Cash-Out Refinance in New Jersey- A Viable Option

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit

- 7 min read

- New Jersey home prices are rising and mortgage rates are still low.

- Check to see if you have built up equity in your home.

- If you need more cash, then check out to see if a cash-out mortgage can help improve your financial situation.

New Jersey Cash-Out Refinance - Use Your Home Equity

A healthy housing market has made it possible for many New Jersey residents to consider a cash-out refinance.

Certain areas in New Jersey were particularly hit hard during the 2007-2008 US housing crisis. The US government created special programs including HARP, HAMP, and the New Jersey’s Hardest Hit Fund (NJHHF) program to help homeowners avoid foreclosure. As home prices plunged, many homeowners were unable to refinance their mortgage.

Due to rising home prices in New Jersey, a cash-out refinance mortgage is now an attractive option for many homeowners who can either lower their mortgage rates, reduce their monthly payments, and take out cash to improve their financial situation.

Cash-Out Equity Calculator

Use the Cash-Out Home Equity Calculator below to figure out how the maximum amount of cash you can take out in your cash-out mortgage. (Click here for the full Cash-out Calculator).

What Do You Need for a Cash-Out Refinance?

The most important thing you need is home equity, which is affected by the amount of cash you put in your home, how much you paid off your mortgage, and how home prices fluctuated.

In general, to take a cash-out mortgage, you need to have a mortgage balance of less than 80% of the value of your home. So, for example, if your current mortgage balance is $200,000 and your home is currently worth $300,000, then your LTV is 66.67%. In this example, if you wish to tap into your equity, most conventional loan programs would allow you to take out up to $40,000 above your existing mortgage.

Of course, you will need to qualify for the mortgage based on all the regular requirements including credit scores, credit history, income and debt to income ratios.

New Jersey Cash-Out Refinance Quote

Do you own property in New Jersey? Interested in tapping into your home equity? Get a free consultation from a Bills.com cash-out mortgage provider.

Do New Jersey Residents Have Equity in their Home for a Cash-Out Mortgage?

While each homeowner has to evaluate their particular situation, it is clear that home prices in New Jersey have continually risen since 2012. Higher housing values opened up a market for a cash-out refinance mortgage.

According to the FHFA New Jersey all-transaction Housing Price Index (HPI), home prices more than doubled between 2000 and mid-2007; however, the housing market crashed in 2007, and by 2012 the HPI dropped by more than 20%, leaving many homeowners in a negative equity position.

New Jersey, in contrast to the USA HPI, had a much larger bubble. Since hitting the low point, housing prices in the USA have risen above their previous peak by about 35%. However, in New Jersey, housing prices have still not reached their previous peak and only increased by about 15%.

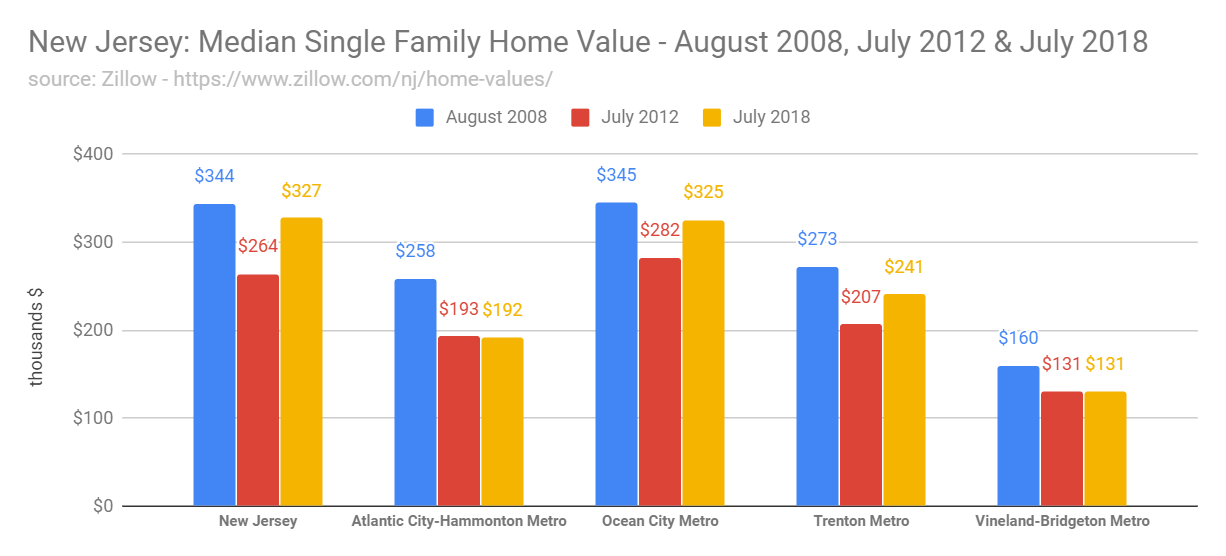

While the FHFA HPI gives us a good idea of housing prices in general, housing prices vary by counties and neighborhoods. For example, here is a picture of the median housing prices in different areas of New Jersey, based on data from Zillow. Looking at the chart below you can see that housing prices vary significantly between different regions and the recovery is not uniform.

