Learn About HECM Reverse Mortgages

- The FHA backed HECM reverse mortgage is the only game in town.

- The HECM comes in a Standard or Saver model.

- Before shopping, learn how the HECM fits into your financial plan.

FHA's HECM Reverse Mortgage - The Basics

The Home Equity Conversion Mortgage (HECM) reverse mortgage is the name for the FHA-backed reverse mortgage product. As of early 2013, the HECM is the only reverse mortgage product on the market. It remains to be seen if private lenders will re-enter the reverse mortgage market.

A reverse mortgage can have a strong impact on your financial future. It is important to learn about a reverse mortgage, how a reverse mortgage works, and the pros and cons of a reverse mortgage.

The FHA recently announced that there will changes in the reverse mortgage market. Make sure that you understand your choices. This article will help you learn:

- What makes a HECM reverse mortgage special

- HECM Reverse mortgage – What are your choices?

- HECM Standard vs HECM Saver - Differences

- HECM Reverse Mortgage - An Example

What Makes a HECM Reverse Mortgage Special?

A reverse mortgage is a special type of mortgage that can aid your staying in your home and managing your cash-flow.

The HECM, like any reverse mortgage, is for borrowers over the age of 62. The amount of money you can borrow depends on the appraised value of your home, your age, and the interest rate. Reverse mortgage lenders offer HECM loan amounts based on FHA tables which set out the percentage of money you can borrow based on your age, the interest rate, and the value of your home.

Some additional rules the FHA has that make the HECM special are:

- HECM reverse mortgages are available for primary residences only.

- The FHA sets a ceiling on the amount you can borrow. Currently the maximum amount is $625,000.

- To receive a HECM you must take a Mandatory Counseling session and receive a HECM counseling certificate to complete an application.

Get a HECM Quote!

Looking for a HECM reverse mortgage? Get a mortgage quote from a Bills.com reverse mortgage provider.

HECM Reverse Mortgages – Learn Your Options

The FHA currently has a few different types of HECM reverse mortgages, including:

- Traditional or Standard HECM

- HECM Saver: Comes with less fees, and less funds available

- HECM Purchase: A product for those who want to purchase a new property (usually downsize).

News Update

On December 18, 2012 the FHA’s acting director, Carol Galante, sent a letter to Sen Bob Corker (R- Tenn.)indicating that the FHA will place a moratorium on traditional lump-sum HECMs. The FHA’s intent is to move the borrowers into less risky loans lump sum loans (the HECM Saver), which offer a smaller sized loans, or to loans that have monthly draws.

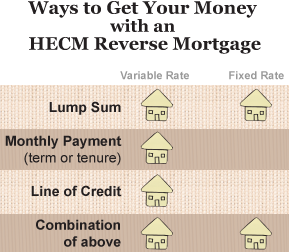

The HECM reverse mortgage comes with a number of options based on the type of interest rate and the method you decide to take the money.

Ways to Get Money in a HECM

You can elect to take out all the money in one lump sum, monthly payments (for a set amount of time or until you leave the home or the last borrower passes away).

You can take monthly payments in one of the following methods:

- Term option: You receive equal monthly payments for a fixed period that you choose.

- Tenure option: You will receive equal monthly payments for as long as you occupy your home as your primary residence.

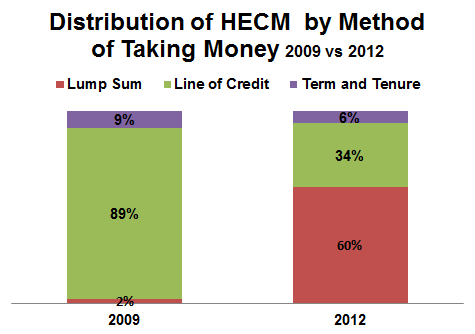

Because the fixed-rate option is only available for the lump-sum option, many borrowers elected to take that type of HECM reverse mortgage. In fact the chart below shows the movement from lines of credit which represented 89% of HECMs in 2009 to just 34%, whereas the lump sum rose from 2% to 60%:

Caution: With the decline in housing prices, many homeowners have seen their equity position drop. By taking a lump sum and using your home equity now, you may not leave yourself with sufficient assets to deal with new situations, including the need to move for personal or health reasons. In fact some borrowers are in a position where they can’t afford their property taxes and homeowner’s insurance. The failure to maintain those payments puts you at risk of losing your home.

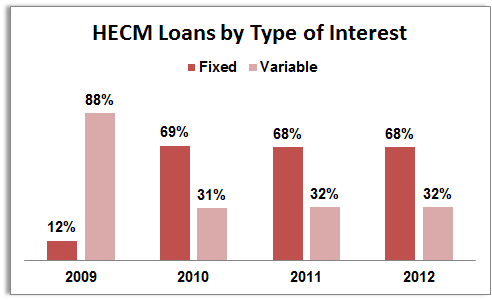

Should I take A HECM with a Fixed or Variable Interest Rate?

The fixed rate option has become the more popular option, due to the low interest rates. As noted, this has pushed many people into the lump sum HECM loan. The Chart Below shows the dramatic shift to fixed rate mortgages between 2009 – 2012:

When choosing a variable interest loan you can choose between a LIBOR-based index or a T-bill-based index. You can also choose between monthly or annual indexation. Make sure that you ask the lender the following questions:

- What is the starting rate?

- What is the margin?

