The HomeOne High LTV Mortgage

- Many purchasers do not have a large down payment.

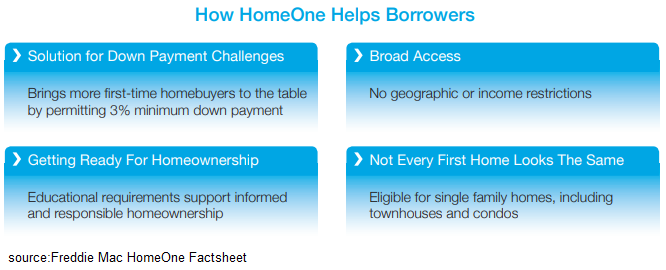

- Freddie Mac introduced the 97% LTV HomeOne Mortgage and revised the Home Possible® Mortgage.

- The HomeOne Mortgage does not have income or geographical restrictions

HomeOne Mortgage - A Low Down Payment Option

Is a small down payment holding you back from buying a home?

Many households want to purchase a home, but don’t realize that there are purchase mortgages with a low down payment option.

Some years ago Freddie Mac introduced a special program for homebuyers with a small down payment and a high loan to value ratio (LTV). The Home Possible Mortgage allows for an LTV as high as 97%, and even higher for homebuyers with special assistance programs. Can you afford the monthly payments, but can’t find the appropriate option?

In April 2018, Freddie Mac announced a new low down payment mortgage, the HomeOne Mortgage which offers a low down payment (3%) and high LTV (97% or more in certain circumstances) that does not have income or geographical limitations.

Get a Low Down Payment Mortgage Quote Now.

If you are in the market looking to buy a home and have a small down payment, then check out all of your options, including a HomeOne mortgage. Get a mortgage quote now.

HomeOne Mortgage - Key Program Points:

The HomeOne mortgage is very similar to other conventional mortgage programs. The HomeOne mortgage requires standard credit score and history requirements. Although the required minimum credit score is 620, most lenders have stricter standards. It is always a good idea to shop around.

Here are some of the main points of the Freddie Mac Home One Mortgage:

Down payment: Only 3% down payment required. As high as 105% Total LTV when secondary financing is an Affordable Second.

Type of Property: 1-unit properties, including condominiums and units in Planned Unit Developments. Manufactured homes are excluded from the program.

Homebuyer Education: According to their fact sheet, “When all Borrowers are First-Time Homebuyers, at least one Borrower must participate in homeownership education. This requirement may be fulfilled with our free, online CreditSmart® program or another acceptable homeownership education program.”

Loan Restrictions: Adjustable Rate Mortgages are excluded. HomeOne mortgages must be conventional, fixed-rate mortgages. Loan limit size is restricted, so super conforming mortgages are not permitted.

Mortgage Insurance: Private Mortgage Insurance is required.

Get a Low Down Payment Mortgage Quote Now.

If you are in the market looking to buy a home and have a small down payment, then check out all of your options, including a HomeOne mortgage. Get a mortgage quote now.

Low Down Payment - Check Your Options

If you are looking to purchase a home, but have minimal funds for a down payment, then check your options.

One of the most popular options is the FHA mortgage. The FHA mortgage offers an LTV up to 96.5% (a down payment of only 3.5%), however, has both an upfront mortgage insurance charge as well as a monthly mortgage insurance payment, which is not canceled for the entire term of the loan. Other possible options for special circumstances are VA loans and USDA/RHF rural mortgage loans.

To broaden the availability of 3% low down payment mortgage options, Freddie Mac introduced the Home Possible mortgage. The Home Possible mortgage helps low to middle-income homebuyers. It has income and geographical limitations. However, it also has discounts on the mortgage insurance coverage, which translates to a lower cost to the borrower.

In April 2018 Freddie Mac introduced the HomeOne mortgage, which is similar to the Home Possible mortgage, without the restrictions on income and geography. This option allows a borrower to take out a Fixed Rate mortgage with only 3% down.

Get a Mortgage Quote

If you are in the market looking to buy a home and have a small down payment, then check out all of your options, including a HomeOne mortgage. Get a mortgage quote now.