What It Means to Be Judgment Proof—and What to Do If Sued

Table of Contents

- Bills Bottom Line

- When Sarah opened the envelope

- Quick legal definition: Judgment proof

- What does "judgment proof" mean?

- How to tell if you might be judgment proof

- What about your home or car?

- Can you still be sued if you're judgment proof?

- Real-life example: Marcus, recently laid off

- Is being judgment proof a long-term solution?

- What happens if a creditor gets a judgment?

- How to protect yourself if you're judgment proof

- What is a judgment-proof letter?

- Will you stay judgment proof forever?

- What to do if you're sued and think you're judgment proof

- Bills Action Plan

Bills Bottom Line

If you're "judgment proof," a creditor can sue you and even win—but they still can't take your income, savings, or basic property because what you have is legally protected. Many people living on Social Security, disability benefits, or very low income fall into this category. Being judgment proof doesn't erase your debt or stop a lawsuit, but it limits what a creditor can actually collect.

If this sounds like your situation, take a slow breath. You're not doing anything wrong. You still need to respond to court papers, but you may have more protection than you think—and knowing your rights can lower the stress of all this.

When Sarah opened the envelope

When Sarah opened the envelope and saw the court papers, her stomach dropped. A debt collector was suing her for an old credit card balance she hadn't touched in years. She was 72, retired, and living alone on Social Security in the same small apartment she'd lived in for more than a decade. Most months, she barely made rent and had little left after groceries and medication.

Her biggest fear was simple and overwhelming: "Are they going to take my check? Can they freeze my account?"

What Sarah didn't know was that she was likely judgment proof. Even if the collector won the lawsuit, her Social Security income and the small balance in her bank account were protected. The lawsuit could still move forward—that part feels unfair—but in reality, there was very little the creditor could take.

If you're in a similar place, understanding how judgment proof status works can help you feel less powerless. Let's walk through it.

Quick legal definition: Judgment proof

Being "judgment proof" means you don't have income or property a creditor can legally take—even if they sue you and win.

Common types of protected income include:

- Social Security and SSI

- VA disability benefits

- State disability benefits

- Certain pensions and retirement income

- Sometimes unemployment benefits

Your everyday property may also be protected under state exemption laws—things like basic household goods, your primary vehicle up to a certain value, and a modest amount of home equity. Every state works a little differently, so it's worth checking the exact rules in your area.

Important: Being judgment proof does not mean the court automatically knows your situation. You still need to open your mail, respond to any notices, and show up if you're summoned.

What does "judgment proof" mean?

When people talk about being "judgment proof," they're describing a situation where:

- You may owe the debt

- A creditor may be able to sue you

- The court may issue a judgment

- But the creditor can't collect from you because your income and property are legally protected

Federal law protects many income sources, including Social Security and SSI, VA benefits, and many retirement and pension benefits (while still in the account). There are also rules limiting wage garnishment if you earn a paycheck—and in many cases, people with low wages are fully or mostly protected.

Two key things to remember:

- Being judgment proof does not stop a lawsuit

- It does not wipe out the debt

It only limits what a creditor can actually collect if they win.