- What rate that is used when adjusting the interest rate?

- What is the yearly cap and ceiling? (FHA has caps and ceilings on annually adjusted interest rate loans)

- What is the mortgage insurance rate that is added to the interest rate?

HECM - Guard Your Equity

Take the money as you need it.

- On the plus side a borrower does not have to repay a reverse mortgage unless they sell the house, move and the house is no longer their primary residence, the last borrower passes away, or fail to maintain the property tax and homeowners insurance or maintain the house. There are noG monthly interest, principal or mortgage insurance payments. Also, your fees sums will be deducted from the proceeds of the sell. In the case that the home is worth less than the balance of the loan, you or your heirs will not be personally liable for any balance.

- However, the more money you take, the less equity you will have in case you do have to move. Plan your finances accordingly.

HECM Fees – Standard vs Saver

April 2013 Update - Change in Fixed Rate Option

Beginning on April 1, 2013 the fixed-rate HECM will be available only through the HECM saver option. The FHA introduced this rule in order to limit the amount of money a borrower can take in one lump sum.

The main difference between the two types of loans are the amount of mortgage insurance you pay (and the amount you can borrow). Here are the standard rates for the two types of loans:

| Type of Fee | HECM Standard | HECM Saver |

|---|---|---|

| Initial MIP | 2.0% | 1.5% |

| Annual MIP | 1.5% | 1.25% |

Here is a partial list of fees in a HECM reverse mortgage:

- Upfront Mortgage Insurance Premium (MIP): Insurance Fee for FHA backing.

- Annual MIP: FHA insurance that is added to the interest rate and is repaid when the loan is called in.

- Servicing Fee: An upfront fee based on the cost to the lender to service you loan.

- Third Party Charges: This includes appraisal, title search, recording fees, credit checks.

- Origination Fee: A lender based fee.

FHA caps those fees based on the home value. You will pay an origination fee to compensate the lender for processing your HECM loan. A lender can charge a HECM origination fee up to $2,500 if your home is valued at less than $125,000. If your home is valued at more than $125,000 lenders can charge 2% of the first $200,000 of your home's value plus 1% of the amount over $200,000. HECM origination fees are capped at $6,000.

Shop For a HECM

Shop around for your reverse mortgage and always check the rates and fees. Get a reverse mortgage quote from a Bills.com reverse mortgage provider.

HECM Reverse Mortgage – An Example

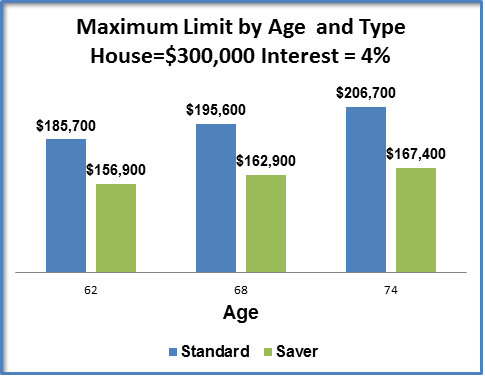

Obviously, the best way to find out how much you are eligible for is to speak with a lender. They will evaluate your situation, including your ages, the value of the property, and current mortgage rates. Then they can give you examples based on the type of loan you choose. The chart below, based on the HUD's principal limit factor table, shows you the difference amounts available, based on three different age categories, between the HECM Saver and the HECM Standard based on property value of 300.000 and a 4% interest:

Remember the Saver has almost 2% less initial fees. Make sure that you check the total amount available less the total fees, which are generally deducted from the amount your receive, or added on to your beginning balance.

HECM - Which Method to Choose?

Choosing a method is definitely not a simple matter.

The example below, (taken from a HUD-directed reverse mortgage calculator) is based on a 62-year-old borrower in California with a $300,000 home and no liens. The chart shows the available sums for four different methods. (It does not have the line of credit or the monthly term payment). Note: The standard HECM-fixed will not be available after April 1, 2013.

| Standard HECM -fixed | HECM Saver - Fixed | Standard HECM - 1 Mo. LIBOR (tenure) | HECM Saver - 1 Mo. LIBOR (tenure) | |

|---|---|---|---|---|

| Starting Interest Rate | 4.75% | 5.5% | 2.709% | 2.959% |

| Available Sum | $185,700 | $136,800 | $185,700 | $156,900 |

| Net Sum (see fees below) | $177,217 | $131,287 | $174,217 | $131,287 |

| Monthly Tenure | $904 | $800 | ||

| Fees: Total | $8,483 | $5,513 | $11,483 | $5,513 |

| Loan Origination | - | $3,000 | $3,000 | $5,000 |

| Upfront MIP | $6,000 | $30 | $6,000 | $30 |

| Other Closing Costs | $2,483 | $2,483 | $2,483 | $2,483 |

By taking the HECM Saver you will save on fees.

- Have close to $6000 less in upfront fees but have a slightly higher interest rate.

- If you choose the monthly tenure, you will receive $100 less per month, but will:

- If you choose the HECM Fixed Saver you will owe about $33,000 less to begin with.

Reverse mortgage interest rates and the fees vary over time and between lenders. Make sure your lender explains to you the different options and how they work over time. Be prepared for your counseling session by learning how the HECM reverse mortgage works.

Get a HECM Reverse Mortgage Quote!

Looking for a HECM reverse mortgage? Get a mortgage quote from a Bills.com reverse mortgage provider.