- Rural mortgage shoppers have less banking opportunities.

- Rural mortgage borrowers can use online sites and national lenders to even the playing field.

- Rural borrowers should check out USDA/RHS mortgages.

Are Rural Mortgage Shoppers at a Disadvantage

Are you familiar with mortgage loan products? What credit score do you need to qualify for an FHA loan? Does a conventional loan have less expensive mortgage insurance? Do you meet the income and property requirements for a USDA/RHS mortgage?

According to a study published in March 2018, “Mortgage Experiences of Rural Borrowers in the United States Insights from the National Survey of Mortgage Originations,” rural borrowers are at a slight disadvantage when it comes to shopping for a home mortgage. Among their conclusions, they found that:

“... borrowers in completely rural counties paid slightly higher interest rates on average and were less satisfied that their mortgage was the one with the best terms to fit their needs than borrowers in other areas.”

Shopping for a mortgage takes time, effort and knowledge. Comparing loan offers is complicated. However, thanks to many non-bank lenders and online mortgage shopping sites, it is easier to get quotes and compare loan offers.

Background: Who is a Rural Borrower?

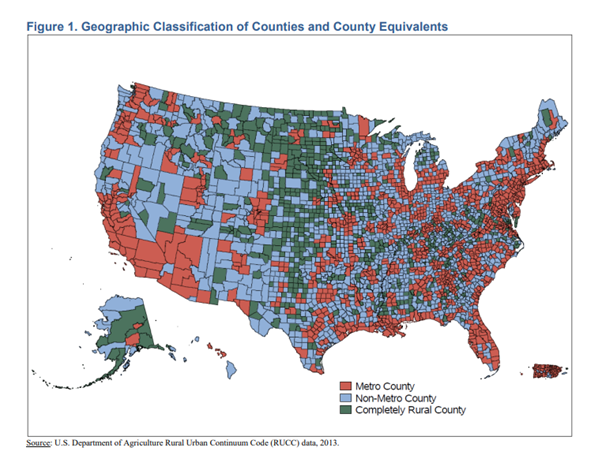

The term rural can be used in a number of ways. For example, the US Census (https://www.census.gov/geo/reference/urban-rural.html) classifies geographical areas into three categories:

- Urbanized Areas (UAs) of 50,000 or more people;

- Urban Clusters (UCs) of at least 2,500 and less than 50,000 people.

- “Rural” encompasses all population, housing, and territory not included within an urban area,

See the map below for a breakdown of counties by urban/rural classification.

Using a broad-based definition of rural, data from the 2010 U.S. Census Bureau’s there are 3142 counties, of which 22% are mostly rural; however, those counties only accounted for 2% of the total population. The Census Bureau broke down population within each area by rural vs urban population. About 19%, or 1 in 5 US residents lived in a rural area.

The demographics are different for the groups. The American 2016 Community Survey, which is an in-depth survey of American Households in rural areas found that:

“people who live in rural areas are more likely to own their own homes, live in their state of birth and have served in the military than their urban counterparts,”

Check out this infographic https://www.census.gov/content/dam/Census/library/visualizations/2016/comm/acs-rural-urban.png for a summary of their results:

Shopping for a Mortgage? Get a Quote Now.

Looking to buy a home? Find a mortgage that fits your budget and downpayment. Get a purchase mortgage quote now.

Rural Area Mortgage Borrowers: At a Disadvantage?

The study above looked at rural borrowers who lived in a completely rural area. The authors examined to see if there are differences between those rural borrowers and the general public.

The authors suggest that completely rural area borrowers are serviced by small community banks and credit unions lenders. Those borrowers were more dependent on their lender to provide information.

They found that borrowers in completely rural areas were less confident or knowledgeable about mortgage terms and details. They received less favorable conditions than borrowers in other areas, and they were more likely to initiate contact with their lender and be dependent on that lender for information. The study showed that higher interest rates were affected by loan size and credit factors and not by the type of population.

Rural Mortgage Loans: Level the Field

If you are looking for a mortgage, then you can level the field by becoming a more informed consumer. Before you buy a home and shop for a mortgage learn about the various types of loans, repayment plans, and how to qualify.

Local lenders might better understand the community environment and offer you benefits in your everyday banking activities. However, big players who provide both conventional and Government-backed loans, dominate today’s mortgage market. It is easy to get mortgage quotes from multiple lenders and compare rates and fees.

In today’s market, there are some low down payment purchase mortgages including the FHA loan, Fannie Mae HomeReady, and Freddie Mac’s Home Possible Mortgage. Additionally, the USDA rural loan program helps low to middle-income borrowers.

Rural borrowers do not need to be at a disadvantage when shopping for a mortgage. It is possible to get multiple quotes for the various loan programs from online sites, such as Bills.com. National and regional lenders are eager to grant mortgages to rural borrowers at competitive prices.