Low-Interest Credit Card Consolidation Loan Choices

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 4 min read

- There are two types of low-interest rate credit card consolidation loans.

- If your credit is good to excellent check out a personal loan.

- If you have equity in your home and you want low payments, check out a home equity loan.

- Start your FREE debt assessment

Simon from So. Carolina asked: What are my low-interest debt consolidation loan options?

"I have four credit cards totaling about $30,000. My interest rates vary between 12% and 24%. Can you help me with a low-interest rate and low monthly payment? Can I combine all my credit cards into one low payment? My credit report is good, and I haven't missed any payments. Is there such a thing as low-interest credit card consolidation"?

Check Out Your Low-Interest Credit Card Consolidation Loan Options

Thank you for your question about low-interest credit card consolidation loans. The good news is that with a good credit score, you can combine all of your credit card debt into one monthly payment.

Are you looking to lower your monthly payment? Or, pay off your debt quicker? There are two types of low-interest rate loans you can use to consolidate debt. The lowest interest rate is through a long-term mortgage, either a cash-out refinance or a home equity mortgage. Your other option is a personal unsecured debt consolidation loan.

Here are three things to consider when shopping for a low-interest credit card consolidation loan:

- The lowest rates are available on a long-term secured loan.

- You can save the most money by taking out a short-term personal unsecured loan.

- You need a very good to excellent credit score to qualify for the best rates, although a good credit score will still get you a low-interest rate mortgage.

Looking for A Personal Debt Consolidation Loan

Bills.com makes it easy to shop for a debt consolidation personal loan. Start by filling in your credit score, zip code, loan purpose, and the amount of loan you need. Check out different offers and click on the appropriate ones.

Low-Interest Rate Personal Debt Consolidation Loan

According to an Experian (one of the top three Credit Reporting Agencies) report for Quarter 2, 2018, about personal loans, "the #1 reason consumers take a personal loan is debt consolidation".

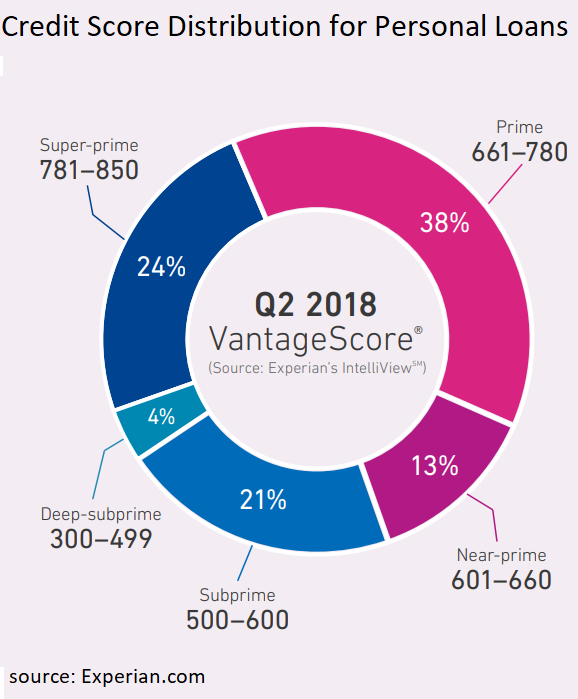

Do you need a good credit score to qualify for a personal loan? The answer is no. According to the Experian report, the "Average VantageScore® was 650 for new personal loans".

While 24% had excellent credit scores, 34% of consumers had near-prime or sub-prime credit scores. However, while interest rates vary by lenders, they are profoundly affected by your credit score. For example, with an excellent credit score, you can get a five-year personal loan for about 7.5% versus 12% with a good credit score.

Using your example of a paying off your $30,000 at about 18% with a low-interest rate credit consolidation loan, you could lower your payments and your total costs as follows:

- Keep paying minimum payments, at about 2.5% of your total debt. Your starting payment would be $750 and decrease very slowly. It would take you over 35 years to pay off your credit card debt, and your total interest payments would be more than $34,000.

- Don’t consolidate debt, but continue to make fixed payments of $750. Your total interest payments would be about $16,159, and you would be debt-free after five years and two months.

- If you have excellent credit and consolidate your debt with a five-year loan at 7.5%, your monthly payment would be only $601, and your total interest payment would be just $6,068. If you reduce your payment schedule to four-years, you would pay about $720 per month and save even more money. Your total interest payments would drop to $4,818.

The following graphs show your monthly payments and overall interest payments for a five-year and 30-year loan:

Low-Interest Mortgage Credit Consolidation Loan

You don’t mention whether you are a homeowner, and if so, do you equity in your home. If you are looking for a low-interest rate debt consolidation loan with the lowest possible monthly payment, then a long-term mortgage is your best alternative.

It is possible to get a conventional loan with a credit score as low as 620 and an FHA loan with a credit score of 580. Since a mortgage loan is available for up to 30-years, your monthly payment for a $30,000 would be as low as $161 at 5%, or $180 at 6%. Naturally, your overall costs would be quite high, assuming that you don’t prepay the mortgage. Although most borrowers pay off their loans early, the total scheduled interest payments on a 5% interest rate for 30-years would be close to $28,000.

Before you consolidate your unsecured credit card debt, consider if you have sufficient equity in your home. You are transferring some additional risk into your home in the case of default.

Low-interest Rate Credit Card Alternatives

If you can’t qualify for a low-interest rate debt consolidation loan or are not sure if that is the best alternative, then check out Bills.com innovative tool, the Debt Navigator. With just a few questions and a soft credit pull that does not affect your credit, you get a personalized recommendation with up to five different debt consolidation offers, including personal loans, mortgage loans, credit counseling, debt settlement, and bankruptcy.

Review your debt consolidation options

Not sure how to consolidate your debt? Get a free debt consultation now.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836