- Consolidating credit card debt can save you money and simplify paying your bill.

- Credit card debt consolidation can help put you on the right financial path.

- It is crucial to find a program that matches your financial situation.

- Start your FREE debt assessment

Is Credit Card Consolidation a Good Idea?

Are you tired of watching your credit card debt grow? Maxing out your credit lines? Or just, paying back too many bills?

Credit cards are not only useful, but they are also a basic necessity in today’s marketplace. If you want to order items online, rent a car, or take a vacation you will need a credit card. However, many households run up big credit card debt due to financial hardships or poor financial management.

There are many different types of debt including credit card debt. Of course, you don’t have to build up credit card debt, but many consumers do utilize their line of credit.

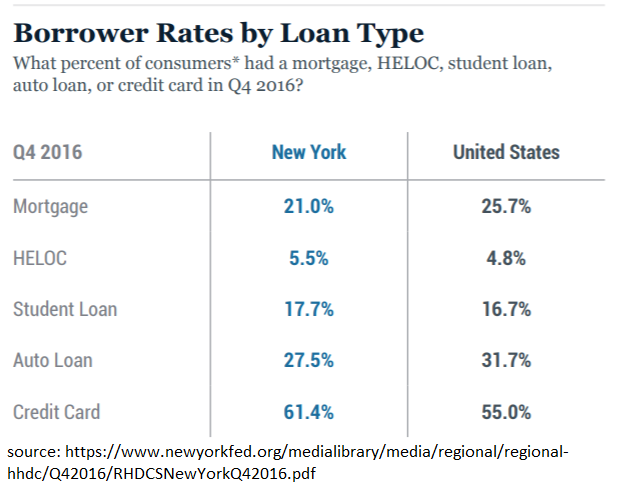

In fact, according to the New York Federal Reserve's Regional Household Credit and Debt Snapshot, credit card debt was the most popular type of credit.

Nationally, for the Fourth Quarter of 2016, only 26% of consumers had mortgages, whereas almost 54% of consumers had credit card debt.

The NY Fed also estimated the average credit card debt, for those consumers that had credit card debt was $5,700.

There are various ways to consolidate debt, including personal debt consolidation loans, home equity or cash-out mortgages, balance transfers, credit counseling, and debt settlement. Credit card consolidation is a viable option for many consumers; however, you should carefully check to see the reason you should consolidate your credit card debt and then match that reason with the right consolidation program.

Get Help with Credit Card Consolidation Debt Relief

If you are struggling with your monthly payments and are looking for to consolidate your debt, then get a free consultation with a Bills.com debt provider.

Three Reasons to Consolidate Credit Card Debt

There are different reasons to run up credit card debt due to varying financial situations. Some people mismanage their finances and end of paying high interest rates and hefty credit card fees. Others use their credit cards instead of leveraging their home and taking out a long-term low-interest loan. Many people run up credit card debt due to a financial hardship caused by a drop in income, job loss, divorce, or severe medical hardship. Their only short-term option may be to use a credit card and wait for better times.

The primary goals when considering to consolidate your credit card debt are saving money, creating more affordable payments and simplifying your bill payment process. Credit card debt consolidation can save you money, by reducing your interest and allows you to pay the debt off faster. Consolidating your credit card bills simplifies your payments because you'll only have one bill to pay. A third goal to consider is affordable monthly payments.

When choosing the type of debt consolidation consider your goals and the underlying reason you are consolidating credit card debt. Then, you can search for the most appropriate program. A debt consolidation loan is just one of the possible solutions and is not the best one for each case.

Here are three reasons to consider credit card consolidation including appropriate tactics to help you get debt free.

Poor or Sloppy Financial Management: If you are paying high interest rates and just making minimum payments, but have good credit, a substantial income or assets, then you are paying too much for your credit card debt.

Credit Card Consolidation Solutions: Look for a personal debt consolidation loan. If you have good to excellent credit, then you can get a low-interest rate and pay off your debt over a short-term, generally between 2-5 years. Remember, to get your budget in order and don’t run up your debt again.

If you have a home with equity, then consider talking out a cash-out refinance mortgage or a home equity loan, which offer a low monthly payment and low-interest rate. However, since they are long-term loans, you will end up paying more interest over the life of the loan. One other possible solution is a balance transfer, which allows you to take out a new credit card and pay off older ones. Generally, these cards have 0% introductory rates but as the CFPB warns: "The promotional interest rate for most balance transfers lasts for a limited time. After that, the interest rate on your new credit card may rise, increasing your payment amount."

No Financial Plan, or Temporary Change in Situation: Do you have a budget? Maybe you don’t have a sufficient rainy day or saving funds, or have a sudden loss of income, or emergency bills? Can you afford your minimum payments but have high interest rates? A lack of a financial plan or a sudden temporary change in your financial situation is common reasons to consolidate credit card debt.

Credit Card Consolidation Solutions: A Credit counseling program will offer you professional help to organize your budget and implement a financial plan to improve your situation. If appropriate, you will be enrolled in a Debt Management Program (DMP) that offers one payment to your creditors at negotiated lower interest rates. This plan is a good alternative if your credit is not good enough to get a debt consolidation loan.

Financial Hardship: If you have suffered a loss of income, medical hardship, or other personal hardship, then most likely you have turned to credit cards to help tide things over. Maxing out available lines of credit and falling behind on payments will cause a drop in your credit and a ton of stress. You will not be able to get a credit card consolidation loan; however, you should consider other debt consolidation programs.

Credit Card Consolidation Solutions: The best solution depends on your overall financial situation and the amount of stress you are willing to withstand. One program, debt settlement, will help you negotiate your credit card debt, lower your monthly payments, but leave you with the possibility of dealing with debt collectors and possible legal battles. If you are seriously struggling and cannot afford the monthly payments, then consider a bankruptcy. However, it is difficult to qualify for a Chapter 7 liquidation bankruptcies, and Chapter 13 often have high monthly payments.

Get a free debt consultation now

Use Bills.com Debt Navigator To Find Ways to Consolidate Credit Card Debt

Should you consolidate credit card debt? Let Bills.com innovative tool, the Debt Navigator, help you find a debt consolidation program that fits your budget, income, credit, and financial goals. The tool is free and only requires a soft credit pull that doesn't affect your credit score.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.