Is it a Good Idea to Take a Bad Credit Debt Consolidation Loan?

- Bad Credit can be a barrier to getting a debt consolidation loan.

- Some lenders do offer bad credit loans but check the rates.

- Check other debt relief alternatives

- Start your FREE debt assessment

Table of Contents

Bad Credit Debt Consolidation Loan Pros and Cons and Alternatives

Are you accumulating debt? Are you struggling to make your monthly payments? Are you dealing with a drop in your credit score?

Did you know that according to the New York Q3 2018 Household and Debt and Credit Report:

"Of the $638 billion of debt that is delinquent, $415 billion is seriously delinquent (at least 90 days late or “severely derogatory”).

You are probably familiar with different types of debt consolidation programs, but should you use a personal debt consolidation loan if you have bad credit? Learn more about the reasons you should or shouldn’t take a bad credit debt consolidation loan.

First Consideration: Why do You have Bad Credit?

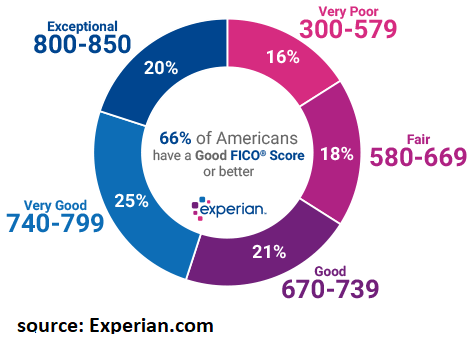

If your credit score is below 670, then you will be considered sub-prime. If your credit is under 580, then you have very poor credit.

The primary reason for bad credit is late payments. The more you have, the longer they are delinquents, and the more recent the activity, the lower your credit score. Another significant reason for bad credit is a bankruptcy, foreclosure, or short-sale.

It takes time to recover from severe financial hardship. However, it is essential to consider not just your current credit but also its direction on the credit scale. <

If you are facing financial hardship, you will most likely not qualify for a debt consolidation loan. Even if you are eligible, a debt consolidation loan is limited to 3-5 years, making the monthly payments unaffordable.

Reason #1 to Take a Bad Credit Debt Consolidation Loan:

Your financial situation is improving, and you can afford the payments.

Second Consideration: Loan Terms

The most important consideration is the loan terms. Is the interest rate attractive? Are you improving your financial situation? If you are consolidating credit cards, then you can easily compare interest rates. If you are paying off various bills, such as medical and hospital bills, then you need to consider the overall financial costs and your alternatives.

If for example, you have $25,000 in credit card debt at 30% and your minimum monthly payment is $750 (3% of your balance and decreases over time), your total scheduled payments would be about $147,000. Assuming you can qualify for a five-year bad credit debt consolidation loan at an interest rate of 30% (although it might be higher or lower), your monthly payment would be just slightly higher at $809, and your total payments would only be $48,530. If you could qualify for a lower interest rate, for example, 25%, then your monthly payment would be $734, and total scheduled payments decrease to about $44,027.

Reason #2 to Take a Bad Credit Debt Consolidation Loan:

You qualify for a lower interest rate than your current credit card debt.

Shop for a Bad Credit Debt Consolidation Loan

Bills.com makes it easy to shop for a bill consolidation personal loan. Start by filling in your credit score, zip code, loan purpose, and the amount of loan you need. Check out different offers and click on the appropriate ones.

Third Consideration: Scams and Debt Traps

If you are in financial hardship, then you are in a higher risk group to be scammed. Phony debt relief programs, easy to qualify bad credit debt consolidation loans, or payday loans that keep you in a debt trap are just a few examples of programs that will not help you solve your debt problems.

Avoid programs that take upfront fees, or promise you unrealistic solutions. In general, bad credit is an indication that you are a credit risk. Make sure that you are dealing with a reputable lender and you can afford the payments.

Reason #1 Not to take a Bad Credit Debt Consolidation Loan:

The loan is a scam or a debt trap.

Pros and Cons of a Bad Credit Debt Consolidation Loan

The most critical consideration in choosing a debt consolidation option is to make sure that the solution fits your solutions. Check out some of the pros and cons of bad credit debt consolidation loans:

Get a personalized debt consolidation consultation

Not sure which is the best alternative? Get a free consultation to get a personalized plan to fit your budget and meet your needs.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.