- FHA mortgage insurance in 2013 is more costly.

- FHA announced higher annual premiums for 2013.

- FHA announced new cancellation policies starting in 2013.

FHA Mortgage Insurance 2013 - Higher Costs

Following the Great Recession and housing crash of 2007-2008, FHA loans became a popular alternative, especially for first-time homebuyers. With less private mortgages available and tighter lending criteria by Fannie Mae and Freddie Mac, FHA loans offered borrowers with low-credit and/or low down payments an alternative to take out a mortgage.

Due to rising defaults and a huge deficit, the FHA is facing a possible bailout and announced changes in a number of their programs. The FHA announced these changes in January 2013 for their FHA mortgage insurance program:

- Annual Premium: Increase the cost of their annual Mortgage Insurance Premium (MIP)

- Cancellation of Policy: Increase the amount of time the MIP is paid before final cancellation of the policy.

- Exceptions: Certain FHA loans are exempt for the above mentioned changes.

Tip

Whenever you shop for a mortgage remember to consider the mortgage rate and mortgage fees. FHA loans also have an Upfront MIP, which was set at 1.75% for most FHA loans, as of April 2012. The Upfront MIP can be rolled into the loan.

FHA MIP 2013: How Much Do You Have to Pay per Month

FHA Annual Mortgage Insurance Premium (MIP) is based on three factors:

- Term (Length of the Loan): less than/equal to 15 years or more than 15 years

- Loan Amount: More or less than/equal to $625,000

- LTV: Has different ranges depending on the length of the loan.

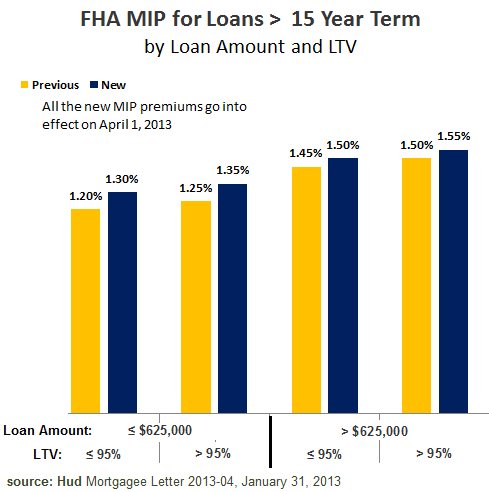

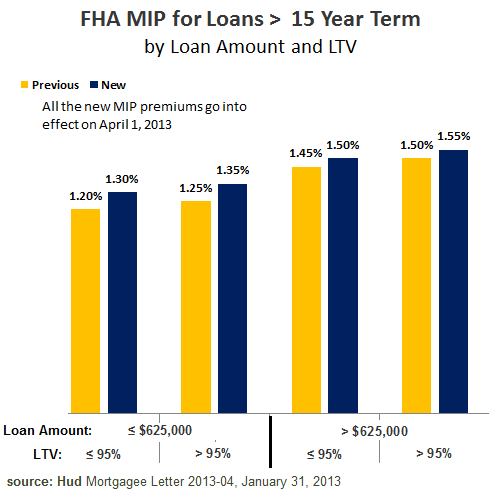

Most homebuyers take out a 30-year mortgage in order to lower their monthly payment. Here are the major changes for loans more than 15 years:

- For all loans less than $625,000 the Annual MIP was raised by 0.1%

- For all loans more than $625,000 the Annual MIP was raised by 0.05%.

The following chart shows the FHA Annual MIP for loans more than 15 years, comparing the old rates to the new rates established in April 1, 2013:

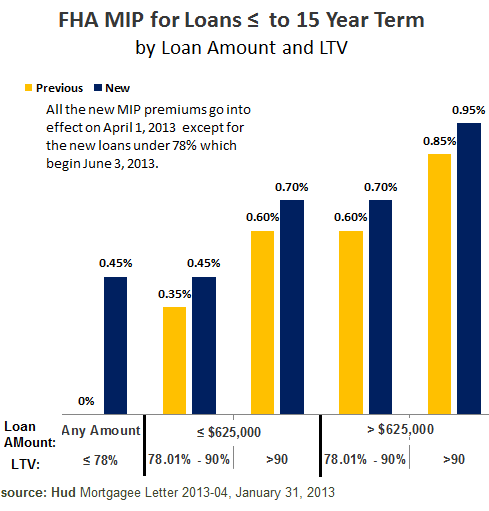

Here are the major changes for loans less or equal to 15 years:

