Budget Guide - A Free Guide to Managing Your Budget

Using a Personal Budget Guide

| Bills.com Budget Guide |

|---|

| The Need for a Budget |

| Creating a Personal Budget |

| Your Budget Worksheet |

| Analyze Your Cash Flow |

| Eliminating Unhealthy Debts |

| Setting Long Term Goals |

| On the Road to Financial Freedom |

The Need for a Personal Budget

Why do Americans need a personal budget?

Each and every one of us chooses how to use our money. Making wise money decisions isn’t easy. What’s smart for one family just might break another family’s bank. Day to day, we spend money on both basic necessities and also on non-necessities that are sometimes luxuries. Some expenses blur the lines. For example, we all need to eat, but do we need to eat lunch at a restaurant every day? Besides using money for consuming, it is up to each of us to build a solid financial future, by using some of our money for savings, investments, and asset building. The best way to build a solid financial future and to actually build wealth is to have a solid game-plan. You can’t have a viable game-plan without a personal budget. Bills.com has created this free budget guide to help you get started.

Download the Bills.com Personal Budget Guide & Budget Worksheets

Get the full printable Bills.com budget guide:

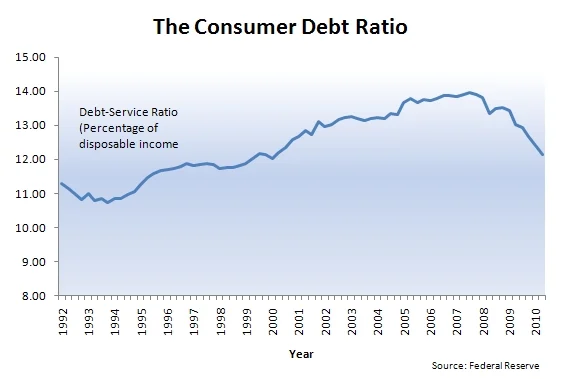

Fueled by an increase in credit card usage and record debt levels, the average American is spending more and saving less than ever before. Credit cards and lender financing allow us to purchase things beyond what we have in the bank or what we can just plain pay off. That gives us convenience and the ability to buy larger ticket items, like cars and homes, but it also means that if you are not careful you can easily accumulate a significant amount in debt. Due to increased spending, the ratio of consumer debt to income reached an all time high in 2007, according to the Federal Reserve. More American families today are experiencing financial hardship, some of them serious enough to lead to bankruptcy. Although the average consumer debt has decreased recently, many Americans are still struggling financially and looking for a way to get out of debt. If you are struggling with debt, review our free budget guide materials below and attached, and also review our tips on how to consolidate debt.

The Importance of a Personal Budget

A first step you can take to improve your financial health is to develop your own personal budget. Your budget will help you figure out what you can afford, where your money is going, set appropriate spending targets and really plan for a solid financial future. Having a well managed budget can also help you reduce your debt and avoid getting into deeper financial trouble. Many people without a budget do not realize how quickly and how easily they spend their money. A latte may only cost you $3.00, but purchasing one every day adds up to more than $1,000 per year. If you have the income level to support your expenses, then get all the lattes that you want, but if you are in debt and don’t know where your money goes every month… then now’s the time to get into money shape!

Making and following a budget helps you understand how you spend your money. It forces you to breakdown your expenses by specific categories (e.g. housing, transportation, food and clothing, entertainment, etc.) and can help you set appropriate targets for your cash flows. A budget also helps you identify areas where you can reduce spending, so you can trim your debt and use your money most effectively.

Your budget is your financial plan; you set limits on the amount of money that you will spend on each category of expenses in a given month. Setting limits keeps you accountable on how much you can spend on each category and can prevent you from spending excessively. Once you develop a budget, you must continue to update your budget regularly. Like going to the gym, it is not enough to go once and think you will be fit. It’s a little like a diet too. You don’t just decide to lose weight. You come up with a plan, and then you stick to it!

Use your budget to plan for your future. When used properly, your budget will help you spend wisely and achieve your financial goals, such as reducing your debt, saving for big-ticket purchases, paying for college education, starting a business, or building a retirement fund. A strong budget can also provide peace of mind, since you will feel and be in control of your financial destiny — a very liberating feeling.

Here at Bills.com, we’ve developed this free personal budget guide to help you take that first step to better money management — and like any great journey, the first step is the most important — but you need to make the commitment to take that step and let us point you in the right direction. The goal of this budget guide is to help you:

- Create a personal budget and analyze your actual expenditures

- Eliminate “unhealthy” debts

- Set long term financial goals

- Meet your long-term goals and feel in control of your financial destiny

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.

7 Comments

You are welcome to call a Bills.com Money Coach for a free consultation.

Thanks. This helped me understand.