Learn About Taking Steps to Fixing your Credit

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 7 min read

- Fix your credit by dealing with past debts, and creating a plan for the future.

- Take out your credit report and fix bad items.

- Fix your credit by paying off your debt.

- Start your FREE debt assessment

Fixing your Credit: Yes, you Can!

Bills.com receives many questions about bad credit, disputing credit entries, and queries on fixing bad credit. Some readers want to purchase a house or refinance their mortgage loan but their bad credit makes taking out a mortgage loan impossible or very expensive. Other readers have bad credit and are in the midst of the collection process, ranging from harassment by collection agents to court judgments, which lead to wage garnishments, bank levies and liens on their personal property.

Often, bad credit is due to bad spending and financial practices and habits; however, bad credit can also be due to unexpected circumstances, like sudden unemployment, drop in income, or sickness and heavy medical bills. No matter what the reason for you having bad credit, it is important to get on the right track to fixing your credit.

By following the advice in this article, you can achieve the following goals:

- Deal with past items: This includes disputing inaccurate tradelines on your credit report, and dealing with debt in the collection process. By taking care of old debt, you may hurt your score in the short term. However, by retiring debt, you will help your DTI (Debt-to-Income) ratio, which will help you qualify for new loans, once you improve your credit score.

- Correcting your Credit Report

- Dealing with Debt in Collection

- Correct future behavior: This includes steps to improve your credit score, budget correctly and get yourself out of the debt cycle. Create new spending and financial habits for the future.

Correcting Your Credit Report

When dealing with past items start with your credit report.

Taking out your credit report

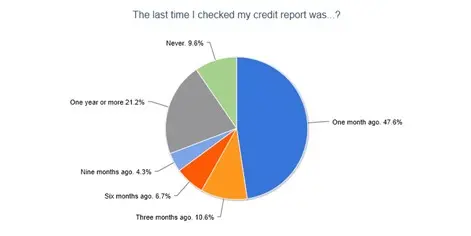

According to a recent Bills.com survey, 47% of the respondents indicated that they had checked their credit report in the last month. This perhaps is not surprising, since many of the respondents are facing credit problems. However, 21% of the respondents had checked their credit report more than one year ago and 10% never checked their credit report. Here is a chart showing the results of the survey:

You can receive a free copy of your credit report at AnnualCreditReport.com, where you are entitled to one free report from each of the three bureaus every year. I recommend that you stagger your requests, accessing one report every four months in an alternating fashion. This report will not include your credit score, which you will either have to pay for, or sign up for a free introductory service, and cancel before the subscription kicks in. The free copies will not influence your credit score; however, whenever creditors, or you, take out a full copy, this can lower your score.

Quick tip #1:

Get your Credit Score for free.

Your first step to fixing your credit is to review the tradelines that exist on your credit report. Your credit report includes all of your current debt, along with all satisfactorily paid-off past debts. Bad credit items, often-referred to as derogatory items, will remain on your report for 7 years, after the initial 180 days from the initial delinquency. This included debt or reported bills that have been reported as delinquent, charged-off, or paid off. Other items reported on your credit report include public records, such as judgments, tax liens, and bankruptcies. The period that these items can stay on your report vary, and be longer than the 71/2 years.

Credit bureaus operate under federal and state law. If you have problems or complaints, then contact these government agencies.

- FTC regulates the activities of the credit bureau. Important tip from the FTC Web site: "No one can legally remove accurate and timely negative information from a credit report."

- The newly created CFPB (Consumer Financial Protection Bureau) has begun to monitor their activities, gather consumer complaints and set up a system to insure honest industry standards.

Methods to Fixing your Credit report

Once you see an item on your credit report that is a negative item, you can fix your credit report using one of these tools:

Dispute an item: This works for items that were not correctly reported, such as an item that did not belong to you. Read the Bills.com article about how to do a dispute.

Settle your debt: If you have an item that is delinquent, and still active, then you can attempt to negotiate a settlement with the creditor. Thiss will not immediately improve your score, since the damage has already been done; however, it is better to have a paid in full (or even settled payment) than an outstanding debt. Be sure to check the statute of limitations before settling debt.

Debt validation: Anytime you receive a collection letter and are not sure if you really owe that money, then immediately send a debt validation letter (within a 30-day period). The collection agency must follow the procedures as set out by the FTC and desist from collection activities until it has sent out proof of the debt. These items may have already appeared on your credit report, and sometime they will show up later, as debts are often sold from a creditor to a collection agency (and between collection agencies).

You have probably heard of Credit Repair companies that offer their services, for a fee, to dispute your items and clean up your credit report. The FTC discourages consumers from using a paid service, and offers instructions on how to dispute a credit report. The three main credit-reporting agencies also provide on-line credit dispute instructions and links. I recommend that you read the Bills.com article about Lexington Law Review, a Credit Repair servicer, as well as the many comments left by readers.

Dealing with Debt in the Collection Process

Sometimes, dealing with debt, in the short run will cause damage to your credit. However, doing nothing is not an alternative, as the collection agencies will be pounding on your door, and flooding your mailbox and phone with messages. Eventually the creditor will sue you and seek a court judgment. If you want to achieve a real long-term effect then you will need to clean up the bad credit accounts.

Your debt relief alternatives will differ based on your situation, and each one will have a different effect on your credit and the period it will take to fix your credit. The chart below shows you the debt relief options, what effect they will have on your Credit Score and the period it takes to finish the process.

| Debt Relief Option | Negative Effect on Credit | Time frame |

|---|---|---|

| Debt Management | Minor. You might have some delinquent accounts at the beginning and a mention of being in the plan will be recorded on your credit report. | It takes about 5 years to finish the program. |

| Debt Settlement | Strong. You will have many accounts marked as delinquent. | It takes about 2-4 years to finish the program. |

| Bankruptcy | Very Strong. The Bankruptcy is recorded on your credit report. | It depends on the type of bankruptcy, Chapter 13 or Chapter 7. There is a waiting period between 2-7 years to receive most new loans. |

Fixing Your Credit: Debt in the Collection Process

Quick tip

#2: Contact one of Bills.com's pre-screened debt providers for a free, no-hassle debt relief quote.

Improve Credit Scores and Credit Ratings

Fixing your credit means dealing with the past issues and creating a financial plan to avoid getting back in debt. If you want to improve your credit score, make sure to take the necessary steps.

- Keep and maintain your budget. Making payments on time is the number one factor in your credit report. Make sure you make the payments, without taking on debt.

- Control your credit utilization. Keep your balances down to the minimum. In general, don't close a card, but put it aside and don't use it. If you want to close accounts due to high fees, then do it gradually.

- Have a mixture of accounts. Build up your credit score by taking out small installment loans, credit cards, and a manageable auto loan.

- Most importantly pay everything on time.

Most anyone, even someone who has just completed a bankruptcy, can build a good credit score in a couple of years by taking the proper steps. For more details and tips, read the Bills.com article about how to improve your credit score.

Credit, like reputation, is something that you need to work hard on to build up, maintain and protect. When your credit is damaged, it can affect different facets of your life. By dealing with Bad Credit correctly, you can improve the quality of your life, by saving money and opening up more opportunities. Bills.com has a wealth of information about credit, credit reports, and credit solutions, which can help you deal with Bad Credit.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836