New Jersey Homeowners Should Consider a Cash-Out Refinance

Due to the increase in home prices since 2008, many homeowners in New Jersey are now sitting on valuable home equity. Cash-out mortgages can help New Jersey residents consolidate debt, make home repairs and home improvements, pay for medical expenses, or college expenses.

As previously noted, evaluate your situation and check your home equity position, current mortgage rate, and monthly payments.

Here are some ways to see how a cash-out refinance can help benefit you:

- Lower interest rates: Although today’s interest rates are not at all time lows, they are still more economical for many homeowners. This would be especially the case for borrowers who took a mortgage before 2011. Check out Freddie Mac's Primary Mortgage Market Survey to see average mortgage rates between 2008 and 2018. It is possible to get even lower rates if you can afford a 15-year mortgage, or can take the risk in a 5/1 or 7/1 Adjustable Rate Mortgage.

- Get rid of mortgage insurance: There are some cases where rising home prices allow a borrower to take a cash-out refinance and get rid of mortgage insurance. Most borrowers who took out a conventional loan with an LTV over 80% were required to take out private mortgage insurance. All FHA borrowers are required to take out mortgage insurance, and since 2013 the premium is not canceled for loans with a downpayment of less than 10% and a loan period of 30 years. If your current LTV is over 80%, based on your original home value, but lower today due to an increase in home prices, you can save money by getting rid of your PMI.

- Lower Monthly Payments: For some borrowers, the monthly payments are higher than they wish to budget for, or just too high. Even if today’s mortgage rates are higher than your existing mortgage, it is possible that by extending your loan period your monthly payment will drop enough to make it affordable. This is especially true if you are using the extra cash to consolidate debt. Your combined monthly payment will decrease, and most likely your overall financial costs are going to be less.

Do You Live in New Jersey? Did Your Home Value Increase?

Do you need cash? Maybe you are considering home improvements, pay off debt, pay for college? Get a free cash-out mortgage consultation from a Bills.com mortgage provider.

An Example of A New Jersey Cash-Out Refinance

To help you see the benefits of a cash-out refinance we took data from Zillow that tracked median home prices in the Ocean Metro area for a single-home property from 2008 to 2018. We also looked at mortgage rates for those periods, using the Freddie Mac Primary Mortgage Market Survey.

Our Assumptions:

Let’s say you bought a single family house at the median home price in February 2011 for $302,000. According to the Zillow data, today’s median home value is now $325,400, an increase of about 17%. Based on average interest rates, your original 30-year mortgage rate would be 4.95% and your monthly payment, assuming you put down a 10% down payment, would be $1,451. After paying the mortgage down for 89 months, your balance would be about $236,442, around 78% of your original home value. (You would not be liable for private mortgage insurance). However, using new home prices your LTV would be 72.7%, meaning you would be able to refinance your home and take out an additional $25,000. Given today’s mortgage rates at about 4.5% for a 30-year FRM, or 4% for a 15-year FRM, you can refinance and save money and still have affordable payments.

Here are some examples of your new monthly payment, including your additional $25,000:

- Refinance into a 30-year mortgage at 4.5%: $1351.

- Refinance into a new mortgage without extending the period, at 4.5%: $1545

- Refinance into a 15-year mortgage at 4%: $1947

When comparing costs, take into account the extra $25,000. Before choosing a loan, make sure that your monthly payment is affordable. For example, a 15-year mortgage will cost you about $500 more per month. However, if you use the cash-out to consolidate debt, then you are probably paying between $500-$750 per month for your credit card debt.

New Jersey Cash-Out Refinance Quote

Do you need cash? Did your home value increase? Are you looking for lower interest rates, more affordable monthly payments, or... Get a free cash-out mortgage consultation from a Bills.com mortgage provider.

Is a New Jersey Cash-out Refinance Your Best Alternative?

Home prices vary, and each person should carefully evaluate their personal situation. As previously explained, housing prices vary between areas. You need to ask yourself a few questions:

- Do I have excess equity in my home? Do I want to use that equity for other purposes, or allow it to build up and increase my net worth?

- Is my current mortgage rate attractive? Can I afford my monthly payments? Do I need to extend my payment period to create lower monthly payments?

Fortunately, there are other mortgage alternatives. If you want to hold on to your current low-interest rate, and want to use your home equity for other purposes, then you should consider a home equity loan, or a home equity line of credit.

However, if you are struggling with payments, have a low credit score and might not qualify for a cash-out mortgage, then consider other debt consolidation solutions. Check out Bills.com Debt Navigator for a personalized debt consolidation solution.

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit