Financial Well-Being: Your Financial Numbers and How You Feel About Them

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 4 min read

- There are objective ways of measuring your financial well-being.

- There are also subjective, psychological elements that determine your financial well-being.

- The amount of money you have in savings and how you feel about it are key factors in your financial well-being.

- Start your FREE debt assessment

Your Financial Well-Being is More than Income, Assets, and Expenses

Financial freedom is a common goal. Doing well financially brings peace of mind.

It takes more than earning a good income to achieve financial well-being. If you are spending more than you make, carrying too much debt, and not saving enough money to build a secure retirement, these are clear indicators of financial problems.

To measure financial well-being, you need to look at both your current financial situation and your ability to cope with future events.

Part of this is numerical: How much do you earn? How much do you spend each month? What is in your retirement account? How much debt are you carrying? It is important to remember, too, that your financial well-being has a significant psychological element.

While it is easy to measure the total amount of debt you owe, the size of your mortgage balance, and your monthly spending, it is harder to gauge your sense of financial security, how you feel about your financial ability to cope with the future, and your financial health.

Bills.com Provides Tools to Help You Improve Your Financial Well-Being

Bills.com has advocated, for years, that you need to learn about your financial situation to improve your financial life. Then, you should find the best, feasible options that fit your priorities and goals. We provide free tools, such as our Debt Payoff Calculator and Financial Health Survey, to help you accomplish both these tasks, and save money, too.

Get Your Financial Health Score Now

The CFPB Model of Financial Well-Being

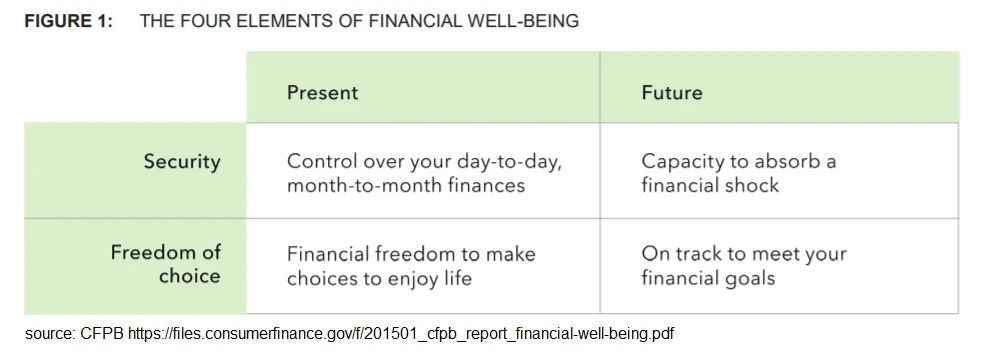

The Consumer Financial Protection Bureau (CFPB) studied financial well-being, in depth. The CFPB defined financial well-being,

"... as a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow enjoyment of life."

The CFPB claimed that financial measures are not enough to determine the level of financial well-being. They focused on two more areas, behavior and knowledge.

Financial Behavior: Creating good financial habits and incorporating them into your financial behavior should increase your financial well-being. Here are four areas of your financial behavior that the CFPB mentioned:

- Managing your everyday finance, including keeping and maintaining a budget, and watching your saving habits.

- Making a financial decision based on research.

- Making plans and setting goals.

- Acting in a way that helps you achieve your goals.

Financial knowledge: In today’s marketplace, information is abundant. However, there is also a lot of biased information.

Gather reliable information is an important first step. To increase your financial well-being, you also need to know how to process the information and use it. Make sure that you choose a method that fits your personality. For example, your level of self-motivation will also determine if you stick to a plan.

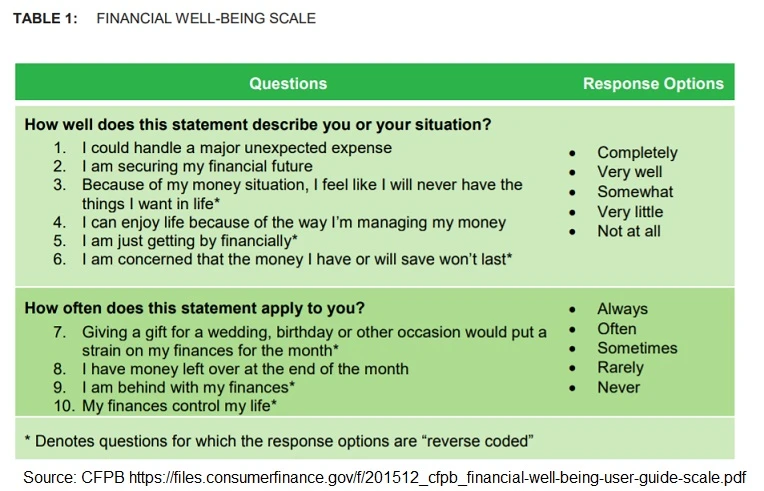

The CFPB Questionaire for Financial Well-Being

In line with their attempt to define financial well-being around a state of being and not a numerical financial measure, the CFPB created a well-being scale around ten questions. They are looking to see if you can handle financial emergencies, feel comfortable with your present situation, and are preparing for the future.