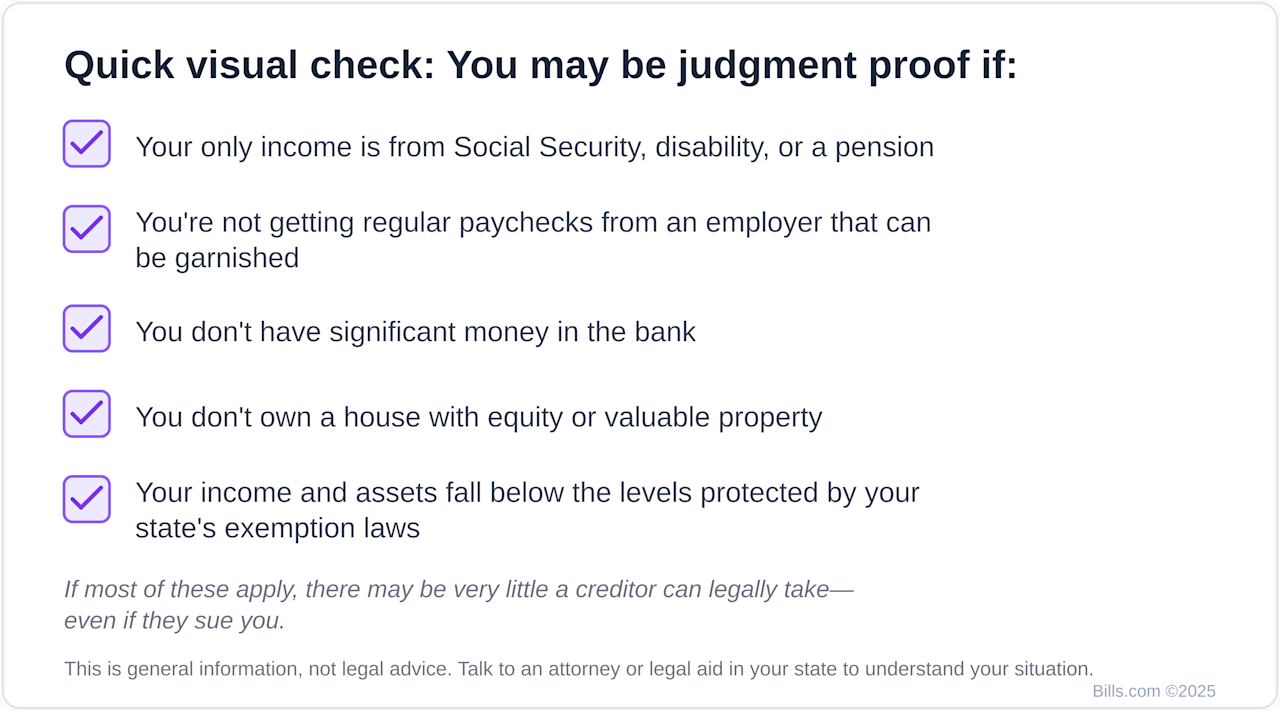

How to tell if you might be judgment proof

You don't need a legal background to get the basics. Here's a simple way to check your situation.

1. What type of income do you have?

If most or all of your income comes from Social Security, SSI, VA benefits, state disability, a pension you haven't withdrawn from, or unemployment, then your income may already be protected.

If you're working gig jobs or picking up cash work, creditors generally can't garnish money that isn't paid through an employer.

2. Do you have a paycheck from an employer?

If you do, a creditor may try to garnish wages—but many states protect a portion of low income. If you don't have wages, there's nothing to garnish.

3. What's in your bank account?

Protected funds receive automatic safeguards. For example:

- Up to two months of direct-deposited federal benefits must be automatically protected by the bank.

- If your protected income is mixed with other deposits, you may need to show where the money came from.

4. What property do you own?

Ask yourself: Do I own a home with significant equity? Is my car worth more than the exempt amount in my state? Do I have savings or investments?

If the honest answer is "not really," you may be judgment proof right now.

And remember: being judgment proof describes your current financial picture. It can change if your income or assets change.

If you're struggling just to cover rent, food, and insurance, there may be very little a creditor can legally take—even if they sue you. Still, check with legal aid if you're unsure.

What about your home or car?

Owning a home or car doesn't automatically disqualify you from being judgment proof. Many states have:

- Homestead exemptions that protect a certain amount of home equity

- Vehicle exemptions that protect part of your car's value

However, a creditor may place a lien on a home with higher equity. A lien usually won't force a sale, but you may have to deal with it if you refinance or sell.

If you own property—even modest property—legal aid can help you understand your protections.

Can you still be sued if you're judgment proof?

Yes. Creditors can still file a lawsuit.

The court doesn't know your financial situation until you explain it—which means ignoring the lawsuit is the one thing that can make your situation worse.

Your best defense is simple:

- Open every letter

- Respond by the deadline

- Attend the hearing if possible

- Clearly explain your income and assets

Most people are surprised by how understanding judges can be when they show up and explain their situation honestly.

Real-life example: Marcus, recently laid off

Marcus worked in a warehouse for 15 years before being laid off. He applied for unemployment and started doing weekend delivery shifts just to keep the lights on. Money was tight. He rented a small apartment, drove an older car, and had no savings left.

Then he was sued for a $3,500 credit card debt.

A friend told him to call legal aid, and they explained:

- His unemployment benefits were protected

- His car wasn't worth enough for seizure

- He needed to file a response to avoid a default judgment

- The creditor might try again if his income increased later

The creditor got a judgment—but they couldn't collect anything because Marcus had no non-exempt assets. The key was that Marcus responded, showed up, and understood his rights.

Is being judgment proof a long-term solution?

Not necessarily. Being judgment proof is about where you stand right now.

A judgment can last many years. In many states, judgments last around 10 years and can often be renewed. So a creditor who can't collect today may try again later if your finances improve.

