no one will do it for you.

It is not only you, the consumer, who is affected by how credit reporting agencies compile and maintain your records. The banking and financial system also depends on the information in your file. Inaccurate credit reports harm the efficiency of the financial system, which in turn harms confidence in the financial system. As both the consumer and the financial system depend on what is reported by the credit reporting agencies, Congress decided to regulate the rules of credit reporting.

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA), a federal law, was created to promote accuracy, fairness, and privacy of your information kept in the files of the consumer credit reporting agencies (CRAs). The most well-known CRAs are Experian, TransUnion, and Equifax, but there are others, too. Specialty agencies compile and sell information about various types of financial activities, such as your check writing history, medical records, utility payments, and rental history.

Here is a summary of your rights under the FCRA, based on information from the FTC. It is important to know these rights, so you can protect your credit rating and the privacy of your personal information.

1. You have the right to know if information in your file is used against you.

If you are ever denied when you apply for credit, an insurance policy, or a job, or if anyone takes adverse actions against you because of information contained in your credit report, the entity that denied you is required to provide you with the name, address, and phone number of the agency that provided the information.

2. You have the right to know what information is in your file.

You are allowed to request and you are entitled to receive all the information about you that is kept by a credit reporting agency. Sometimes, your request for disclosure may require a fee, sometimes the disclosure is provided free-of-charge. According the the Federal Trade Commission (FTC), under the FCRA, you are entitled to a free file disclosure if:

- "A person has taken adverse action against you because of information in your credit report;

- "You are the victim of identify theft and place a fraud alert in your file;

- "Your file contains inaccurate information as a result of fraud;

- "You are on public assistance;

- "You are unemployed but expect to apply for employment within 60 days."

3. You are also entitled to one free disclosure every 12 months from each nationwide credit reporting agency and nationwide specialty consumer reporting agencies.

While the information in your credit report must be furnished, your credit score is not required to be given to you for free.

4. You have the right to request your credit score.

Your credit score is a number that summarizes your credit-worthiness. As the FTC says, "You may request a credit score from consumer reporting agencies that create or distribute scores used in residential real property loan (mortgages)," but you may have to pay for it.

5. You have the right to dispute any inaccurate or incomplete information.

If you follow the proper procedures to identify and report inaccurate or incomplete information, the CRA is legally bound to investigate your dispute, unless your dispute is frivolous.

6. CRAs are required to correct or delete any information that is inaccurate, incomplete or that cannot be verified.

All inaccurate, incomplete or unverifiable information must be corrected or removed, usually within 30 days, if you follow the proper procedures. If you dispute information that is accurate, it does not have to be removed and will continue to be reported.

7. CRAs are required to stop reporting outdated information.

It is usually the case that negative information about you that is over 7 years old (and 10 years in the case of bankruptcy) can no longer be reported.

8. Not anyone can access your credit file.

A CRA may divulge information about you to someone or some business that has a valid need to know, such as a business where you applied for credit, an insurance company you want to insure you, or a landlord.

9. Employers must obtain your consent to view your credit report.

A CRA is not allowed to provide your private information to your current employer or any prospective employer without first obtaining your written consent. The FTC states that "written consent generally is not required in the trucking industry."

10. You have the right to limit ‘prescreened’ credit and insurance offers that are based on information in your credit report.

Any unsolicited offer that you receive for credit or insurance is required to include a toll-free opt out number. To opt out with the nationwide credit bureaus by calling 1-888-5-OPTOUT.

11. You have the right to seek damages from anyone who violates your rights under the FCRA.

According to the FTC, "If a CRA, or, in some cases a user of consumer reports or a furnisher of information to a CRA violates the FCRA, you may be able to sue in state or federal court."

12. You have additional rights if you are a victim of identity theft or are on active duty in the military.

See the FTC Active duty Alerts page and Identity Theft Resources page to learn more.

13. Under FCRA §605 (a) and (b), an account in collection will appear on a consumer’s credit report for up to 7½ years.

The clock starts up to 180 days after the date of first delinquency on the account. To learn when an account will be removed by the CRA, add 7 years to the date of first delinquency. Subsequent activity, such as resolving the debt, is irrelevant to the 7-year rule. The 7-year rule does not apply for all debts, however. Here are four exceptions:

- Tax liens: 10 years if unpaid, or 7 years from payment date

- Bankruptcy: 10 years from the date of filing (15 U.S.C. §1681c)

- Federal student loans: As long as they are delinquent

- Judgments: 7 years or the debtor’s state statute of limitations on judgments, whichever is longer

The FTC Web site contains more information about the FCRA, credit, your credit rating, identity theft, and more. You can do further research by starting at the FTC Credit & Loans page.

Where Can You Report FCRA Violations?

Although the FCRA is a federal law and applies to all of the United States, some states have their own versions of the FCRA that may offer you even greater protections. To find out about the protections offered in your state, contact your state Attorney General’s office or your state or local consumer protection agency. There are attorneys that specialize in cases involving FCRA violations. Consult with a lawyer who has consumer law experience if you believe an original creditor, collection agent, or CRA violated your rights under the FCRA or your state laws.

The federal agencies that enforce the federal FCRA are found below, taken from a table at the FTC Web site:

| Type of Business | Contact |

|---|---|

| Consumer reporting agencies, creditors, and others not listed below | Federal Trade Commission (FTC) Consumer Response Center - FCRA Washington DC 20580 Telephone 877-382-4357 |

| National banks, federal branches/agencies of foreign banks (word "National" or initials "N.A." appear in or after the bank's name) | Office of the Comptroller of the Currency Compliance Management Mall Stop 6-6 Washington DC 20219 Telephone 800-613-6743 |

| Federal Reserve System member banks (except national banks, federal branches/agencies of foreign banks) | Federal Reserve Consumer Help PO Box 1200 Minneapolis MN 55480 Telephone 888-851-1920 www.federalreserveconsumerhelp.gov consumerhelp@federalreserve.gov |

| Savings associations and federally chartered savings banks (word "Federal" or initials "F.S.B." appear in federal institution's name) | Office of Thrift Supervision Consumer Complaints Washington DC 20552 Telephone 800-842-6929 |

| Federal credit unions (words "Federal Credit Union" appear in the institution's name) | National Credit Union Administration 1775 Duke St. Alexandria VA 22314 Telephone 703-519-4600 |

| State-chartered banks that are not members of the Federal Reserve System | Federal Deposit Insurance Corp. Consumer Response Center 2345 Grand Avenue, Suite 100 Kansas City MO 64108-2638 Telephone 877-275-3342 |

| Air, surface, or rail common carriers regulated by former Civil Aeronautics Board or Interstate Commerce Commission | Department of Transportation Office of Financial Management Washington DC 20590 Telephone 202-466-1306 |

| Activities subject to the Packers and Stockyards Act, 1921 | Department of Agriculture Office of Deputy Administrator - GIPSA Washington, DC 20250 Telephone 202-720-705 |

Federal agencies that enforce the FCRA.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.