Cash-Out Refinance in Arizona - A Viable Option

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit

- 5 min read

- Arizona home prices are rising and mortgage rates are still low.

- Check to see if you have built up equity in your home.

- If you need more cash, then check out to see if a cash-out mortgage can help improve your financial situation.

Many Arizonians Can Now Qualify for a Cash-Out Refinance Mortgage

Cash-out refinances are becoming more popular. Due to an improving housing market, many homeowners are now sitting on valuable equity in their homes and can qualify for a cash-out refinance.

Arizona was one of the hardest hit areas in the 2007-2008 US housing crisis. The US government created special programs including HARP, HAMP, and The Save Our Home AZ ("SOHAZ") Program. As home prices plunged, many homeowners were left with unaffordable mortgage payments and unable to refinance their mortgage. They could not lower their interest rates, their mortgage payments, or take out a cash-out refinance.

Currently, with rising home prices and low interest rates, cash-out refinance mortgages are especially attractive for many Arizona homeowners offering a chance to both readjust their mortgage rates and payments as well as take out cash to improve their financial situation.

What Do You Need for a Cash-Out Refinance?

The most important thing you need is home equity, which is affected by the amount of cash you put in your home, how much you paid off your mortgage, and how home prices fluctuated.

In general, to take a cash-out mortgage, you need to have a mortgage balance of less than 80% of the value of your home. So, for example, if your current mortgage balance is $200,000 and your home is currently worth $300,000, then your LTV is 66.67%. In this example, if you wish to tap into your equity, most conventional loan programs would allow you to take out up to $40,000 above your existing mortgage.

Of course, you will need to qualify for the mortgage based on all the regular requirements including credit scores, credit history, income and debt to income ratios.

Arizona Cash-Out Refinance Quote

Do you own property in Arizona? Interested in tapping into your home equity? Get a free consultation from a Bills.com cash-out refinance provider.

Reasons Arizona Home Owners Should Consider a Cash-Out Refinance

Due to the increase in home prices since 2008, many homeowners in Arizona are now sitting on valuable home equity. A cash-out refinance can help Arizona residents consolidate debt, make home repairs and home improvements, pay for medical expenses, or college expenses.

Make sure to evaluate your situation. While home prices are on the rise in Arizona, not all counties, cities, or neighborhoods are the same. Here are some ways to see how a cash-out refinance can help benefit you:

- Lower interest rates: If today’s mortgage rates are lower than your existing mortgage, then you are going to benefit from a cash-out refinance immediately. Also, weigh the cost of the additional mortgage amount versus the alternative charge of funding your project. If for example, you are going to pay off expensive credit card debt, then the mortgage rate is going to be much cheaper. However, keep in mind the amount of time you take to repay your debts.

- Get rid of mortgage insurance: There are many cases where rising home prices allow a borrower to take a cash-out refinance loan and get rid of mortgage insurance. Most borrowers who took out a conventional loan with an LTV over 80% were required to take out private mortgage insurance. All FHA borrowers are required to take out mortgage insurance, and since 2013 the premium is not canceled for loans with a downpayment of less than 10% and a loan period of 30 years.

- Lower Monthly Payments: Even if today’s mortgage rates are higher than your existing mortgage it is possible that by extending your loan period your monthly payment will drop enough to make it affordable. Besides, if you are consolidating debt, your overall financial costs are most likely going to decrease over the initial period of the loan.

Arizona: Utilizing a Cash-Out refinance in Phoenix

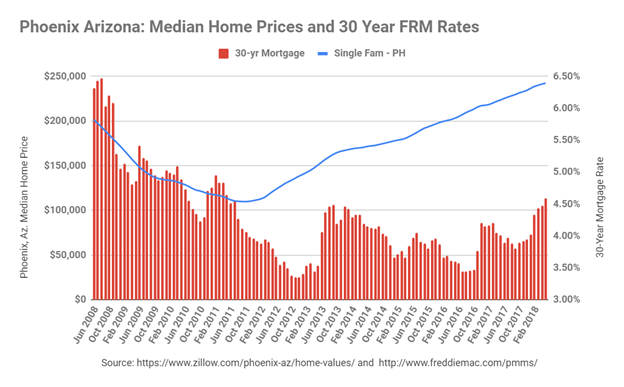

To help you see the benefits of a cash-out refinance we took data from Zillow that tracked median home prices in the Phoenix area for the single-home property from 2008 through 2018. We also looked at mortgage rates for those periods, using the Freddie Mac Primary Mortgage Market Survey.