- An increase, as of April 1, 2013 for all loans (less than or equal to 15 years) of 0.1%

- As of June 3, 2013 any loan with a LTV under or equal to 78% will now include MIP of 0.45%. Previously these loans were exempt from MIP

The following chart shows the FHA Annual MIP for loans less than 15 years, comparing the old rates to the new rates established in April 1, 2013 and June 1, 2013:

FHA Cancellation Fees: When Do You Stop Paying MIP

Previously, the Annual MIP was terminated based on loan amount, LTV, and term of loan.

The new cancellation policy is valid for all loans assigned a case number on or after June 3, 2013 and is based on LTV only. Here are the new policies:

- LTV less than or equal to 90%: 11 years

- LTV greater than 90%: : full term of the loan.

Tip

The LTV is based on the lower value of the purchase price or appraised value. The FHA’s new cancellation policy is a major change in their Mortgage Insurance policy. Previously, borrowers were obligated to pay mortgage insurance until their LTV based on the original payment schedule reached 78%, similar to Private Mortgage Insurance policies. FHA additionally had a five year payment clause before termination.

However, unlike PMI Companies, the FHA remains a guarantor on the loan. That means, even if the borrower’s stops paying Mortgage Insurance, and the FHA could be liable toward the lender, if the borrower defaulted. In fact, because of the big drop in home prices, many borrowers became underwater and the FHA is now liable for a large amount of loans that possibly might reach the payment cancellation period.

In order to get a grasp of how much more the new loans will cost, here is an example comparing two different loans for a house valued at $200,000. The first example has a 96.5% LTV and the second one has a 90% LTV. Both examples have loans under $625,000:

Example 1: LTV=90%, UFMIP=1.75%, Interest Rate=3.5%, Term=30-years. Cost is based on reached full term of loan.

| Annual MIP | Termination | Cost of Annual MI | 1st MIP Payment | |

|---|---|---|---|---|

| Previous Policy | 1.2% | LTV reaches 78% (Payments scheduled for 8 years. | $14,049 | $178.43 |

| New Policy | 1.3% | End of 11 years | $20,970 | $193.30 |

Example 2: LTV=96.5%, UFMIP=1.75%, Interest Rate=3.5%, Term=30-years. Cost is based on reached full term of loan.

| Annual MIP | Termination | Cost of Annual MI | 1st MIP Payment | |

|---|---|---|---|---|

| Previous Policy | 1.25% | LTV reaches 78% (Payments scheduled for 9.25 years. | $20,156 | $199.82 |

| New Policy | 1.35% | Full Loan Term - 30-years | $45,900 | $215.53 |

Tip

Interest rates are at historic lows. Even with the extra MIP costs, FHA Loans are still relatively inexpensive. If you are looking to finance a home with a low down payment and/or a low credit score, then get a quote for a FHA mortgage loan.

FHA Mortgage Insurance: Exceptions

The new FHA Mortgage Insurance changes for 2013 do not apply to these loans:

- MIP Duration Changes: Title I an Home Equity Conversion Mortgages (HECM) reverse mortgage loans

- MIP Increases:

- Streamline refinance transactions of existing FHA loans that were endorsed on or before May 21, 2009.

- Title I

- Home Equity Conversion Mortgages

- Section 247 (Hawaiian Homelands)

- Section 248 (Indian Reservations)

Bills Action Plan

Home prices in 2013 are on the rise in many areas of the United States. Mortgage rates are at historical lows, although it is not clear how long this trend will continue. The new changes made in 2013 in the FHA Mortgage Insurance program will make the popular FHA mortgage loan more expensive. However, even with the higher costs of the FHA mortgage insurance, they still offer to many borrowers an attractive mortgage loan alternative. Here are some steps to take:

- Check out home prices in the area you wish to buy.

- Check out how much you can afford. Take into consideration the amount of debt you are carrying.

- Make sure that you qualify for a mortgage.

- Get a mortgage offer and carefully compare the mortgage them, including the interest rate, mortgage insurance and other costs.