Improve Your Finances with a Cash Out Refinance

- Mortgage rates are still low.

- Home prices and homeowner equity is improving.

- A Cash Out Refinance can help save money and create affordable debt payments.

Cash Out Refinance Opportunities in 2018

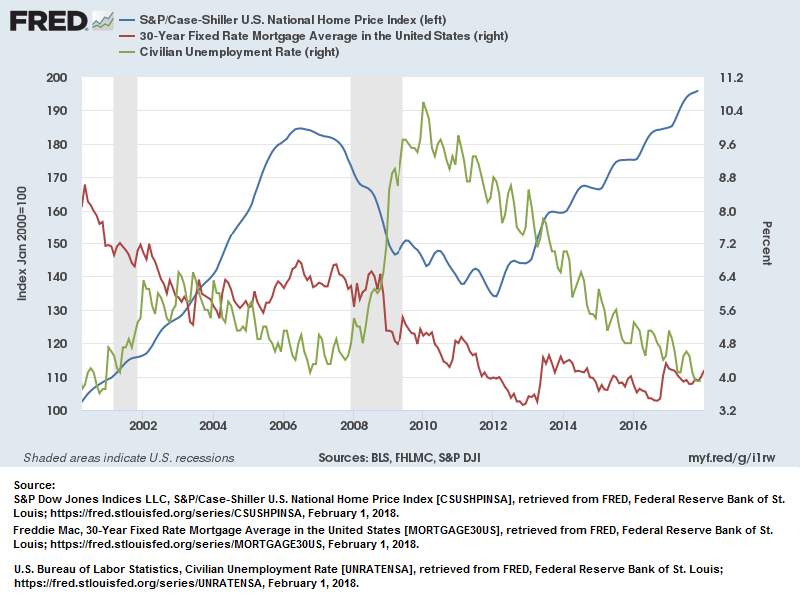

The year 2018 has a lot of potential for cash-out refinance mortgages. Combine low-interest rates with rising home prices and you have a winning combination.

Many savvy borrowers are looking to use the hard-earned equity in their home to improve their financial situation. According to the November 2017 Black Knight Mortgage Monitor Report (published in January 2018), 62% of all refinances in Q2 and Q3 of 2017 were cash-out refinances. The total volume of cash out refinances in Q3 2017 was $26 billion. According to the report:

Tappable equity has now increased by more than $3T from the bottom of the market in early 2012, and sits well above prior peaks seen in in 2005 and 2006.

Three economic indicators in 2018 point to significant opportunities for a Cash Out Mortgage Refinance: Low-Interest Rates, Low Unemployment, Rising Home Prices.

Get a Cash Out Refinance Quote

If you want to tap into the equity in your home and improve your mortgage terms, then get a mortgage quote now.

How can a Cash-Out Mortgage Help Me?

Perhaps you have been pushing off making essential home repairs, adding a room for your growing family, creating an office, or fix a leaking roof? Are you topping off your retirement funds, or just don’t feel that you have the funds necessary to do that?

There are a number of great reasons to take out a cash-out mortgage. It can be an excellent opportunity to readjust your overall financial position. With today’s low-interest rates you can create an overall affordable monthly mortgage payment and accomplish critical financial goals.

A cash-out refinance can both improve the terms of your current mortgage as well as help you meet other financial goals. The most common reasons are to make home improvements, consolidate credit card debt, pay off medical bills, pay for a college education, or shore up retirement and investment accounts.

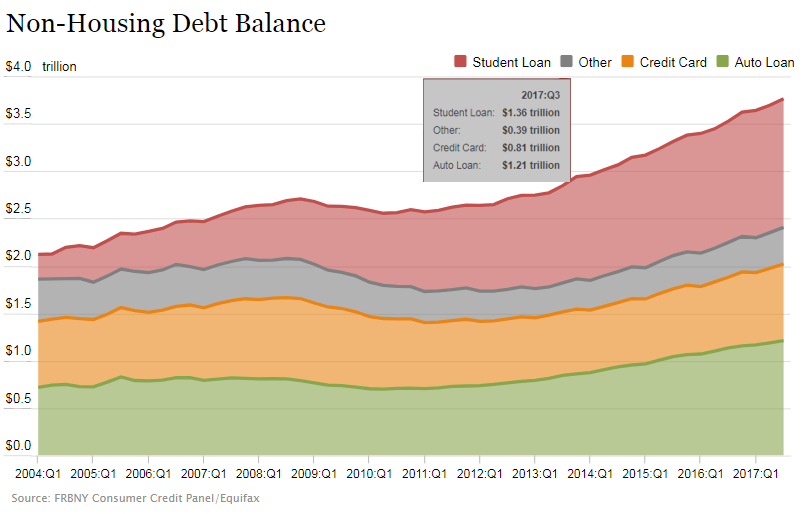

Rising debt levels and rising home equity offers an opportunity for many homeowners to use a cash-out refinance and lower their monthly debt payments and interest rates. According to the New York Federal Reserve,

As of September 30, 2017, total household indebtedness was $12.96 trillion, a $116 billion (0.9%) increase from the second quarter of 2017. Overall household debt is now 16.2% above the 2013Q2 trough.

Source: www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2017Q3.pdf

Use a Cash Out Refinance with Caution

One lesson learned from the Great Recession, and Housing Crash in 2007-2008 is to use a cash-out refinance with caution. Using your equity to improve your financial situation is great. Using it as a piggy bank or for frivolous or risky adventures can be disastrous.

Cash Out Mortgage Refinance in 2018 - Check Your Options

While mortgage rates are still low, it is a good time to consider a cash-out mortgage. Most forecasts are that mortgage rates will slightly increase during 2018 but will remain low, fluctuating between 4.25% - 5%.

Here are some steps to take before considering a Cash Out Mortgage refinance:

- Mortgage Rates: Check your current mortgage rate and payment. If your current mortgage rate is lower than today’s rates, then consider taking a Home Equity Loan (HEL) or Home Equity Line of Credit (HELOC). However, if you are struggling with the monthly payment, then refinancing into a long-term mortgage might make sense.

- Home Price: Before you stop shopping for a refinance mortgage, check out your home price. Although appraisal values will most likely differ from a realtor or an online site, researching your home value will give you an idea of just how much you can borrow. Most mortgage programs limit your overall Loan to Value ration to about 80%.

- Financial Position: Take a snapshot of your finances. Do you want to lower your monthly debt payments? Are you carrying too much credit card debt? Are you looking for a way to finance home repairs.? Now is an opportune time to consider a cash-out refinance mortgage and improve your financial situation.

Cash Out Mortgage Refinance

If a cash out mortgage can help you save money, improve your financial position, get more affordable payments, and tap into your home equity to reach your financial goals, then get a mortgage rate quote now.

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit

Great article! I believe that refinancing your mortgage is a good option for those who struggle to make mortgage payments or simply need cash. There are several reasons why homeowners opt for mortgage refinancing, such as to obtain a lower interest rate, to shorten the term of their mortgage, to convert from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, or vice versa, to leverage a home’s equity in order to finance a large purchase or to consolidate debt.

One reason you left out is related to the first sentence of your comment. People struggling to make their mortgage payment may benefit from lengthening the term of their mortgage, resetting the clock to 30 years.