The government wants to help the housing market, and especially first-time homebuyers.

Announced by President Obama, the FHA lowered some of its Mortgage Insurance Premiums by 0.5%. This follows some other changes made to open up conventional loan programs, such as lowering the down-payment requirement to 3% and reducing risks for lenders by easing lenders rep and warranty requirements.

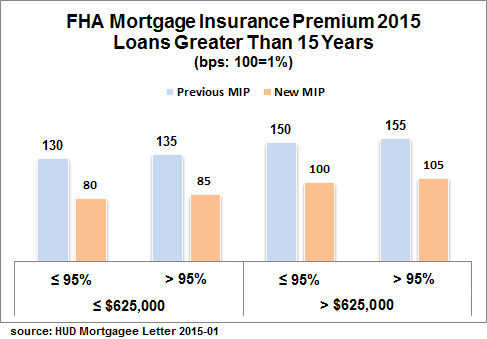

New FHA Mortgage Insurance Premiums – 2015

Despite the FHA’s current deficit, President Obama ordered the FHA to reduce their mortgage insurance premiums (MIP). His goal is to aid first-time home buyers qualify for affordable mortgages.

Traditionally, FHA loans are more popular with mortgage seekers who have either a low credit score and/or a low down payment. For example, the FHA loan program allows for a FICO score as low as 500 for borrowers with a 10% down payment and 580 for those with less than a 10% down payment. (Note: Many lenders do have stricter guidelines).

The only changes made were for loans greater than 15 years. The most common mortgage loans for new homebuyers are 30-year mortgages.

Here is a breakdown of the new FHA Mortgage Insurance Premiums for 2015:

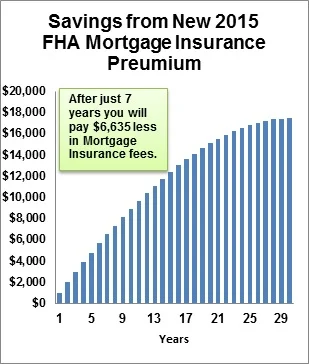

New FHA MIP – How Much Savings? – BIG!

The government is giving money away at the tune of tens of thousands of dollars to anyone taking out a FHA loan.

The new 2015 FHA MIP rates are 0.5% less than the previous rates. The new premium on a loan under $625,000 and a LTV over 90% is now 0.85% instead of 1.25%.

Check out the cumulative savings based on a $200,000, 30-year FHA loan with a 3.5% down payment at 3.25%. (I assume that you would finance the upfront FHA MIP fee of $3,500, making your total loan $203,500).

You start saving about $83 a month during the first year. Since the FHA payments decrease over time, your savings will marginally decrease each year.

If you keep the loan the entire 30-years (which is rare), you can thank the government for helping you save over $18,000! Even if you pay off the loan after seven years, you will have saved over $6,600 in mortgage insurance fees.

Click here to see your monthly payments for the two scenarios.

Lower 2015 FHA Mortgage Insurance - Cheaper FHA Loans

If you are looking to buy a home, or refinance your mortgage, then a FHA loan might be a great choice. Get a mortgage quote from a Bills.com mortgage provider.

New FHA Mortgage Insurance Premium – More Affordability?

While the new FHA premiums are going to save you a lot of money, they are not going to make the house tremendously more affordable. This is due to the fact, that the mortgage insurance monthly fee is a small part of the total housing bill.

Here is an example showing the impact of the new FHA MIP rates on the monthly household payments. Once again I am using a $200,000, 30-year FHA loan, at 3.25%, 3.5% down payment. (I assume that the upfront FHA MIP fee of $3,500 is financed, making your total loan $203,500).

Assumption of Loan and Housing Costs

| Purchase and Loan Amounts | Loan and Housing Costs | |||

|---|---|---|---|---|

| House | $ 207,254 | Interest Rate | 3.25% | |

| Down Payment | $ 7,254 | Term (years) | 30 | |

| Loan | $ 200,000 | Property Tax (annual) | 1.2% | |

| Upfront Fee | $ 3,500 | Homeowner Insurance (annual) | 0.4% | |

| Finance Upfront Fee | yes | |||

| Total Loan | $ 203,500 |

Monthly Payments and New 2015 FHA MIP:

While the monthly payments are a whopping 37% less for the monthly MIP fee, they are only 6% less for the total monthly housing expenses. Using the FHA’s front-end debt-to-income ratio (DTI) of 31%, you would need to earn $4201 to qualify with the new MIP rate versus $4468 with the old MIP rate.

| Monthly Payment | Old MIP | New MIP |

|---|---|---|

| Mortgage Principal & Interest | $ 886 | $ 886 |

| Property Tax | $ 207 | $ 207 |

| Homeowner Insurance | $ 69 | $ 69 |

| Mortgage Insurance (starting payment) | $ 223 | $ 140 |

| Total Monthly Payment | $ 1,385 | $ 1,302 |

Cost of House and New 2015 FHA MIP

On the other hand, using the same amount of monthly payment along with the new MIP rate, you could increase the amount of house you buy to about $220,725, with a loan of $213,000 and a slightly larger down-payment.

While this is not a major change, it could make the difference between closing a deal and be pushed out of the housing market.

Lower FHA Mortgage Insurance Premiums in 2015

Shopping for a mortgage is not simple. While FHA loans have advantages due to looserr credit requirements, they are not always the cheapest loan or the best choice.

The FHA MIP, reduction makes FHA loans more attractive loan for some borrowers, especially for those who are at the bottom tier of the credit score for a conventional loan (620-680).

Your key for maximizing savings to to find a loan with the terms that best fit your financial situation. Pay attention to the interest rate, term of the loan, and all of the fees, including mortgage insurance fees.

Here are a few steps you should take before buying a home and/or refinancing your mortgage:

- Learn how to qualify for a mortgage.

- Find today’s mortgage rates.

- Save money by getting multiple mortgage offers. Pay attention to your credit score and the differences in mortgage insurance premiums and cancelation policies.