Personal Loan Growth in 2018

- The Personal Loan market grew in 2017, both in balances and number of loans originated.

- Delinquency rates dropped.

- According to Transunion, the personal loan market will continue to grow in 2018.

Personal Loans: More Growth in 2018

Are you looking for a debt relief solution that can improve your credit, save you money, and get you on the track to becoming debt free?

One popular solution is a personal loan. With a debt consolidation loan, you can pay off existing, high-interest debt and set up a fixed monthly payment, paying off the balance over a period of 3-5 years. By setting up fixed payments you can avoid the minimum payment cycle that traps many credit card users. Personal loans can be used to pay off medical bills, refinance credit cards, pay for major purchases, home improvements, weddings, travel, or many other personal reasons.

The number of personal loans in 2017 increased, and it looks like 2018 will be another big year. According to the TransUnion’s Industry Insights Report for Q4 2017:

Total personal loan balances ended 2017 at $117 billion, up from $102 billion at the close of 2016.

Transunion predicts that 2018 will see a growth in balances and originations, as well as low delinquency rates.

Applying for a Personal Loan - Online Option

It only takes a few minutes to apply for a loan. Check out Bills.com sister company FreedomPlus for a personal loan quote.

Credit Scores and Personal Loans

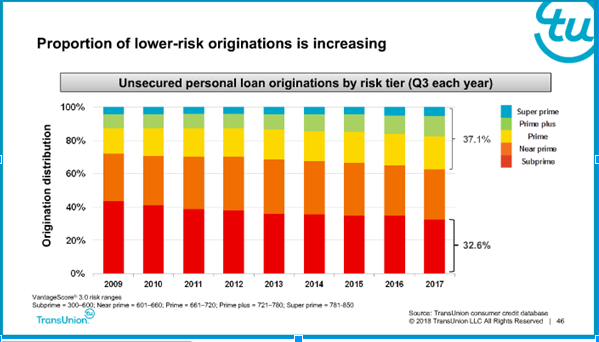

According to the Transunion report, 37.1% of borrowers had a credit score that was 661 or more (prime, prime plus and super prime); However, 32.6% of unsecured personal loans originated in Q3 2017 were to subprime borrowers. The other 30.3% of originations were to borrowers with credit scores between 601-660 (near prime), which is down from 40% level in 2009.

Overall the trend in Q3 2017 were less low score borrowers and a larger percentage of prime or more borrowers.

Personal Loans and Delinquency Rates:

According to the Transunion Report, delinquencies were at a low rate, and they expect that they will remain low in 2018. They noted, that:

Unsecured personal loans continued to perform well at the conclusion of 2017, with serious delinquency rates dropping to 3.29% from 3.83% in Q4 2016.

It is most likely that due to stricter underwriting rules and a shift from poor credit to higher credit risk borrowers lenders have been successful in reducing the delinquency rates.

Personal Loans and Increasing Loan Sizes

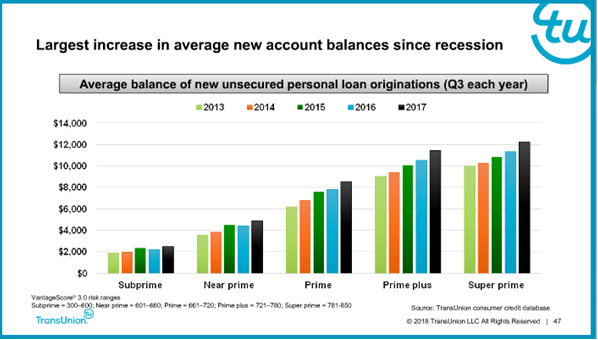

When shopping for a personal loan, lenders offer differing loan sizes. One factor that can affect the loan amount you can borrow is credit score. A high score will lead to lenders offering larger balance loans, and lenders will offer smaller loans to borrowers with less strong credit.

The following chart from Transunion shows that loan sizes have increased steadily from 2013-2017 for all of the higher credit risk categories. For Q3 2017, super prime borrowers had an average loan size of $12,000. This is compared to subprime borrowers with an average loan size a bit over $2,000.

Shopping for a Personal Loan in 2018

A personal loan can be an excellent tool to consolidate debt, pay off large bills, or make large purchases. However, you must be careful to shop around and compare your options.

The lower your credit score, the higher the interest rate you will get. Here are a few steps that you can take to make sure that you get a personal loan or other financial product that meets your needs:

- Credit: Monitor your credit report. Dispute any incorrect items. Take steps to improve your credit.

- Monthly payments: Make sure that you can afford your monthly payments.

- Control your debt: Don’t keep running up debt. If you take a personal debt consolidation loan, then be careful not to run up more debt.

- Compare your options: If you are looking to get out of debt, then look for a debt relief option that fits your personal situation. For example, a bad credit personal loan may be very expensive and not help you get out of debt. If you want lower payments, then a cash-out mortgage refinance (or Home Equity Loan) might be a better option.

Struggling with Debt? 2018 Debt Solutions

Looking for ways to get out of debt? Worried about debt collectors? Check out Bills.com Debt Navigator to find a personalized debt relief solution.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Get your personalized offer

Choose your desired loan amount

Pre-qualification won’t impact your credit