Learn About Different Types of Bad Credit Debt Consolidation Loans

- Even with bad credit you can consolidate personal debt, mortgages, and student debt.

- Expect to pay higher rates on a personal loan.

- Carefully examine all of your bad credit debt consolidation options.

- Start your FREE debt assessment

Different Types of Debt - Different Types of Debt Consolidation Loans

Can you consolidate different types of debt into a bad credit debt consolidation loan? The answer to that question depends on a lot of factors, including your actual credit, the types of debt you have, and the types of assets you have.

You can consider consolidating debt using one of the three types of loans:

- Cash-out Refinance or Home Equity Mortgage

- Personal Debt Consolidation Loan

- Student Consolidation Loan (only for student loans)

In general, If you have bad credit, you may find it hard to qualify for a debt consolidation loan at an attractive rate. Carefully examine all of your bad credit debt consolidation options.

Different Types of Debt to Consolidate

Did you know that US household debt is at is at record high levels? According to the New York Federal Reserve’s Q2 2018 Quarterly Report on Household Debt and Credit published August 26, 2018,

"...total household debt increased by $82 billion (0.6%) to $13.3 trillion in the second quarter of 2018. It was the 16th consecutive quarter with an increase, and the total is now $618 billion higher than the previous peak of $12.7 trillion, from the third quarter of 2008.

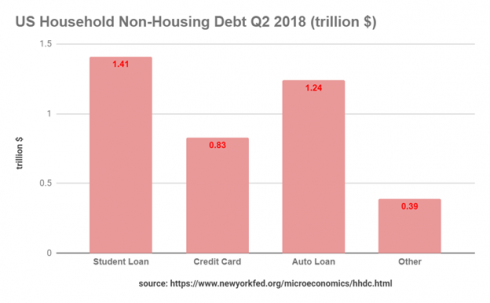

Total Household debt breaks down into housing debt of $9.43 trillion and non-housing debt amounting to $3.87 trillion. Check out the breakdown by types of debt:

On top of mortgages, personal loans, student loans, auto loans, and credit cards, many households have other debts, including medical bills.

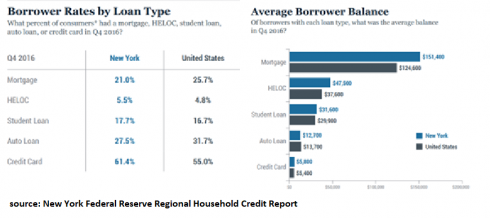

Very few people have all types of debt; however, according to the NY Federal Reserve, about 26% of households in the US have mortgages, 55% have credit card debt, and 17% have student loan debt. Check out the graph below to see average debt levels for the US and NY state. How do you match up with those averages?

Loan Option #1: Personal Loans

A personal debt consolidation loan allows you to pay off some bills and debt, creating one payment. Lenders set interest rate based on risk. Currently, there are Fintech lenders who look at alternative credit and will look beyond your credit score. If you are on the rebound and making payments on time, this will help your chances, even if your credit score is sub-prime.

When shopping for a bad credit debt consolidation loan expect to get a smaller loan and to pay higher rates and fees. Make sure that you can afford the monthly payments. The loan may be easy to obtain, but hard to pay back. If you don’t pay on time, expect aggressive collection tactics. Be wary of many of the online "bad credit, easy to get" sites.

Shop for a Bad Credit Debt Consolidation Personal Loan

Bills.com makes it easy to shop for a bad credit consolidation personal loan. Start by filling in your credit score, zip code, loan purpose, and the amount of loan you need. Check out different offers and click on the appropriate ones.

Loan Option #2: Cash-Out Refinance or Home Equity Mortgage

If you have a mortgage or home with equity, you might be able to consolidate all of your debt with a cash-out refinance or a home equity mortgage. However, if you have bad credit, then you might find it hard to qualify for a mortgage.

Lenders will consider two factors:

- Credit Score: Your credit needs to be above 620 for a conventional loan and 500-580 for an FHA loan. Some lenders are offering non-Qualified private mortgages with even lower credit scores.

- Equity: In general, you will be able to borrow up to 80% of the value of your home, including your current mortgage and any additional money used to consolidate debt.

Here are a few more details about the FHA cash-out loan:

The FHA cash out mortgage loan is available for bad credit borrowers, although lenders may apply stricter guidelines than the FHA requires. Here are some of the major points of the FHA cash-out mortgage:

- Up to 85% LTV.

- Low FICO score (over 500)

- Less stringent bankruptcy and foreclosure rules.

- No delinquencies on your mortgage for last 12 months

- DTI of 41%, although higher if you have compensating factors.

- Requires stricter underwriting requirements if the cash-out portion is for debt consolidation

Get a Mortgage Quote Now

Loan Option #3: Student Loan Consolidation

There are two types of student loans, federal student loans, and private student loans. In general, private student loans require a co-borrower, especially if you have no credit or bad credit.

Check your loan documents to see which kinds of student loans you have. The advantages of student loan consolidation are:

- Lower interest rate and/or smaller monthly payment

- Reduce the number of loan payments you have to deal with each month.

Federal Student Loan Consolidation: Consolidating federal student loans with bad credit is possible. Student loan consolidation can be complicated because there are different types of loans and repayment plans. Start by reviewing the information on the Department of Education’s Web site under the Federal Student Loan Consolidation page. Don’t forget to consider all your options, including income-based repayment plans.

Private Student Loan Consolidation: Lenders offer private student loan consolidation with the same underwriting criteria as any other personal unsecured loan. Lenders look for borrowers with good credit. If you have bad credit, then you will need strong co-borrower. Your co-borrower must be aware that they are liable for the whole debt, for the entire period of the loan. If there are late payments, then their credit score will be damaged. For more information read the Bills.com article about student loan debt consolidation.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.