Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 2 min read

Rolling Jubilee Aims to Buy & Forgive Debt

It’s an open secret in the debt collection world that bad debt accounts are bought and sold for pennies on the dollar. That means an original creditor will sell a written-off credit card account with a balance of $1,000 for $10 to $80. The collection agent who buys the account has the right to collect the face value of the debt.

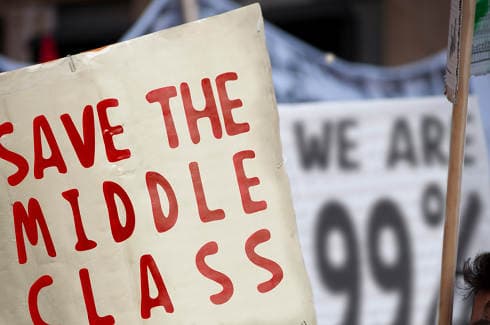

Some Occupy Wall Street organizers decided to raise money to buy debt bundles, and then forgive the collection accounts for the lucky consumers who had debt included in the bundles. The effort is called Strike Debt, and its primary fundraising activity is Rolling Jubilee, a Web site launched on November 15, 2012. Strike Debt hosted a live music variety benefit show in mid-November in an effort to gather donations. It’s initial goal was to raise $50,000, and as of the last week in November 2012, the Rolling Jubilee Web site claims to have raised $373,289, which it will use to abolish $7.4 million in debt.

Getting rid of $7.4 million of debt would be quite an accomplishment, but it will not help 99% of the people carrying delinquent credit card debt. Most consumerswith debt are going to find a debt relief solution on their own.

Quick Tip

Have outstanding debts you struggle with? Get a no-cost, no obligation analysis of your debt options from a Bills.com debt relief partner.

Debt Resistors’ Operations Manual

Strike Debt also created The Debt Resistors’ Operations Manual, a no-cost 122-page PDF describing consumers’ rights, including how to correct an error on your credit report and stop a collection agent’s calls.

The Debt Resistors’ Operations Manual describes the consequences of defaulting on a federal student loan, and how to repay a defaulted payday loan. The Manual, rather cheekily, describes how 1,000 people in four countries working in concert could drive all payday lenders out of business.

The weakest chapter of The Debt Resistors’ Operations Manual covers bankruptcy, which to its credit points out that bankruptcy can have a long-term positive effect on a person’s credit score. Unfortunately, the author does not describe why, and is ignorant of Fair, Isaac & Co.’s disclosure on bankruptcy’s short-term impact on a debtor’s credit score.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836