Higher Mortgage rates? 5/1 ARM vs 30-Yr FRM

- 2018 Mortgage Rates are on the Rise

- An Adjustable Rate Mortgage (ARM) can save you money in the short-run.

- Consider overall costs and long-term risks.

Adjustable Rate Mortgages and Rising Mortgage Rates

Before you get into the technical details of an adjustable rate mortgage, get a quick look of how an adjustable rate mortgage can possibly save you money – or lose you money. The amount of savings (or loss) will depend on rates, fees and the amount of time you hold on to the loan. If you plan on holding on to your mortgage for a five year period, then a 5/1 ARM will be your best choice.

If you are shopping around for a mortgage, then an adjustable rate mortgage might start to look more attractive. With mortgage rates rising, you should check out the pros and cons of a Fixed Rate Mortgage vs. an Adjustable Rate Mortgage.

In order to help you make the choice learn more about:

- Fixed Rate vs Adjustable Rates in today’s market

- Saving with a 5/1 ARM in the short term

- Risks of a 5/1 ARM

Check Out Today's Mortgage Rates

Shopping for a mortgage? Or, just want to get abreast of mortgage rates? Check out bills.com mortgage rate table for a personalized rate.

Mortgage Rates Going Up – ARM rates at a Slower Rate

The rate on a 30-year Fixed Rate Mortgage has risen by 0.23% over the year from February 2017 to February 15 2018. While the 5/1 ARM rate has risen at a faster pace, it is still 0.75% lower than the 30-Yr FRM rate.

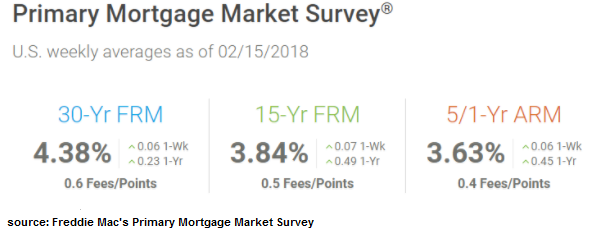

Here are average rates as published by the Freddie Mac’s Primary Mortgage Market Survey for the week of February 15, 2018.

The Chart below shows the change in average monthly rates for 5/1 ARM and 30-Yr FRM for the period of January 2005 – January 2018. (The rates are average national rates based on the Freddie Mac PMMS)

5/1 ARM Short Term Savings

Compared with a 30-Yr FRM, a 5/1 ARM offers a substantial savings, at least for the first 5-year period. If you can afford the monthly payments on a 15-YR FRM and want to build equity quickly, then stick with the short-term FRM.

Here is an example for 30-year loan for $200,000 loan based on market rates for week of February 15, 2018. The three benefits of an 5/1 ARM loan, for the first five years, over a 30-Year FRM are:

- Lower monthly payment

- Less interest paid

- More principal paid

The charts below summarizes your monthly payments for the first five years:

| Compare Payments | Compare Balance | Compare Interest |

Adjustable Mortgage Rates - Learn the Details

Since there is no way to know the future interest rates, you should prepare for the worst-case scenario. ARM’s come with built-in based rates, margins, caps and ceilings. Make sure that your lender explains to you what they are and how they can affect your monthly payments.

Risks in an ARM vs FRM: 5/1 ARM – Long Term Risks

Rising interest rates translates into higher monthly payments or the ability to take out a smaller mortgage. As shown above, the short-term gains of an ARM can be beneficial. However, before you take an ARM, you need to weigh your short-term savings versus the potential risks of higher rates and higher payments.

An ARM carries the risk of higher payments when interest rates are adjusted. (That means after 5 years on a 5/1 ARM). Since you don’t know the exact amount of time you will hold on to your home/mortgage or what future mortgage interests will be, you might find yourself in the position of:

- Higher payments that you can’t afford.

- Higher interest rates and a turning point where you start losing money.

Since there is no way to know the future interest rates, you should prepare for the worst-case scenario. ARM’s come with built-in based rates, margins, caps and ceilings. Make sure that your lender explains to you what they are and how they can affect your monthly payments.

Based on Today’s Rates: 5/1 ARM vs 30-Yr Fixed

The chart below shows your potential saving/losses comparing a $200,000 30-Yr loan with a fixed rate of 4.38% vs. an adjustable rate starting at 3.63%, an annual cap of 1%, and a lifetime cap of 5% over the initial interest rate.

In this potentially “worst-case”scenario:

- Payment Shock: Beginning in the sixth year your payment will be more than $100 more than your beginning payment and the seventh year an additional $200. Can you afford those payments?

- Overall loss: Many people don’t stay in a home more than seven years. However, the longer you hold on to the home the more risk you take in terms of overall savings.

Bills Action Plan: Rising Mortgage Rates and Adjustable Rate Mortgage

Since the beginning of 2018 Interest Rates are rising. That includes fixed and variable rates. If you are thinking of saving money in the short run, then consider an ARM.

An ARM loan offers many advantages, including a lower monthly payment and a potential savings on your finance costs; however, it also carries long-term risks, depending on the movement of interest rates. Before you take an ARM make sure that you:

- Understand all the terms of the loan including the initial rate, margin, caps and ceilings.

- Don’t rely on a APR and be careful to examine the lender’s assumptions. If they are showing an adjusted payment based on today’s base rate + margin, then you may be in for a surprise down the road.

- Shop around based on the mortgage fee and rate.

- If you are staying in the house for 5-years, then a 5/1 ARM offers good savings; however, if you stay in your home for a longer period then you face a potential loss and maybe an unaffordable mortgage.

Shop for Mortgage Rates

Is a Fixed Rate Mortgage the best alternative? Or maybe you are looking for an Adjustable Rate Mortgage ? Get a mortgage quote today from a bills.com mortgage provider.