For example, your status could change if:

- You start earning more

- You get a tax refund or inheritance

- You build savings

- You buy a home

- You begin withdrawing from retirement accounts

If the debt is valid, you may want to consider settling the debt for less than you owe, setting up an affordable payment plan, talking with legal aid, or bankruptcy if your debt load is unmanageable.

You don't need to decide right away—you just need to understand the road ahead.

What happens if a creditor gets a judgment?

They may try:

- Wage garnishment

- Bank account levy

- Property liens

If your income and assets are exempt, these attempts often fail—but they can still cause temporary stress, like an account freeze while the bank reviews your deposits.

If that happens and your income is protected, contact the bank and legal aid immediately. You may need to show where your money came from.

How to protect yourself if you're judgment proof

Here are practical steps:

1. Keep proof of your income. Award letters, deposit records, and bank statements matter.

2. Respond to every lawsuit. Even if you know you're judgment proof, never skip this.

3. Talk to legal aid in your state. They understand your state's specific exemption laws.

4. Keep protected money separate if possible. This helps show what funds are exempt.

What is a judgment-proof letter?

A judgment-proof letter is a simple message you send a creditor explaining:

- Your income is exempt

- You don't have wages or assets they can take

- You're asking them to stop collection efforts

It doesn't guarantee they'll stop, but it can discourage unnecessary pressure. Many legal aid offices provide templates.

Will you stay judgment proof forever?

Probably not. Your situation can change over time.

You may stop being judgment proof if:

- Your income increases

- You build savings or property

- You begin withdrawing more from retirement accounts

Because judgments can last a long time, it's worth checking again if things improve.

