What to Do When Mortgage Rates Are Going Up

Mortgage Rates Going Up? How You Are Affected

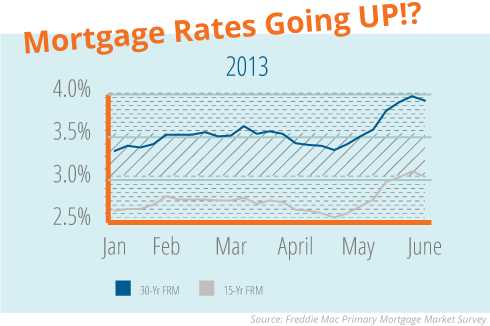

Mortgage Rates Going Up - 2013

If you are planning to buy a home or refinance your mortgage, then you are in all likelihood a Rate Watcher. It’s an inescapable fact that the interest rate on your loan dictates how much you can borrow. And after years of steadily falling rates, it seems we have finally reached the bottom as interest rates have begun to climb once again.

Below is a chart showing 30 and 15-year mortgage rates since 2008. The direction of the two squiggly lines at the very end is what should catch your attention - if that upturn continues, then it could mean less house for you.

The good news is that even after increasing to 3% for a 15-year loan, today’s rates are still lower than anything prior to mid-2011. But what does that really mean for you and how much you can borrow?

Quick tip

Get a mortgage quote from a Bills.com mortgage provider.

Mortgage Rates Going Up - Your Monthly Payment Increases...

Rising mortgage rates means increased monthly payments for the same loan amount, or a smaller loan for the same mortgage payment. The table below helps you understand just how much you need to pay on your mortgage (principal and interest).

Example 1: Same Loan Amount - Rising Mortgage Rate = Higher Monthly Payment

| 30-Yr. FRM for $200,000 | 15-Yr FRM for $200000 | |||

|---|---|---|---|---|

| Interest Rate | Monthly Payment | Interest Rate | Monthly Payment | |

| 3.00% | $843.21 | 2.50% | $1,222.58 | |

| 3.50% | $898.09 | 3.00% | $1,381.56 | |

| 4.00% | $954.83 | 3.50% | $1,429.77 | |

| 4.50% | $1,013/37 | 4.00% | $1,479.83 | |

The higher the rate, the higher the monthly note. In the example above, let’s assume your monthly payment us 20% of your income. A quick calculation shows that you would need to make almost $7,000 more per year in income before taxes to afford a 4.5% 30-year loan versus one at 3.5%.

Tip

In order to qualify for a mortgage your lender will look at your debt-to-income ratio (DTI). In general, your total DTI includes household payments (mortgage principal and interest, property tax, homeowners insurance, mortgage insurance if applicable) + your total monthly debt payments (credit card, auto loan, student loan, personal loan and court ordered payments). For more information check out Bills.com article about creditworthiness.

Mortgage Rates Going Up - Your Loan Amount drops?.

For those shopping for a loan by the maximum they can pay every month, consider the table below. The amount of money you can borrow for an $800 a month payment drops considerably with just one percentage point increase in interest. You lose roughly $22,000 in loan amount when the rate on a 30-year rise from 3% to 4%.

Example 2: Different loan amounts based on fixed payment (Two types of loans and monthly payments)

| 30-Yr. FRM with Monthly Payment of $800 | 15-YrFRM with Monthly Payments of $1,200 | |||

|---|---|---|---|---|

| Interest Rate | Loan Amount | Interest Rate | Loan Amount | |

| 3.00% | $189,752 | 2.50% | $179,967 | |

| 3.50% | $178,156 | 3.00% | $173,767 | |

| 4.00% | $167,569 | 3.505 | $167,860 | |

| 4.50% | $157,889 | 4.00% | $162,231 | |

Now, this is an admittedly overly simplistic view of rates and mortgages. The amount you are qualified to borrow can change by lender and will be impacted by things like existing debt and your current income . But these tables are instructive. Those in the market for a loan or a refinance should act quickly if they think rates will continue to rise.m.

Tip

Caution: Be very careful not to take too high of a debt load. Mortgage payments are not flexible and if not made on time, can cause much financial hardship.

Bills Action Plan

Rising mortgage rates means that you have to prepare extra carefully before purchasing a home. Here are some steps to help you prepare:

- Learn how to qualify for a mortgage.

- Don't max out on your home affordability. Leave yourself some room for changing rates.

- Learn about mortgage rates today.

- Get pre-approved for a loan.

- Learn about locking your rate.

- If you are refinancing , then use Bills.com Refinance calculator to help you figure out your break-even point.

Quick tip

Get a mortgage quote from a Bills.com mortgage provider.