Differences Between the Three Credit Bureaus

Are all three major credit bureaus the same? Should I pay more attention to one than to the others?

Is there a credit bureau that I should pay more attention to. Some credit bureaus have collection accounts listed that others do not. When I start paying off collections, should I pay off the ones on a certain credit bureau first, in order to build my credit score faster?

Thank you for your question about credit bureaus, collection accounts, and credit scores. I will discuss the differences between the credit bureaus and whether you should pay off the collection accounts that appear on a specific credit bureau in order to improve your credit score.

Credit Reporting Agencies

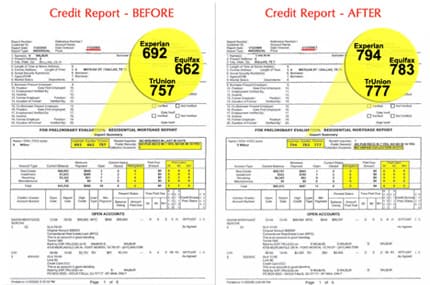

While there are many different credit reporting agencies (CRAs), the three largest ones are the most important. The big three are Experian, Equifax, and TransUnion. They are also called credit bureaus. The main purpose of the CRAs is to gather, compile, and analyze data they receive from your credit providers.

The main differences between the big three CRAs is they will not necessarily have identical information on their credit reports and each apply similar but unique scoring models. Your case is an example of the CRAs not showing the same information. Different collection accounts appear on different reports. This is not uncommon. Another example is rental payment data, which Experian has been collecting (from landlords that choose to report it) since December 2010. By contrast, TransUnion and Equifax don’t factor rental history into your credit score.

Credit providers are able to choose which credit bureaus it reports to, but most creditors who report to any bureau at all, report to all three of the major credit bureaus. In addition to credit providers, the bureaus also gather information from public records that affect your score. Examples of public record items are tax liens, judgments against you, or the fact that you filed for bankruptcy.

Based on the information the CRAs receive and the mathematical models they use, they convert your credit history into a score. Your credit score reflects your creditworthiness. Your score gives credit providers who review it a way to assess the risk level of lending to you.

FICO Scores

Credit scores can be quite confusing. For one, each of the three bureaus has developed its own proprietary model to compute their version of your score. You can purchase a credit score directly from the individual bureaus that is designed for consumers. While these scores will give you a good idea of your credit rating, they are not the same scores that lenders or credit issuers will use when deciding whether to approve your credit application. Amazingly, each bureaus has tens of different scoring models it employs. Here is a list of more than 100 different TransUnion scoring models (PDF) it employs for different situations!

Know What You’re Paying For

For the scores that consumers can purchase, Experian uses the "Experian PLUS Score." Equifax has the "Equifax Credit Score." TransUnion has their own "Trans Unions" credit score. In all cases, the higher your score, the better.

The Consumer Financial Protection Bureau (CFPB) warns that "Consumers who are unaware of the variety of credit scores available in the marketplace may purchase a score believing it to be their ‘true’ score." This can harm consumers who find out that the score the score they purchased varies from the score that a lender or credit issuer will use.

Each bureau’s score is not identical to your FICO score, which is compiled by the Fair Isaac & Co. The scoring ranges are different, too. Some examples of credit score ranges are:

- Equifax Credit Score: 280 to 850

- Experian Plus: 330 to 830

- TransUnion: 501 to 990

- FICO: 300-850

The FICO scores are the scores most commonly used by lenders and credit issuers. FICO offers a score for each of the three bureaus, but it is not the same score you get when you purchase a report from any individual CRA. Even if you buy a score from FICO’s myfico.com Web site, you are not going to get the same score that lenders use.

According to the CFPB, the reasons that the scores you can buy online can vary from the scores that lenders use include:

- "Use of different scoring models;

- "Lenders and consumers may not use the same CRA;

- "Data in the consumer’s credit reports change between the time the consumer purchases a score and the time the lender obtains the score;

- "A consumer and a lender could possibly access different reports from the CRA, if they were to use different identifying information about the consumer."

Even a FICO score you get directly from Fair Isaac & Co. may not be the same one that a credit provider uses, because there are different versions of the FICO score. For instance, there are different FICO scoring models used by mortgage lenders, auto financing institutions, and credit card issuers.

When it comes to mortgage lending, Fannie Mae, for instance, requires that lenders use the "classic FICO" score for each borrower, for any loan Fannie Mae will purchase. The "classic FICO" is different than other scoring models FICO employs. Freddie Mac also requires all loans it will purchase to have a FICO score.

Each CRA calls the "classic FICO" score by a different name: • Equifax Beacon 5.0 • Experian/Fair Isaac Risk Model V2SM • TransUnion FICO Risk Score, Classic 04

The bottom line is you should pay attention to all three credit bureaus. The differences between them are not significant enough to make one more important than the other.

Even if the scores that you can get from them are not fully reflective of the scores that lenders will use, they give you a good baseline to measure whether your score is heading up or down. If you monitor any one score, over time, you should get a realistic picture of your credit score and how your behavior is affecting it. Of course, if you watch all three, you will have an even more accurate picture.

Collection Accounts

Collection accounts degrade your score. They can appear on your credit report from creditors who normally report your to the bureaus on your account status each month or from accounts that never before appeared on your report. For instance, it is common for a cell-phone or utility provider collection account to appear on your report, when neither normally report account activity.

Which Collection Account to Pay First?

There is no one-size fits all answer to which collection account you should pay first. Here are the factors I think you should weigh when deciding to pay off collection accounts.

- Your Goal in Paying the Collections: Why do you want to pay off your collection accounts?

- If you are applying for a mortgage loan to buy a home or to refinance your current mortgage, you may have to pay off the collection accounts in order to qualify.

- If you are trying to just improve your score, you have to decide if the benefit to your score will outweigh the financial cost of paying them off.

- Date of Collections: If your goal is simply to improve your credit score, see how long it will be until the account falls off of your credit report due to federal law. The Fair Credit Reporting Act states that derogatory accounts will fall off your report on their own 7 years after the date of first delinquency, which can be as long as 180 days. That means an account should come off your report no later than 7½ years. If it does not, you can dispute the presence of the account on your credit report. Unpaid federal student loans, judgments, and liens can remain for a longer time.

- Statute of Limitations (SOL): If one of your collections accounts has passed the SOL for debt, but not yet reached the time it falls of your credit report, you have to decide whether it makes sense to pay it.

- Aggressiveness of Creditor: The more aggressive the collection efforts you face, the greater your incentive to work out a solution. To halt collections, you may need to try to negotiate a reduced-balance settlement, have to pay the debt in full in a lump-sum, or be able to work out some kind of payment plan.

- Size of Collection Accounts: Practically, you may need to decide which account to attack first based on the reality of your budget. As much as you may want to pay off a large debt, it may not be realistically within your means to work out a solution.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836