- FHFA Announced New Conforming Limits for 2019.

- Both Baseline and Maximum Amounts increased by 6.9%.

- About 94% of the counties have a conforming limit of $484,350, which is the baseline amount.

Conforming Mortgage Loan Limits Increase in 2019

The Federal Housing Finance Agency (FHFA) announced on November 28, 2018, that new mortgage loan limits for Fannie Mae and Freddie Mac loans. The good news for many borrowers is that,

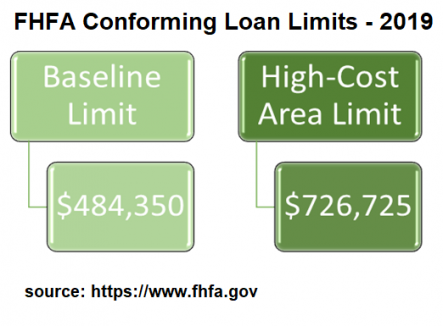

" In most of the U.S., the 2019 maximum conforming loan limit for one-unit properties will be $484,350, an increase from $453,100 in 2018.

The maximum amount varies by county. The FHFA distinguishes between a maximum "baseline" amount, set at $484,350 and a high-cost area, which allows for a loan amount up to $726,525.

How Does the FHFA set Conforming Loan Limits

The baseline limit is set based on the change in housing prices. The FHFA uses its seasonally adjusted expanded-data HPI for the US, which changed between the third quarter of 2017 and the third quarter of 2018 by 6.9%.

In addition to the baseline loan limit, conforming loan limits are different for “areas in which 115% of local median home value exceeds the baseline conforming loan limit.” The ceiling on the maximum amount is set at 150% of the baseline amount.

It is important to understand that housing prices vary greatly between states and counties. Also, the FHFA is using median home prices. So there are many people, especially in high priced areas, that are not going to qualify for a conforming loan because of the loan limits.

Check out the map below that shows how home prices changed between 2017 Q3 and 2018 Q3, based on the FHFA seasonally adjusted state based HPI.

FHFA HPI Change between 2017 Q3 and 2018 Q3, Source: FHFA.gov.com

2019 Conforming Loan Limits - Changes and Amounts

About 94% of the counties have a conforming limit of $484,350, which is the baseline amount. Only 15 states, including Alaska and Hawaii, which are automatically defined as high-loan limit states, and 102 counties (3%) had the maximum amount of $726,525. Here are the top 5 states by the number of counties:

- Alaska: 29

- Virginia: 17

- New Jersey 12

- New York: 12

- California: 11

There are an additional 90 counties that have higher conforming loan limits than the baseline, but don’t reach the maximum amount.

| Baseline | Between Baseline and Maximum | Maximum | Total |

|---|---|---|---|

| 2,951 | 90 | 102 | 3,143 |

| 94% | 3% | 3% | 100% |

Conforming Loan Limits 2019 - County Count, Source:FHFA.gov

What if Conforming Loan Limits Aren’t Enough?

The most popular loans in today’s mortgage markets are Fannie Mae and Freddie Mac conventional loans. The maximum amount of money offered are set by the FHFA conforming loan limits.

The next most popular loan is the FHA mortgage, which has similar maximum loan limits. However, the FHA has lower limits than the FHFA baseline amount. That means if you buy a more expensive house than the average home, then you might not qualify for a FHA loan.

If you are purchasing a home or refinancing your mortgage and your loan amount is higher than the conforming loan limits, then look into a jumbo loan. According to a November 27, 2018 article on the industry website, www.mortgagedaily.com,

“Jumbo share was 11.1 -- the widest it's been since the week ended Dec. 29, 2017. Interest rates on jumbo mortgages were 31 basis points lower than conforming rates.

2019 Conforming Loan Limits - Prepare and Shop for a Conforming Loan

By preparing your budget, saving money for a large down-payment, lowering your monthly debt payments, and increasing your credit score you will increase your chances to qualify for a mortgage loan at the best rates. Most borrowers should be able to fit into the 2019 conforming loan limits

When you are ready to buy a home and take a mortgage loan or refinance your current loan, check out your options, then shop around.