- Fannie Mae has a manual Refi Plus and an automated DU Refi Plus system for your HARP mortgage.

- Only your original lender can do a manual Refi Plus.

- Any participating DU lender can process your DU Refi Plus application.

Can I do a HARP refinance through Fannie Mae's Refi Plus automated system?

I've recently began the refinancing process with a lender that was offering me a DU Plus refinance. Everything was going fine until I was informed that my debt ratio was too high to qualify (they said I'm at 40%). I had an appraisal that put me at 119% loan to value ratio and they told me that I would still be able to refinance if I brought $4000 to closing. I have a 726 credit score and I meet all of the other HARP requirements. Would the new modifications help me to not have to bring money to closing?

Thank you for your question about DU Plus refinance and the HARP program.

Background Information

Before I get to the specifics of your question, here is some general background information to better understand the economic climate and how the largest mortgage investor, the federal government, has responded. Since 2009, the Home Affordable Refinance Program (HARP) program has helped more than 1 million homeowners refinance their underwater homes. The new HARP 2.0 changes are expected to include at least another 1 million homeowners by the end of 2013.

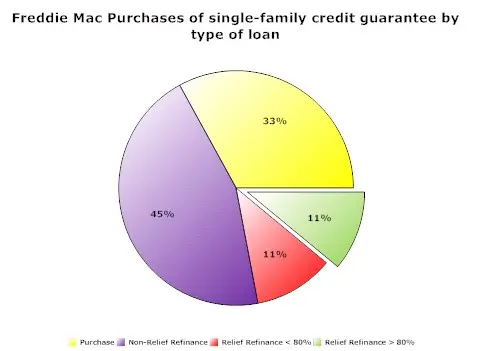

As an illustration, you can see that Freddie Mac's loan purchases for single family homes during the third quarter of 2011 included 22% relief refinances, of which 11% were loans with LTVs over 80%.

HARP 2 Updates

Read the Bills.com HARP 2 mortgage page for the latest updates about HARP.

The HARP Program at a Glance

The US housing market has been in a state of upheaval since the 2008 crash. As prices dropped, many borrowers found themselves in a situation where their house is worth less than the balance owed on their home loan. President Obama, and the US government stepped up to create Making Homes Affordable and various other programs, like HARP, to help Americans stay in their homes. These programs cover homes all across the country, in different types of properties. The rules and regulations are lengthy and not always easy to understand.

In October 2011, HARP was extended until the end of 2013. New guidelines were announced on November 2011 by the two secondary mortgage market participants of the HARP program, Fannie Mae and Freddie Mac. Both buy loans from mortgage originators, such a independent brokers and banks big and small.

For more information about the HARP program, eligibility and updates see Bills.com resource HARP Mortgages.

The Underwriting Process

Mortgage underwriting is a complicated process, as the guidelines for eligibility cover a vast set of possibilities. Each secondary market participant has its own processing systems, including manual and automated systems. Freddie Mac uses the Loan Prospector (LU) system and Fannie Mae the Desktop Underwriter (DU) system.

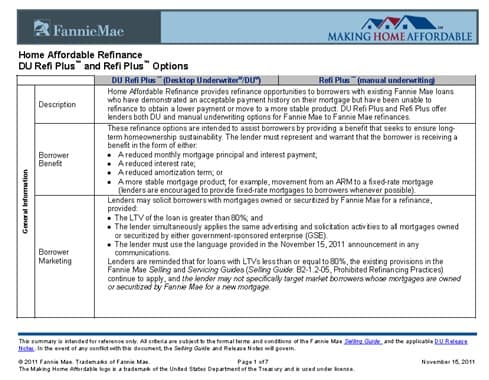

Fannie Mae uses the tradename Refi Plus to process the loans under the HARP program, differentiating between the manual Refi Plus and the automated DU Refi Plus.

Although it is out of the scope of this article to address the types of approvals in the DU system, you should know, that these are the acceptable outcomes :

- Approve/Eligible

- Expanded Approval/Eligible

- Approve/Ineligible

- Expanded Approval/Ineligible

- Refer/Eligible

- Refer/Ineligible

- Refer with Caution/IV

- Out-of-Scope

Your lender should provide you with an accurate picture as to why you do not qualify, and what steps you can take to rectify the situation.

