10 Questions to Ask Your Debt Relief Counselor

- Take good notes, when speaking to a debt counselor.

- Shop around, to compare different approaches to debt relief and how information is presented to you.

- Don't hesitate to ask the same question twice, if you don't understand the answer.

- Start your FREE debt assessment

Debt Relief Counseling - Questions to Ask Your Debt Relief Counselor

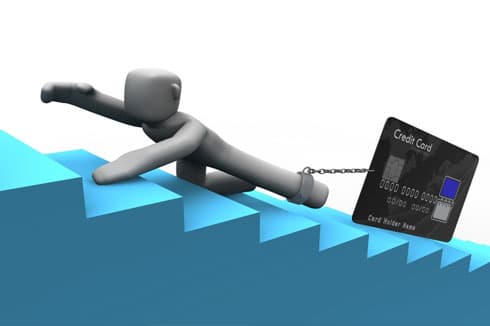

Many Americans struggle with debt. In addition to work pressures and anxieties about everyday life, worrying about debt can cause further stress. However, most problems have a solution. There are effective ways to work towards becoming debt free. If you are having problems putting in place a solution on your own, seek guidance from a professional debt relief counselor. Find an experienced debt relief counselor who understands your problems thoroughly. Information is power and speaking with someone does not obligate you to hire their firm.

To get useful advice, it is important for you to know the right questions to ask any debt counselor with whom you consult. The more informed you are before you start the process, the better the questions you can ask and the less likely that you will be led astray. Predators shy away from knowledgeable consumers, as they prefer to go after the easy mark. Remember, while there are qualified and legitimate debt relief counselors who can assist you, it is up to you to be the front-line in protecting your own interests. View any information you receive with a healthy degree of skepticism.

1. Do I Need a Minimum Debt Amount to Use Your Services?

Some debt relief counseling firms offer services only will work with you if you owe your creditors at least a certain amount of money. Ask this question up-front, so you do not waste your time hearing all the program details, only to find that you do not owe enough to be taken on as a client.

2. What Debt Relief Services Do You Offer?

Ask your counselor about the services that the firm offers, making sure that you thoroughly understand the firm’s specific approach to handling your debt. Some firms offer multiple services, such as offering both credit counseling and debt settlement. It can be confusing to have a lot of detail thrown at you in an initial consultation. Take good notes, to ensure you can recall the details of the discussion. Be on the alert for anything that sounds too good to be true. Anytime you use the services of a firm to help you with your debt, there is bound to be some bad mixed with the good. If a firm promises you only sunshine and roses, it is a sign that they are trying to take advantage of you. Stay away from any firm that promotes "Debt Elimination," where you are told that your debts are not collectible because only the government is allowed to create money and that if you pay a fee to the firm they can help you eliminate your debt, no matter how much you owe.

3. How Does Hiring You Benefit Me?

Do not be passive when speaking with a debt consultant. That can lead to having the consultant control the conversation, where you end up receiving the cookie-cutter presentation that the consultant can recite in his or her sleep. Test your debt relief counselor with specific questions, so you can find out whether the services benefit you or not, such as:

- How long will it take me to become debt free?

- How soon do you start working on my case?

- What are the initial steps you take to help me?

- What is the drop out rate/completion rate for clients that hire you?

4. How Long Have You Been in Business?

Find out how long the agency has been offering debt relief services, how many clients they have serviced, and their client dropout rate. Ask your debt consultant how long he or she has worked at the firm and in the industry. Someone brand new may not know as much as an experienced debt consultant.

5. Is Your Organization Accredited?

Is the firm a member of any trade associations? Did the debt counselor receive any accreditation or certification? If the organization provides credit counseling, is it an organization that has been approved to offer pre-bankruptcy counseling by the government. Also ask if the firm is fully compliant with all government regulations. Find out if they are willing to put that into writing.

6. How Much Does Your Service Cost?

This is obviously and important question. While you do not want to choose a firm or an approach based only on the fees, you do no t want to start working on a solution that is too expensive for you to see through. Ask also how much of your initial payments go towards resolving your problem and how much go to the company’s fees. Find out if you have time to change your mind, after you sign a contract, without incurring any fees.

If you are speaking with a debt settlement firm you should be aware that, under new FTC rules, you should not pay any up-front fees to a debt settlement firm that sell their services over the phone. If you are asked to pay any fees before an account of yours has been settled, then you know that you are dealing with a firm that is not compliant with federal regulations. It is possible for a debt settlement firm that meets with you face-to-face, or for a lawyer that works negotiating settlements, to charge an up-front fee. I recommend finding a firm that does not charge an up-front fee. Why pay a fee up-front when you can get the same work done without doing so? The more money that you can devote towards settling your accounts, the faster your accounts will be settled.

7. Why Should I Select Your Firm Over Service Providers?

Debt relief counseling is a large industry. Find out what differentiates the firm with whom you are speaking from others in the industry. Again, take good notes. Speak to more than one firm and ask the same question. Are you being given a reasonable answer or one that sounds good but really does not answer your question. Find out if the firm provides any additional help to you, aside from working on your debt problems with your creditors. Do they offer budgeting assistance, educational materials, other financial tips, or a regular newsletter?

8. How Is My Credit Rating Affected in Your Program?

Ask if it will be noted on your credit report that you are enrolled in the program. Find out what the impact on your credit score will be. Credit counseling programs send payments to your creditors each month, but the initial month or two can result in late payments which will harm your credit score. Press the consultant for specifics. If you are speaking with a debt settlement firm, do not work with any firm where a consultant tells you that your credit will not suffer significant harm.

9. Is All the Work on My Case Done In-house?

Many firms are salespeople only. Do not be fooled by a fancy Web site. Make sure to ask directly if the firm handles all the work on your case in-house. There are many debt relief firms that do not do any work on your case, but outsource the actual work on your case to another firm. If you are speaking with a debt settlement firm, find out if their employees handle the actual debt negotiations and customer support functions or if they farm it out to a different company.

10. Is My Private Information Handled Properly?

When you work with a debt resolution firm, you share a great deal of valuable, private information, such as your social security number, your credit account numbers, and your bank account number. Ask if there have ever been any times that the firm’s clients have had their private information compromised.

Summary

Debt can be both overwhelming and scary, but do not let other people prey on your fears. When you are an informed consumer, you greatly reduce the chances that you will be taken advantage of and increase the chances that you will get the results that you hope to achieve. Never be shy about asking the same question more than once, if you do not understand the answer. Any debt counselor that is not willing to be patient with you is not worth working with.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.