Can I Save Money by Refinancing?

My husband and I bought our first home about three years for $300,000. Because we had a low down payment and only fair credit we took out a 30-year FHA mortgage at 4.45%. I recently got a significant raise and both of our credit scores have improved. My husband thinks that mortgage costs are too high, but I think that it might be a good idea to refinance.

Do you think that we should refinance now?

Thank you for your question about refinancing your home to save money.

You should definitely shop around and refinance your home. While some borrowers are only interested in lowering their monthly payments, many borrowers want to refinance to save money over the life of the loan.

Here are three reasons why refinancing your home can save you money. You can:

- Lower your mortgage insurance costs

- Get a better interest rate, if your credit has improved

- Cut time of your loan, if your income has increased

Although there are upfront costs (unless you take out a no-cost mortgage with a slightly higher interest rate), you can save money by taking out a mortgage with a shorter period, lower interest rate, and/or lower mortgage insurance costs.

Quick Tip

: Check out Bills.com mortgage rate tables to see today's rates.

Rising Home Prices - Refinance Your Home and Save on Mortgage Insurance

According to statistics, home prices have greatly risen since you bought your home in 2011. In fact, according to the Case-Shiller HPI for 20 major cities, home prices have risen by more than 20% since you bought your home.

You can refinance your home using the new LTV and either get rid of your mortgage insurance or get a loan that has better mortgage insurance terms. If your LTV is under 80%, then your new lender will not require any mortgage insurance- that means big savings.

If your LTV is between 80-95%, then you will need Private Mortgage Insurance. (PMI is automatically cancelled when your LTV reaches 78%. You can ask for it to be removed when you reach 80% LTV).

Higher Credit Score - Refinance into Better Interest Rate

Since your financial situation has improved, both a higher credit score and more income, you can benefit by refinancing into a mortgage with a shorter term and lower interest rate.

Mortgage rates hit historically low levels during 2012-2013 and began to increase mid-2013. However, mortgage rates are still at very low levels. Today’s 30-year rates are still very low.

If you can afford a higher payment, then you can save a lot of money over the life of your loan by refinancing your loan, that has 27 years left to pay, to a 15-year fixed rate mortgage.

If you want to save even more, you can take advantage of your higher income and take out a 10-year mortgage or pay off your loan faster by making additional principal payments.

Refinance Your Home - Look at Your Numbers

I recommend that you shop around for different loans. Comparison shopping is the smartest way to find the best deal.

From the facts you gave, it's quite possible that you can refinance your home without mortgage insurance.

Your husband is correct; mortgage loans do have closing costs, including lender points and fees, and third party closing costs. You have an option to take out a loan with closing costs or you can choose a no-cost mortgage loan with a higher interest rate. If you choose a no-cost mortgage, be sure to check and see if all the costs are included.

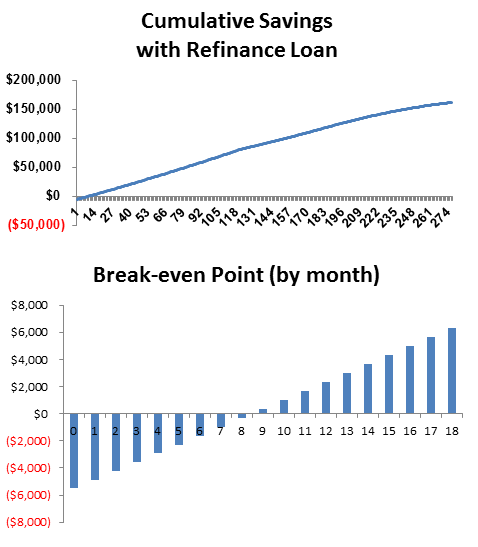

Although I don’t know the exact value of your home, I will show you how much you can save by refinancing into a 15-year loan. Check out your savings:

- Your initial monthly payment would increase by only $141

- You would cut off 12 years on your mortgage.

- Based on 2% fees, your break-even point would be 9 months.

- Your overall savings could be as high as $161,000.

| Current Loan | Refinance | ||

|---|---|---|---|

| Balance | $275,437 | ||

| Home Value | $360,000 | ||

| LTV | 92% based on original value of $300,000 | 76% based on increased market value | |

| Interest Rate | 4.75% | 3.25% | |

| Years to Pay Off | 27 | 15 | |

| Monthly Payment (Principal & Interest) | $1,510 | $1,935 | |

| Mortgage Insurance | Currently about $284 per month | None required | |

| Closing Costs | Already paid | 2% ($5,509) including lender and third party fees. |

Home value was based on an increase of 20% as reflected by the Case-Shiller HPI from 5/1/2011 - 2/1/2014 for the 20-city index.

Bills Action Plan

You can save a lot of money with a refinance loan. Depending on the actual value of your home you can either eliminate the need for mortgage insurance or greatly reduce the cost.

By taking out a short-term loan, you can also reduce your interest rate. Your husband is correct that there are upfront fees, but shop around and compare deals. If you don’t want to pay any out-of pocket expenses, check for a no-cost mortgage.

I recommend that you take these steps:

- Check out the price of your home . The final deal will depend on the value of your home. Don’t pay for an appraisal report unless you are planning on using the lender who refers you to the appraiser.

- Shop around for the best mortgage deal.

- If you are planning on staying in the home for less than about 7 years, then ask the lender about an Adjustable Rate Mortgage. Don’t take a 30-year fixed loan.

- If you can afford a more aggressive payment schedule, look into a 10-year mortgage. This should have a significantly lower interest rate.

- If you have additional income and want to pay off the loan quicker, but you don't want to commit to a higher monthly payment, make lump-sum principal payments periodically.

Quick Tip #2

Get a mortgage quote from a Bills.com mortgage provider.