- Learn about your mortgage needs.

- Learn about the lender.

- Shop for the deal right for you.

Three Steps to Finding a Home Loan Lender

Our goal is to help you find a lender. One that is right for you. Bills.com knows that to find a lender you must be equipped with updated information and specially designed tools. After careful preparation, you will be able to receive quotes from real lenders that will match your needs. Finding a lender can mean different things depending on your situation.

You may want to find a lender for an auto loan, or a student loan, or a debt consolidation loan. Bills.com offers valuable information about all these subjects. However, in this article I will talk about how to find a lender for a mortgage loan, including finding a lender for a home purchase loan, a home equity loan, a refinance loan, or a HARP loan.

STEP ONE: Learn About Your Needs - Defining What You Want

Before you can find a lender, you must define what you are looking for.

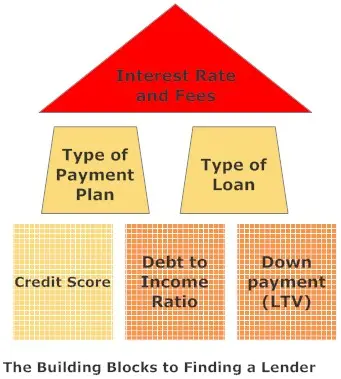

You must know what information you need to ask for, and what information you need to provide to the lender. You will need to familiarize yourself with the terms and jargon of the business. LTV, DTI, FICO…WOW! Qualifying for a mortgage loan or refinancing a loan is a big chore! We need to jump through many hoops because a home is a big investment and a mortgage loan is a long-term commitment.

Bills.com provides you with many resources and tools including:

- Articles About Buying a House

- Articles About Taking a Mortgage

- Articles about Mortgage Rates and Mortgage Fees

- Mortgage calculators: Home Affordability Calculator, Mortgage Payment Calculator, Mortgage Refinance Calculator

By becoming an informed customer, you will be able to better judge the offers you receive and find a lender that matches your needs.

STEP TWO: Learning About the Lender

There are a few different ways to go about finding a lender. You will want to get information, both objective and subjective, from a variety of sources.

The main methods are recommendation of a colleague, friend, or relative, mortgage broker, real estate agent, lender’s website, and on-line reviews. Some of these may be more objective and some have a particular interest to get you to do business with them.

While Bills.com may not be your relative, we are here to offer you friendly and useful advice. The Bills.com Lender Review profile offers both customer reviews about lenders origination (giving you a loan) and their servicing (billing, collecting, modifying your loan) operations. In addition, you will find information and statistics about the lenders. Bills.com is there to help you find a lender that meets your needs, whether it is a:

STEP THREE: Comparison Shopping - Get A Quote

The third step is the one that gets to the bottom of it: getting a quote that matches your needs. If you want to find a lender that offers you a mortgage loan best for you, then you will want to compare offers.

Bills.com has helped you understand the process of getting a mortgage loan, knowing what you what in the loan, and learning about the different lenders. Bills.com has taken the process of finding a lender one-step closer to you. Instead of you finding a lender, Bills.com will have the lender find you. That’s right, you can now receive free, no-hassle, real quotes from top lenders across the country. The lender will be able to learn about your needs, and match them with your products. Of course, you, together with the lenders, can make changes and refinements in the offers.

shop

when you are ready to shop for your mortgage,and find the best mortgage rate, and get a bills.com quick quote and get matched with some of the best lenders in the country based on your unique situation and needs.