Choosing a Home Equity Loan - Check Your Options

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit

- 1 min read

- Which type of home equity loan best fits your situation.

- First, figure out how much equity you have in your home and your loan-to-value ratio.

- Then choose between a cash-out refinance mortgage, home equity loan, or home equity line of credit.

Choosing a Home Equity Loan - Which Option is Best for You?

A home equity loan is a select type of mortgage, which allows you to tap into your home's value to take out cash. There are many reasons to take out a home equity loan, including debt consolidation, home improvements, or paying for college.

Bills.com's Choosing a Home Equity Loan Calculator helps you decide which is the best method to take out the funds you need. It factors in when you need the money and how you can repay the loan with the most affordable and cost-effective payment plan.

Before choosing a home equity loan, take the preliminary steps of figuring out how much home equity you have, and how large a loan you can take.

How Much Home Equity Do You Have:

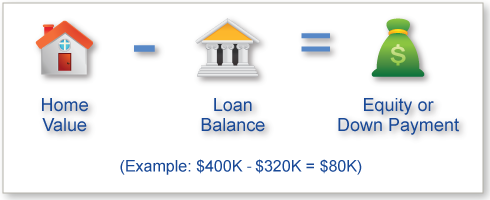

When you financed your home purchase, you made a down payment and then took a mortgage to buy the home. Your down payment represents the amount of equity you possessed.

However, some events occurred since you purchased your home, including changes in your mortgage balance and your home value.

To calculate your current home equity, you need to know your existing home’s value and the balance of your mortgage(s).

Home Equity - How Much Can You Take Out

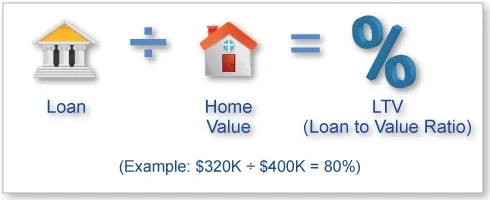

How large of a home equity loan can you take? In general, lenders allow for a combined LTV (CLTV) That would depend on your Loan to Value ratio, and lenders’ rules and guidelines. Your LTV is easy to calculate. Using the previous example, your LTV is 80%: $320,000 / $400,000.

In general, lenders allow for a combined LTV (CLTV) of about 80%. It is essential that you align your cash needs with the amount of money that lenders will offer.

Home Equity Loan Calculator - Choosing an Home Equity Loan Option

It will be back shortly. Thank you for your patience.

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit