Most households have debt. Some debt is healthy because it helps you build wealth. Taking out loans and paying them back are a crucial part of managing your finances. How are your borrowing habits?

Get Your Financial Health Score Now

Borrowing Money and Your Financial Health

Most households borrow money. Ever take out an auto loan, personal loans, student loans, or a mortgage? If you borrowing money appropriately, a loan can help you build wealth or accomplish an important goal. However, if your debt reaches the point where your payments eat up a large part of your income, then your debt is preventing you from creating wealth and harming your financial health.

Credit Cards are a convenient way to pay for bills, order items on the internet, or pay for vacations. It is almost impossible to travel without a credit card. But if you rely on a credit card to pay for emergencies or to make up the difference between your income and spending, then your credit card debt and all the interest can spiral out of control.

If you don’t pay close attention to how your debt fits into your budget, then it's easy to end up deep in debt. At times, taking on debt is the best available solution to financial hardship, but always aim to do so with a plan to pay off your debt. If you are already in debt, then use Bills.com Debt Payoff Calculator to find a personalized debt relief solution.

Can Borrowing be Healthy?

Some people like to tell you that all debt is bad. However, can you imagine buying a home without a mortgage? For many, it isn't possible to get a college education without some student loans?

Healthy debt adds long-term value and increases your financial wealth and well-being. When deciding if a debt is healthy, ask yourself these two questions:

- Is the debt aligned with a long-term goal? For example, a mortgage enables you to become a homeowner.

- Can you afford the payments every month without putting too much stress on your monthly spending capabilities? Even if the debt helps you attain your goals, if it isn’t affordable, don’t commit to more debt than you can afford to service each month.

Credit card debt is helpful to pay for high-ticket items or one-off expenses. However, it is usually not a healthy type of debt because it comes with high-interest rates and servicing the debt takes up resources that you could otherwise allocate to achieving long-term goals.

Borrowing and Your DTI Ratio

Your debt-to-income ratio (DTI) shows you how much of your income you use to service debt. If too much of your income is going to pay off your debt, then you are going to find it hard to pay your other bills, especially emergency bills, and build up a saving fund.

Your DTI is especially important when applying for a loan. Along with credit scores, lenders use your DTI to determine if you can qualify for a loan. Most mortgage loan programs have strict DTI rules.

Calculating Your Financial Health Score for Borrowing

- Two Questions to Measure Borrowing Money and Financial HealthTo measure whether your borrowing is financially healthy, our Financial Health Survey looks at your current debt level and your ability to get the best rates available if you decide to take on debt. Question 1: Is your debt load sustainable? Thinking about all of your household’s current debts, including mortgages, bank loans, student loans, money owed to people, medical debt, past-due bills, and credit card balances that are carried over from prior months... As of today, which of the following statements describes how manageable your household debt is? Do not have any debt Have a manageable amount of debt Have a bit more debt than is manageable Have far more debt than is manageable

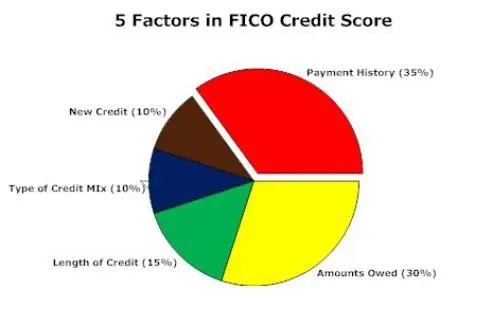

- Borrowing and Your Credit ScoreDo you know your credit score or your what credit range it falls in? One common way to measure financial health is your credit score. While there are many models for various types of debt, the most common are FICO scores and Vantage Scores. It is essential to check your credit report periodically. You are entitled, once a year for each of the three Credit Reporting Agencies, to a free credit report through annualcreditreport.com. Check and make sure that all of the data is correct and dispute any inaccurate, negative items that shouldn’t appear on the report.

Your credit score is one crucial factor lenders use to decide if you are eligible, and your rate and terms. In general, the higher your credit score, the better the rates.

People also ask

Are Credit Scores Important

Building good financial health is like putting together a puzzle. There are many pieces you have to connect, and your credit score is just one piece.

Focusing on your credit score as a primary goal can lead you to make poor financial decisions. You could think that once you have excellent credit, you will end up in good financial health. That isn't true.

What is the Best Way to Pay Off Debt?

Paying bills, loans, and your debt is a regular, important part of your financial activities. To keep financially healthy, borrow money wisely and keep your payments affordable.

There is no one-size-fits-all solution when it comes to paying off debt. The best debt solution depends on your income, spending habits, financial goals, age, assets, and amount of debt.

Use the Bills.com Debt Payoff Calculator to find the best way to pay off your debt.

What is a Personal Loan?

A personal loan is also called an unsecured or signature loan. It requires no collateral, unlike a secured loan, such as a mortgage or auto loan. You can use personal loans for a variety of reasons including debt consolidation, home improvements, weddings, vacations, pay medical bills, or make a large purchase.