Rising Mortgage Rates: Fixed or Adjustable Rate Morgage?

Which is better, a Fixed Rate Mortgage or an Adjustable Rate Mortgage?

I noticed that mortgage rates are going up. I am interested in a 30-year mortgage. Should I take a fixed rate loan or an adjustable rate mortgage?

Thank you for your question about choosing a fixed rate or adjustable rate mortgage. As 30-year Fixed Rate Mortgage (FRM) rates rise, many borrowers are looking into Adjustable Rate Mortgages (ARM) as a cheaper alternative.

If you are shopping around for a mortgage, an adjustable rate mortgage might look attractive. With mortgage rates rising, it is important to compare the pros and cons of a Fixed Rate Mortgage vs. an Adjustable Rate Mortgage.

In order to help you choose the right loan, start by learning more about:

- Fixed rate vs adjustable rates in today’s market

- Savings that are possible with a 5/1 ARM

- The risks of a 5/1 ARM

Mortgage Rates Going Up - ARM rates at a Slower Rate

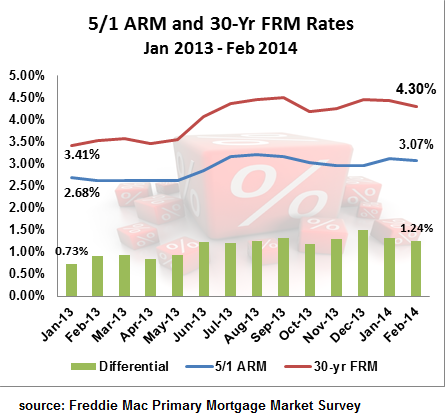

The rate on a 30-year Fixed Rate Mortgage rose significantly in the past year, whereas the 5/1 ARM rate rose less.

According to Freddie Mac's Primary Mortgage Market Survey, average mortgage rates changed between January 1, 2014 and March 27, 2014 as follows:

- Fixed rates rose more than 1% from (3.34% to 4.4%)

- 5/1 ARM rates rose 0.4% from (2.71% to 3.1%)

- The difference between the two rates has increased. The 5/1 ARM is now 1.3% lower than the fixed, when the difference a year ago was 0.6%.

The Chart below shows the change in average monthly rates for 5/1 ARM and 30-year FRM for the period of January 2013 - February 2014. (The rates are average, national rates based on the Freddie Mac PMMS):

Quick Tip

Get a mortgage quote from a Bills.com mortgage provider.

5/1 ARM vs FRM - Short Term Savings

With a far lower interest rate, a 5/1 ARM offers a substantial savings, at least for the first 5-year period.

Here is an example for 30-year loan for $200,000 loan based on market rates for the end of March 2014. Here are three benefits of an ARM loan - for the first five years:

- Lower monthly payment: $147 less

- Less interest paid: $12,752 over 5 years.

- More principal paid: You will owe $3,903 less on your loan balance.

The chart below summarizes your monthly payments for the first five years:

| Your monthly payments and Interest | 5/1 ARM | 30-yr FRM |

|---|---|---|

| Initial Interest Rate | 3.10% | 4.40% |

| Initial Monthly Payment | $854 | $1,002 |

| Total Interest Paid for First 5 Years | $29,377 | $42,129 |

| Balance After 5 Years | $178,135 | $182,038 |

As shown above, the short-term gains of an ARM are beneficial. However, before you take an ARM, you need to weigh your short-term savings against the potential risks of higher rates and higher payments down the road.

5/1 ARM vs FRM- Long Term Risks

An ARM carries the risk of higher payments when your interest rate adjusts. The first adjustment on a 5/1 AMR is after after 5 years. Since you don’t know the exact amount of time you will hold on to your home/mortgage, or what future mortgage interests will be, you might find yourself with:

- Higher payments that you can’t afford.

- Higher interest rates and a turning point where you start losing money compared to the costs of selecting a fixed rate mortgage in the beginning.

Tip

Since there is no way to know the future interest rates, prepare for the worst-case scenario. ARM’s come with built-in based rates, margins, caps and ceilings. Make sure that your lender explains to you what they are and how they can affect your future monthly payments.

The most obvious risk in taking a ARM is that after the initial period is over (after 5 years on a 5/1 ARM), then the monthly payment will increase. If your payment increases, will you be able to afford it?

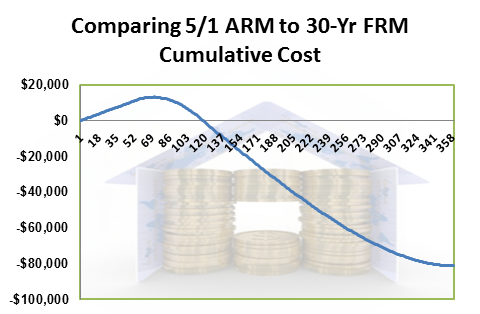

The chart below shows your potential saving/losses comparing a $200,000, 30-year fixed rate loan at 4.4% compared to an adjustable rate loan with a starting rate of 3.1%, an annual cap of 1%, and a lifetime cap of 8%.

In a "worst-case"scenario:

- After 6 years you will reach your peak savings at $13,454.

- Your monthly payment will be $1,002 on the fixed rate.

- On the 5/1 ARM, your payment will jump from $854 for the first five years to $1,341 in the 10th year onward. That's an increase of $487 per month!

- Your break-even point will be close to 10 years. The longer you hold on to the loan, the larger your potential losses. After 15-years you would face a loss of about $28,752.

If you were to choose the FRM at 4.4%, then your payment would always be $1,002. The following table shows your interest rate and monthly payments the 5/1 ARM, under the "worst-case" scenario:

| Months | ARM rate | ARM payment |

|---|---|---|

| 1 - 60 | 3.10% | $854 |

| 61 - 72 | 4.20% | $950 |

| 73 - 84 | 5.30% | $1,048 |

| 85 - 96 | 6.40% | $1,148 |

| 97 - 108 | 7.50% | $1,249 |

| 109 - 360 | 8.00% | $1,341 |

Bills Action Plan

An ARM loan offers many advantages, including a lower monthly payment and a potential savings on your finance costs. However, it also carries long-term risks, depending on the movement of interest rates.

Before you take an ARM make sure that you:

- Understand all the terms of the loan including the initial rate, margin, caps and ceilings.

- Don’t rely on a APR and be careful to examine the lender’s assumptions. If they are showing an adjusted payment based on today’s base rate + margin, then you may be in for a surprise down the road.

- Shop around based on the mortgage fee and rate.

- Weigh how long you plan to stay in the house. If you are staying in the house for 5-years, then a 5/1 ARM (or even a 10/1 ARM) offers good savings.

- Can afford the payments after the initial interest period is over.

- Pay attention to the break-even point.