Debt Consolidation Loans: Comparing Rates and Fees

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- There are different types of debt consolidation loans.

- Check for origination fees. Use an APR to compare personal loans.

- Cash-out mortgages and home equity loans usually have more upfront lender and third party fees.

- Start your FREE debt assessment

Are There Any Fees Charged on a Debt Consolidation Loan?

I am looking for a personal loan, but I am not sure how to compare rates and fees. Can you help me?

Thank you for your question about paying off debt with a debt consolidation loan and the fees.

When shopping for a debt consolidation loan, you probably immediately see interest rates quoted. However, are you familiar with origination fee, late fee, prepayment fee or other fees that might appear on your loan documents?

There are several types of debt consolidation loans, including a personal unsecured debt consolidation loan, a cash-out refinance or home equity mortgage, a payday loan, or a credit card balance transfer. Each type comes with different payment plans, interest rates, fees, and other terms.

Before you choose a debt consolidation loan, make sure that you understand your options, the payment plan, the fees, and any other fine print.

Personal Loan Rates and Fees

Check out Personal Debt Consolidation Loans and Fees using the following Rate Table:

Personal Debt Consolidation Loan Fees - Simplest Option

The most common debt consolidation loan is a personal unsecured loan. There are different types of lenders, including banks, credit unions, peer-to-peer lenders, and new Fintech lenders.

Many lenders offer debt consolidation loans with origination fees. In general, the lower your credit score, the higher the interest rate and origination fees. If you have an excellent credit score you might be able to find a debt consolidation loan without any upfront fees.

Most personal loans have two components: nominal interest rate and origination fees. Lenders provide an APR, which takes into account the length of the loan and how that affects the upfront fees on your interest rate. If there are no fees, then the APR will be identical to the nominal rate that is quoted by the lender. Origination fees vary, as some banks and lenders have zero fee loans, and other lenders, depending on your credit score take fees up to 5% of the loan.

Since most borrowers do not repay the personal loan earlier than the original payment schedule, the APR is a fair indication of your actual interest rate. Don’t forget to check with the lender any other fees.

Here are a few examples of APR on a debt consolidation loan, using different interest rates, repayment periods, and fees and a $10,000 loan:

| Month | Interest Rate | Fee | Monthly Payment | APR |

|---|---|---|---|---|

| 48 | 7.5% | 1% | $242 | 8.02% |

| 48 | 12% | 1% | $264 | 12.54% |

| 48 | 18% | 1% | $294 | 18.57% |

| 60 | 7.5% | 3% | $200 | 8.79% |

| 60 | 12% | 3% | $222 | 13.35% |

| 60 | 18% | 3% | $254 | 19.43% |

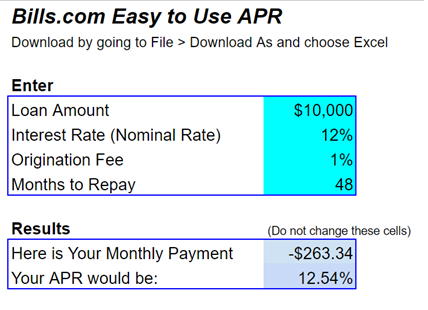

Use an APR Calculator

Here is a link to an APR calculator that you can download and make your own calculations. All that you need to do is enter your loan amount, the number of months you wish to pay back the loan, the nominal interest fee (the rate your lender quoted), and the upfront origination fee.

You will immediately see the monthly payment and the APR.

Cash-Out Refinance or Home Equity Mortgage Debt Consolidation Loan Fees

If you are looking for lower monthly payments and you have equity in your home, then consider a debt consolidation mortgage. The two different ways that you can take out cash using your home, are:

Cash-out Refinance Mortgage: You refinance your current mortgage and add an extra amount to use to consolidate your debt. You can reset your loan period to the maximum of 30 years, or take out a shorter period loan. Compare your overall interest rates and monthly payments. A cash-out mortgage usually comes with origination fees (or higher interest rates) and third-party fees.

Home Equity Loan (HEL) or Home Equity Line of Credit (HELOC): You can keep your old mortgage, but use the extra equity in your home to take out a new loan for the amount you need to consolidate your debt. The fees on a HEL or HELOC are generally much smaller than that for a cash-out mortgage.

When shopping for a mortgage you can also look at the APR, however, it is important to compare similar products and consider the actual amount of time you will hold on to the loan. The APR is based on taking the upfront fees and spreading them over the entire repayment period. If you pay off your mortgage sooner your actual APR will be higher. Also, the APR on a mortgage does not include the third party fees.

Payday Loan Fees

Payday loans are expensive loans. They are not intended to consolidate debt. The main reason to take a payday loan is to pay off an emergency bill, which you don’t have the cash resources but will have them in a short time.

Some people are lured by payday loan advertisements which promise a quick solution to debt problems combined with easy qualification, even if you have bad credit. Payday loans usually have both high-interest rate and high upfront fees.

"Cost of a payday loan. Many state laws set a maximum amount for payday loan fees ranging from $10 to $30 for every $100 borrowed. A typical two-week payday loan with a $15 per $100 fee equates to an annual percentage rate (APR) of almost 400 percent. By comparison, APRs on credit cards can range from about 12 percent to about 30 percent. In many states that permit payday lending, the cost of the loan, fees, and the maximum loan amount are capped.

Credit Card Balance Transfer Fees

If you have built up credit card debt and wish to lower your interest rate, then a credit card balance transfer is a possible solution. in general, you need an excellent credit score to get a good rate. it definitely pays to shop around.

Transferring from an 18% interest rate to a 0% rate sounds like a great deal. however carefully check the terms including:

- Balance transfer fee: credit card balance transfer comes with an up-front fee, generally around 3.5% of your balance

- Interest rate: there is usually an introductory "teaser" period between 12-18 months, that will vary between the balance you transfer and new purchases.

- Annual fees: many new cards come with no annual fees but always check the fine print.

- Rewards: discounts and reward points can be a nice "bonus". but, don't count on making money from rewards, because that means you have to spend money. it may not be for the things you really need.

Bills Bottom Line: Check Your Debt Consolidation Loan Options and Fees

Fees vary widely based on the type of lender, loan and borrower. Usually, with a short-term loan, it is easier to compare terms based on a published APR, especially when dealing with big banks and reputable lenders.

Remember, debt consolidation loan fees are a small part of the cost. If you don't have good credit (credit score, debt-to-income ratio, and credit history), then your rates and fees will be high.

Not sure if a debt consolidation loan is the best debt relief solution? Use Bills.com Debt Navigator for a personalized solution.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836