The graph below shows how median home prices in Phoenix dropped from about $200,000 in June 2008 to about $110,000 in late 2011. Since reaching those low figures, home prices have steadily increased, and as of May 2018, median home prices in Phoenix were close to $250,000.

Here are some conclusions:

- Most likely, anyone who financed a property between 2008-2011 has a mortgage rate higher than today’s interest rates.

- Based on median home prices and a 90% LTV at time of origination all buyers before 2017 will have excess home equity based on a new 80% LTV.

- A cash-out refinance can help many borrowers get rid of mortgage insurance.

- When looking for a cash-out refinance consider savings and payment relief, Choose the best mortgage option that fits your budget and financial situation.

Do You Live in Arizona? Did Your Home Value Increase?

According to the Case-Shiller Home Price Index, home prices in Phoenix increased by 79% between June 2009 and June 2018. Do you need cash? Maybe you are considering home improvements, pay off debt, pay for college? Get a free cash-out mortgage consultation from a Bills.com mortgage provider.

Phoenix Arizona Cash-out Refinance Example

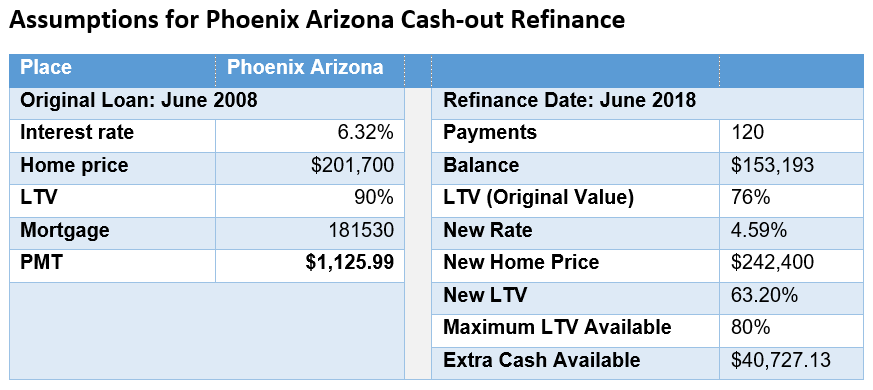

Assuming that someone purchased (or refinance their home in June 2008) and now wants to take a cash-out refinance to pay off credit card debt. Here are our basic assumptions:

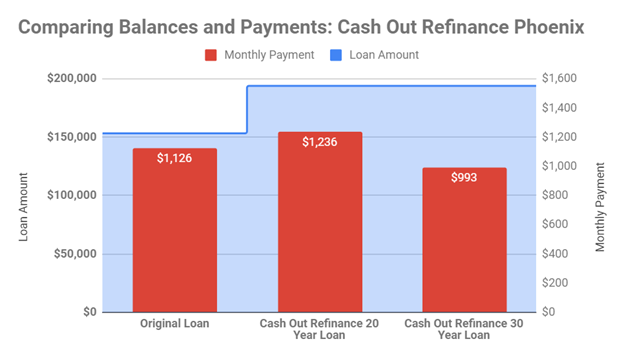

The graph below the difference in balance and payments. Before taking a cash-out refinance, make sure that your new monthly payment is affordable. If you are doing a debt consolidation loan, then your additional monthly payment savings will be more significant. If you consider paying off $40,000 in credit debt, your monthly payment would be around $800. Therefore you are going to have a lower overall monthly payment even if you take out a cash-out refinance for 20 years.

Arizona Cash-Out Refinance Quote

Do you need cash? Did your home value increase? Are you looking for lower interest rates, more affordable monthly payments, or... Get a free cash-out mortgage consultation from a Bills.com mortgage provider.

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit