- FHA announced new loan limits for 2013.

- The maximum limits are the same as for 2012.

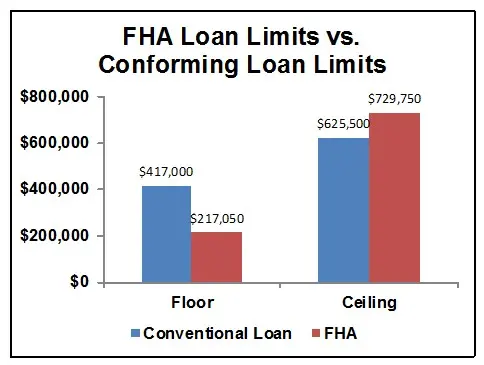

- FHA loan limits for high cost areas are higher than conventional loan limits.

Maximum FHA Loan Amounts - Higher Loan Limits

FHA loans are a popular choice, especially for buyers with low credit scores and/or low down-payment (or high loan-to-value ratios).

The Housing and Urban Development department (HUD) announced that maximum FHA loan limits for 2013 will remain unchanged. This is true for single-family home loans as well as HECM or reverse mortgages.

Similar to Fannie Mae and Freddie Mac conforming loan limits, the FHA Loan Limits are based on:

- The number of units: from single-unit to four-unit properties

- Geographical location: Based on counties

Quick tip #1

Looking for a mortgage loan? Check out today’s low mortgage rates at Bills.com mortgage rate table before getting a mortgage quote from a Bills.com mortgage provider.

Single Family FHA Loan Limits 2013

FHA’s maximum loan limits (PDF) for a single-family house are broken down into four categories as follows:

Low Cost Area (Floor) FHA Loan Limit: $271,050

The maximum allowable FHA loan is not less than $271,050, which is 65% of the Fannie Mae and Freddie Mac conforming loan limit, currently at $417,000).

There are six states — Alabama, Iowa, Kansas, Nebraska, Oklahoma and South Dakota — that do not have any counties with higher limits. All other states have higher limits in some of the counties.

High-Cost Area (Ceiling) FHA Loan Limit: $729,750

The maximum FHA loan limit in Continental United States is still at $729,750. This is about 17% more than Fannie Mae and Freddie Mac High Cost conforming loan limit, currently at $625,500.

There are 74 counties in 14 of the 48 Continental States that have the high-cost limit. Four states - CA., NY, NJ and VA - have 69% of those counties.

Areas between the Floor and the Ceiling: between $271,050 and $729,750

There are 44 states and over 700 counties that have limits between the low areas and the high cost areas.

Special FHA Loan Limit Exceptions for Alaska, Hawaii, Guam, and Virgin Islands: $1,094,625

Those four areas have special higher limits. These limits are similar to the Fannie Mae and Freddie Mac’s conforming loan limits, which are currently at $938,250.

Tip: If you want to find the FHA limit for your area, check out the FHA’s Web site with updated 2013 FHA Loan Amounts.

Quick Tip #2

Purchasing a home or want to refinance? Get a mortgage quote for a FHA, VA, HARP, or conventional loan from a Bills.com mortgage provider.

FHA Loan Limits 2013: Affording a Mortgage

The FHA loan limits are based on housing prices for each county. That means that most people should be able to get a FHA mortgage or conventional loan based on today’s FHA loan limits and Fannie Mae and Freddie Mac’s conforming loan limits.

Quick Tip #3

Shopping for a home? Check out Bills.com mortgage affordability calculator to see how much house and mortgage you can afford.

The table below shows the maximum FHA loan for three different areas (the actual places are just an illustration), the amount of house you can buy, and your mortgage payments (principal, interest and mortgage insurance).

Here are the basic assumptions:

- Mortgage: A 30-year FHA loan at 3.5%.

- Down-payment: 3.5%

- Monthly Mortgage Insurance: 1.25%

| Name of Place | Area | Mortgage-Sum | House Value | Mortgage Payment (Principal and Interest) | Mortgage Insurance |

|---|---|---|---|---|---|

| All of Alabama | Low Cost Area | $271,050 | $280,881 | $1,217 | $282 |

| Athens, OH | Between Loan and High Cost Areas | $443,750 | $459,845 | $1,993 | $462 |

| Santa Barbara, CA | High Cost Area | $729,750 | $756,218 | $3,277 | $760 |

When shopping for your mortgage loan, check mortgage rates and mortgage fees, including lender fees and third-party fees.

The FHA loan limits are, in general, higher than those for conforming loans. The FHA mortgage program currently has less strict credit score requirements; however you still need to meet their debt-to-income ratio. The main disadvantages of an FHA loan are high upfront and monthly mortgage insurance premiums.

Quick tip #4:

Shopping for a mortgage loan? Low credit score? Look into a FHA loan! Great credit qualifications – look into a conventional loan. Make sure to get a mortgage quote from a Bills.com mortgage provider.