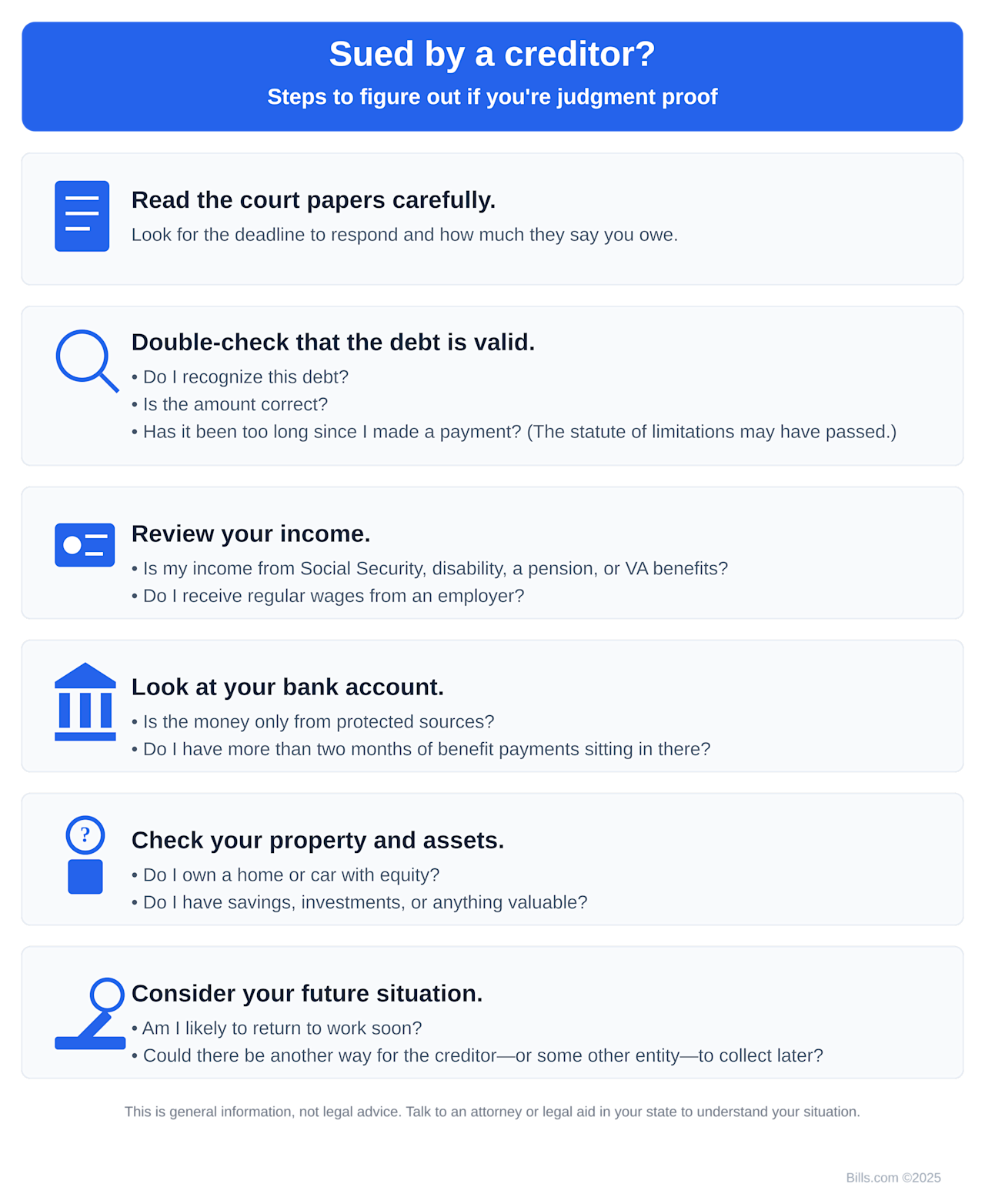

What to do if you're sued and think you're judgment proof

- Open the papers and note the response date. Missing it can lead to a default judgment.

- Contact legal aid. They'll explain your rights.

- Gather your financial documents. Award letters and bank statements help tell your story.

- File a response with the court. Many states allow simple forms.

- Attend your hearing if possible. Judges do take circumstances into account.

Bills Action Plan

Step 1: Review your income and property.

Step 2: Check your state's exemption rules.

Step 3: Respond to any lawsuit right away—typically within 20-30 days.

Step 4: Keep documents organized.

Step 5: Consider sending a judgment-proof letter.

Step 6: Reevaluate if your finances change.

Your next steps at a glance: Not sure where to start? Use this checklist to work through your situation.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.

6 Comments

The article may intend to mean a "cease and desist letter" when it discusses a "judgment proof letter." A cease and desist letter mandates that a collector may no longer call or send letters to a debtor. That letter will stop phone and written communications from legitimate collectors. A cease and desist letter will "make a collection agent stop calling you." And sending demand letters as well. It is certainly true that if a person is judgment proof and owes the debt it is possible they can be sued. If the debt is legitimate there is probably no need to consult a lawyer and file an answer. What would be gained if the debt is owed? Social security, pensions, retirement income, disability income, VA benefits and $217.50 net per week is protected by federal law. The law determines if a person is judgment proof. Most seniors are judgment proof. If a person is judgment proof they don't need to worry about a judgment. It would be extraordinarily unusual for a judgment creditor to pursue non-exempt personal property. Persons who are judgment proof generally have minimal income. They do not need to negotiate settlements, file bankruptcy, attempt to make a loan or enter into debt management programs. The law protects their income and assets. They can use their income for their needs.

No, the article didn't intend to reference a cease and desist letter. If you view the PDF, you can read two sample letters that convey the message that is broader than a C&D letter. As you know, original creditors are not bound by a C&D request.

What is your source for the contention that most seniors are judgment proof? Even if true, wouldn't a sizable number not be so?

It is never advisable to not answer a summons, in my view. Go and make your case and don't let a default judgment take place.

Even if judgment proof, a creditor may well sue. What if someone has equity in a home, but that equity is not exempt from collections? Wouldn't a creditor possibly sue to get a lien to encumber a sale of the property? There could be good reason for such a person to try and find a way to satisfy the debt, through a negotiated settlement at a reduced rate, in order to avoid the judgment and lien, or post-judgment to clear out the debt and satisfy the lien.

A person should do the proper research to find out what would result in a lawsuit and what alternatives exist, then choose the option that fits his or her view of the best decision. There is no one-size-fits all response, especially doing nothing, not consulting with an attorney, and assuming that one is judgment proof simply because one is a senior.

State exemptions vary, so an asset that is protected from a judgment creditor in one state could be subject to collection in another.

Please let me know if I can be sued for a charged off debt in connecticut by a law firm or collection agency.

Hello David.

Thank you for reaching out regarding your inquiry. Please, do not take my answer to be legal advice as I am not an attorney. Only attorneys can offer legal advice.

You did not mention your residence and what kind of debts you earned. I recommend speaking with an attorney to get accurate information.

Generally, a creditor can sue you for debt that has not been satisfied. The Charge Off is a term to describe the accounting feature when a company removes an item from their ledgers. Basically, you may still be responsible for the debt. If the creditor pursues to secure the balance by litigation they may earn a judgment. A judgment or remedy is the right given to creditors from the court to collect the debt by means of garnishment, levy, or lien on your home.

Regards, Josh