Fidelity Retirement Funds and European Debt Crisis

- The global economy means that your retirement funds may be invested abroad. Learn about the types of funds you buy.

- Your retirement accounts can be protected by regulatory safeguards through FDIC and SIPC.

- Diversify your investments.

- Start your FREE debt assessment

How can I protect my retirement account from the European debt crisis?

I have much of my retirement savings being managed by Fidelity. Should I be concerned about their heavy investment in the failing European markets and think about moving my money into something else?

Thank you for your question about retirement savings and the European debt crisis.

Your 401(k)s and other retirement accounts at Fidelity are important assets, which should be monitored and nurtured. All investments have an element of risk, and it is important that you understand the risks that you are taking and the ways to safeguard your investments.

The global economy has made us more aware of events that take place far away from our home. The European debt crisis is one example of how the international financial market can affect us and our retirement accounts.

Remember, your retirement accounts are not invested in Fidelity, rather they are being held and administered by Fidelity. Fidelity has self-administered plans as well as managed accounts. They offer a large variety of investment products, including mutual funds, stocks and options, exchange-traded funds (ETFs), fixed income, and annuities.

The European Debt Crisis

We are witnessing the spread of the European Debt Crisis from Portugal, Ireland, Greece, Spain, and now to Italy. Governments borrow money to finance their activities. Government debt for these European nations has mushroomed, leaving the financial markets wondering if the governments will meet their payment obligations on time. The bond and stock markets are not only affected in Europe, but also in the U.S., Asia and the rest of the world. As the European debt increases, the governments face an increased risk of insolvency as well as an inability to bolster their internal financial institutions. This causes some of our investments to lose value. In order to gauge the risk of the European countries, three main ratios are being examined: the External debt, Government debt and Government deficit to GDP (Gross Domestic Product).

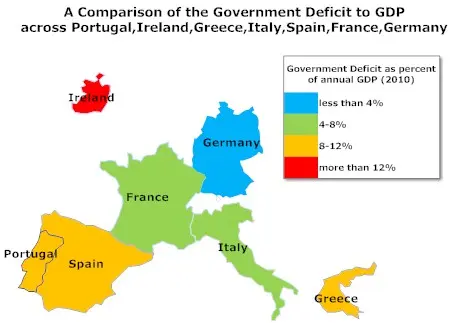

Government Deficit to GDP (2010)

The first three countries to enter the European Debt Crisis were Portugal, Ireland and Greece. They have been joined by Spain, and Italy. For the sake of comparison you can see how they compare with two stronger European countries, Germany and France. The combined deficit of the seven countries is more than 477 billion Euros.

Ireland has an extremely high deficit of 32%. The next four are France (7%), Portugal (9.1%) , Spain (9.2%) and Greece (10.5%). Italy had a lower deficit of 4.6% and Germany had a low deficit of 3.3%.

Government Debt and External Debt of GDP (2010)

As you can see in the chart below, as of 2010, Greece (143%), Italy (119%), Ireland (96%) and Portugal (93%), had very high Government debt to GDP ratios. Spain, had relatively lower rates but their situation has deteriorated. As regards external debt to GDP, Greece is in the worst position, once again.

The data for the map is from eurostat. The data for the chart is eurostat and worldbank.

You are correct that you need to be aware of events in the world market place that affect your investments. In fact, the investment firms, the rating agencies, and the news agencies are all gathering and dispensing vital information. The European debt crisis is one example of how a seemingly external event can affect your life.

Fidelity: A Financial Service Company

Fidelity is a privately owned company providing a vast array of financial services including retirement services, brokerage services, wealth management, investment advice, and mutual funds management. When creating your retirement portfolio, you may have a mix of stocks, bonds, cash and mutual funds, as well as other financial products.

Mutual Funds

According to Fidelity's Web site, as of March 31, 2011 Fidelity has over 500 different mutual funds. Their top five have over $376 billion in assets. Mutual funds, even Money Market Funds, are investments, not deposits, with no insurance or guarantee of their return.

The funds are specialized in many areas, including in emerging markets. Fidelity classifies their mutual funds in these areas:

| Investment Objective | # of funds |

|---|---|

| Equity mutual funds | 398 |

| High-income mutual funds | 19 |

| Fixed-income mutual funds | 50 |

| Money market mutual funds | 38 |

According to Fidelity's statement on money market funds and European Investments (from www.americaninvestment.com), the money market fund has no direct exposure to European banks located in Greece, Ireland, Portugal or Spain. The fund managers closely monitor the European market, diversifying their assets and avoiding high risk areas.

Retirement Fund Management

According to a Bloomberg.com news report from March 23, 2011, there is close to $3 trillion dollars in 401(k) accounts. Fidelity, as of 2009 administered an impressive market share of 27% of all assets held in 401(k) plans.

There are many different types of retirement accounts, and Fidelity retirement accounts come in many forms. Some of the more common accounts, include: 401(k), Traditional IRA, and Roth IRA.

Safeguards for your money

Your main safeguards for your investments are:

- FDIC insurance for cash deposits

- SIPC

- Knowledge.

FDIC Insurance

The FDIC (Federal Deposit Insurance Corporation) was established in 1933 by the U.S. government to protect investors' cash funds in participating banks and savings institutions. The insurance currently covers up to $250,000 per depositor, per insured institution. The FDIC provides more detailed information at their Deposit Insurance Summary page and a Deposit Estimator Tool.

The coverage is limited, as the FDIC, states:

FDIC insurance covers all deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or securities.

Make sure that any depository accounts that you have are covered by the FDIC.

SIPC Insurance

SIPC (Securities Investor Protection Corporation) is a non-profit organization, created by Congress in 1970, in order to protect investors from bankrupt brokerage firms. It does not protect your funds against fraud, nor insure your investments. It does aid in restoring funds to investors whose assets are held by financially troubled or bankrupt brokerage firms.

Before dealing with a brokerage firm check that it is an "SIPC member". SIPC coverage is limited to $500,000 per account, although not all investment items are covered. You will have to provide details regarding your portfolio, so keep good records. Check the SIPC website for updated details.

Private Insurance: Many firms, such as Fidelity carry "excess" insurance to cover sums above those insured by SIPC.

For more information about safeguards on all your Fidelity accounts, including your Fidelity retirement account, see the Fidelity page about protections for clients' assets.

Learn and Diversify

The biggest safeguards you can provide yourself are to become an informed consumer and to diversify your investments. Take advantage of information provided by your broker or retirement fund manager. Fidelity offers a lot of information, as well as updated marketing research. Check the rating agencies before investing in a stock, bond or mutual fund.

No matter how closely you follow the news, there are always unexpected events. The European Debt Crisis is a prime example. Even though we are removed from the European governments' financial decisions and the European Banking system, the European Debt crisis affects our investments. The effects are direct, if, for example, we purchased Spanish government bonds, and indirect, if we purchase a fund that invests in the European market. In a broader sense, the European Debt Crisis affects your Fidelity retirement accounts, due to its influence on U.S. economic growth.

A key step to protecting yourself is to diversify your investments. Stay knowledgeable and consult with your investment and retirement expert.

I hope this information helps you Find. Learn & Save.

Best,

Bill

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.