Fannie Mae’s November 2011 guidelines

You mention several criteria in your question relating to the HARP program. Let's examine each criteria based on the new November 2011 guidelines:

| Criteria | DU Refi Plus | Refi Plus (manual) |

| --- | --- | --- |

| The Lender | Approved Fannie Mae user of Desktop Underwriter | Original lender (or affiliated and current server. |

| Loan to Value (LTV) | No maximum rate, although will be active in DU system March 2012. Valid for fully amortizing loans up to 30 years. Up to 105% if term is up to 40 years or interest rate is ARM, with initial period for at least 5 years. | Same limits but will be effective as of December 1st, 2011. |

| Debt to Income (DTI) | Subject to the maximum allowable DTI in the DU system. According to the October 2011 Selling Guide, the maximum allowable DTI is 45%, with exceptions up to 50%, if there exists strong compensating factors. | No maximum DTI ratio except when principal and interest payments increase by more than 20%, in which case the maximum allowable DTI is 50%. |

| Credit Score | No minimum credit score required. DU performs its standard credit risk assessment. which includes a comprehensive review of the borrower's credit history. Lender must comply with all other requirements in the Selling Guide. | No minimum credit score requirement. (Therefore the borrower will not benefit from a high credit score in the pricing of the product). If the payment increases by more than 20%, then the lender must make additional inquiries. In addition to payment history, the borrower must be re-qualified based on income and asset documentation, a maximum DTI of 45%, and a minimum credit score of 620. |

| Appraisal | It is possible to obtain a property fieldwork waiver under certain circumstances, but currently not if the LTV or CLTV is above 125%. This is only available for one-unit properties, and primary residences, second homes and investment properties. | Requires new appraisal. |

| Limited Cash Out Refinance (LCOR) | According to Fannie Mae’s selling guide from October 2011, part B5-5.1-05, the new loan can include: • Payoff of the unpaid principal balance of the old loan • Financing of the payments of the closing costs, prepaid items and points • Cash back to the borrower in an amount no more than $250. (If it is more than $250, then it can not be classified as a DU Refi Plus loan). • All existing subordinate financing must be re-subordinated. • No new subordinate financing is allowed. | |

Transferring from DU Refi Plus to Refi Plus (Manual)

There is the possibility to transfer a DU Refi Plus casefile to a manual Refi Plus file under the condition that the lender is the current servicer of the loan, the loan complies with all Refi Plus requirements, and if the loan meet with one of the following DU recommendations.

- Approve/, EA- I/, EA- 2/,EA-III/Ineligible loans: The lender can transfer those loans to a manual Refi Plus loan if the only reason for the ineligible recommendation was an excessive debt-to-income ratio.

- Refer with Caution/IV recommendation: The loan can be transferred to the manual system.

Bringing Money to Closing

You have indicated that your lender has begun to process the application through the DU Plus system and you meet all the HARP qualifications, including these specific ones:

- LTV: 119% - You qualified in the old system.

- Credit Score: 726 - No minimum credit score in the old system.

- Debt to Income Ratio: 40% - Same maximum requirements in old system, although less stringent in the manual Refi Plus system.

It is unclear why you did not qualify for the HARP refinance program. Furthermore, there is no mention in the HARP guidelines of bringing funds to closing. The opposite is true, as you can take out a limited cash-out refinance (LCOR), covering closing costs such as points. Certain out-of-pocket expenses you pay prior to closing, such as an application fee, can be refunded at closing. You are able to take out up to $250 in a LCOR Refi Plus.

Subordinated Financing

One possibility where you might have to bring money is if the subordinated financing does not agree to the refinance and requires a pay-off or a partial payoff.

Check carefully with your lender as to the exact terms under which you qualify. You are entitled to receive a detailed answer regarding problems, as well as requirements you fail to meet.

The new HARP program is designed to help good borrowers save money and improve their ability to maintain their monthly payments or build equity more quickly, despite having an underwater property. If your lender is not willing to do a Refi Plus loan, then check with other authorized Fannie Mae lenders, in order to find the best deal you can on a HARP refinance.