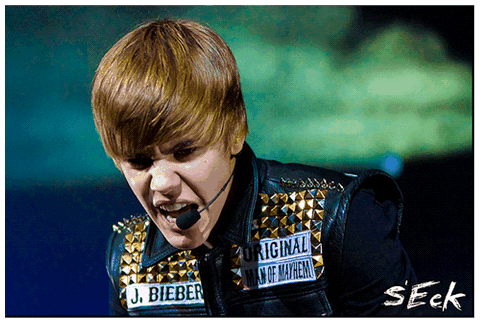

The Justin Bieber Prepaid Card- Read the Facts!

Pros and Cons of the Justin Bieber Prepaid Card

Justin Bieber is the latest celebrity to use his name to market a prepaid debit card, but he is not the first. Russell Simmons is the granddaddy of them all, releasing the RUSH card in 2003. Other celebs who've had cards marketed with their names include the Kardahsians, financial guru Suze Orman, and comedian George Lopez. There's even been a prepaid debit card that featured the faces of the Twilight movie series.

The market for prepaid cards is booming. According to Bloomberg Businessweek, Americans are expected to hold $168 billion on prepaid cards by 2016, generating an estimated $1.7 billion in fees.

A celebrity's name alone does not make the card a good value for you. The Kardashians learned this when their card was pulled from the market within one month of its release, due to a huge outcry over the predatory fees it charged.

Even Suze Orman, one of the best known dispensers of common-sense financial advice, was not immune to criticism. Her card, while not the worst choice for someone looking for a prepaid card, is not the best.

Your daughter may want a Bieber card, to go with her posters, t-shirts, calendar, pillow, backpack, perfume, and even toothbrush! But take a hard look at the card's advantages versus the fees you'll pay. Then, compare the costs to other prepaid cards or other options, like opening a bank account. This way, you’ll feel good about your final decision.

Benefits of a Prepaid Card

The main benefit of a prepaid card is convenience. They are easy to use and widely accepted.

Some specific benefits include:

- A safe way to keep your kids from overspending

- Easy to track all purchases

- Can be used to make purchases wherever credit cards are accepted, including online

- Easy to add money to the card

- Experience using plastic and managing money

Added Benefits of the Bieber Card

The Bieber card has some benefits that are not included with every prepaid card. Some nice features of the Bieber card include:

- You get a text message each time your kid uses it

- It’s easy to schedule regular deposits (think allowance)

- You can freeze/unfreeze access to the card with a text or online

- It may not be accepted by undesirable (to you!) merchants, such as dating websites, bars, liquor stores, and gambling establishments

- Bieber is pushing financial literacy, through a series called "REAL TALK," aimed at educating teens about responsible spending

The Bieber Card Fees

Here is a breakdown of the different fees that come with the card:

- $3.95 monthly fee

- $2.95 to add money from a debit or credit card

- $.75 to add money from a checking or savings account

- $7.95 to replace a lost card

- $.50 for each balance inquiry

- $1.50 for each ATM withdrawal

- $3 inactivity charge, if you don't use your card for 90 days

The Justin Bieber prepaid debit card is not the most expensive card on the market, but it is not the least expensive either. It will cost you a minimum of $47.40 each year from the monthly fees alone, even if you incur no other fees.

Of course, it can be hard to place a dollar value on the intangible benefit that your daughter will get from having Justin's face in her wallet. But remember that the fame of a teen-star can be fleeting. The celeb that's #1 on your daughter's list today, may not be on her list at all in six months.

Bills Action Plan

- Estimate what it would cost you to use the Bieber prepaid card

- Compare those costs to other prepaid cards

- Consider other options, such as having your child open her own bank account

- Weigh the tangible benefits, such as real-time spending alerts

- Weigh the intangible benefits of how much it will mean to your daughter to have the card

Image from Oh-Barcelona.com via Creative Commons

i love his music so much