Here are ten questions from the CFPB:

CFPB Financial Well-Being 2017 Survey

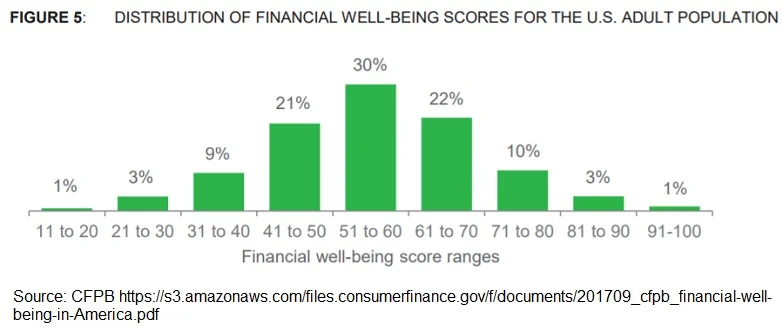

The CFPB conducted a national survey based on their 10-point questionnaire. Also, they made an extensive profile based on age, income and other demographic factors.

Their results indicate that there is a wide variation of scores. The average score for US adults was 54 (based on the scale of 0-100). The breakdown was about a third scoring 50 or less, a third between 51-60 and a third 61 or more. Here is the overall distribution:

It should come as no surprise that the person's level of material hardship was highly correlated with the score. The CFPB survey findings

suggest people with financial well-being scores up to 40 are experiencing very significant financial insecurity, with those in the 41–50 score range doing somewhat better but still largely struggling to make ends meet. People in the 51–60 score range seem to have more stable finances for the most part. At the upper end of the distribution, scores greater than 60 appear to be associated with largely secure financial circumstances, with nearly universal financial security at scores greater than 70.

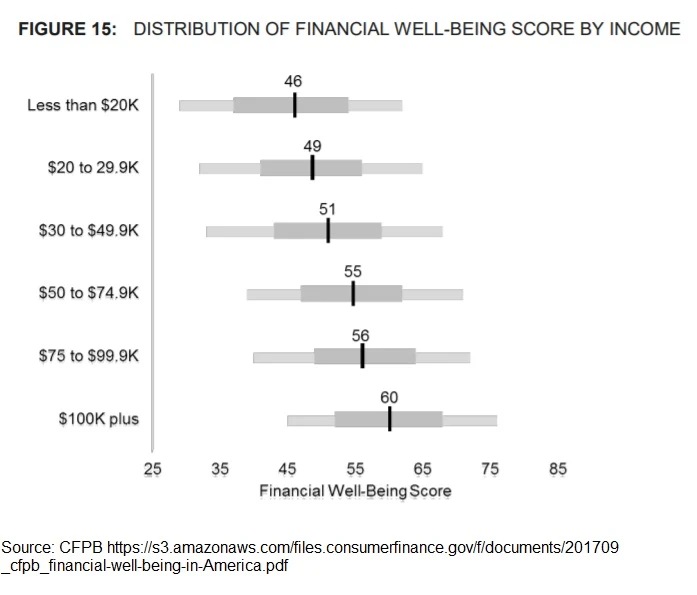

Unsurprisingly so, two of the most critical factors in determining financial well-being are savings and debt levels. On the other hand, while a higher income was correlated to a higher financial wellness score, there was a significant variation within each income group.

Income: As would be expected, the higher the income, the higher the average financial wellness. A higher income offers more opportunity to save, purchase health insurance, and prepare for the future. However, the findings show that within each group, there is a wide variation of financial wellness.

Savings cushion: The CFPB findings highlight the importance of savings and other safety nets in helping people to feel financially secure, one of the essential elements of financial well-being.

On average, adults with greater liquid savings (total savings held in cash, checking, and savings accounts) have higher financial well-being

Debt Experiences: The survey showed that not only the level of debt but the type of experience affected the debt level. Some of the strongest and most negative experiences included credit denial, using payday loans, and being contacted by a debt collector.

Check Your Financial Health

- Overall Financial Health Check your financial well-being by using Bills.com's Financial Health Survey. Answer a few questions and get your overall Financial Health score as well as scores about spending, saving, borrowing, and planning.

- Financial Well-Being: Savings Check out how you are doing in terms of saving money. Use the Bills.com Monthly Savings Ratio Calculator to see how you stack up in terms of putting money away. Also, check out Bills.com's Emergency Savings Calculator to see if you have a large enough cushion to handle an unexpected expense.

- Financial Well-Being: Borrowing and Spending - Your Debt to Income Level Borrowing is a crucial element in terms of measuring your financial well-being, and a major factor lenders use when considering your personal, car, or mortgage loan application. Check out Bills.com Debt-to-Income Ratio Calculator to see how much of your income you are using to service your debt.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836