Budget Guide - Analyzing Your Cash Flow

Analyzing Your Cash Flow

| Bills.com Budget Guide |

|---|

| The Need for a Budget |

| Creating a Personal Budget |

| Your Budget Worksheet |

| Analyze Your Cash Flow |

| Eliminating Unhealthy Debts |

| Setting Long Term Goals |

You have worked hard to prepare a detailed personal budget worksheet. You can now see if your cash flow is positive or negative and by how much. Your first budget worksheet will not be fine-tuned. It is likely that you have left out some expenses. For this reason, you need to prepare worksheets for a three-month period. Your month-to-month adjustments will improve your worksheet’s accuracy. Completing the worksheet for a number of months also gives you a solid basis for comparing your projected income and expense totals with your actual totals.

As you work through your worksheets, keep in mind the following questions:

- Am I cash flow positive or negative?

- How do my actual income and expense figures compare to my projected figures?

- Am I properly allocating my resources in order to pay down my debts and to build my savings?

Positive vs. Negative Cash Flow

Are you making more than you spend each month? Great! But, is there an area where you did not realize you are spending so much money? In which areas can you spend less?

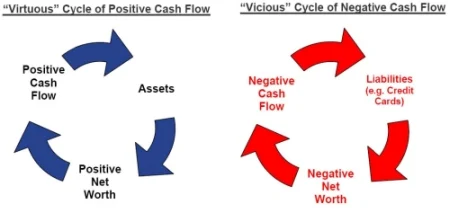

Although your monthly cash flow is an important indicator of your financial situation, you should also review your total liabilities and assets. It is possible for you to have a positive monthly cash flow, but also have a lot of debt. With credit cards, you are only obligated to make the minimum payments on your debt. If you are running up your credit card debt, you may find yourself still able to make the minimum payments and remain cash flow positive. Keep in mind that increasing your debt load will not only decrease your net worth, but also increase the amount you have to pay in interest and debt costs. Use your positive cash flow instead to pay down your debts and become debt free.

If you are spending more than you make, you should reduce your expenses. Review your budget worksheets carefully and determine areas where you can improve your cash flow. If you are getting by through running up credit card debts, you could face serious financial trouble in the future if you cannot reduce your expenses.

Projected Budget vs. Actual Cash Flow

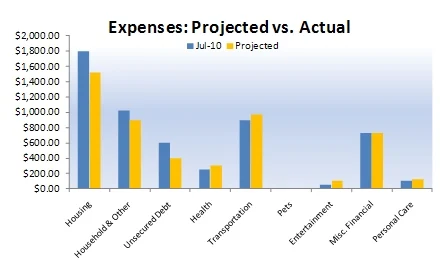

Compare your projected budget against your actual cash flow. This helps you identify areas where you may have over budgeted or under budgeted. It can also reveal categories that you are struggling with and overspending. For example, you may have allocated $150 for entertainment but in reality you may have spent $300. Don’t be discouraged if your numbers do not match initially. Instead, use the information to identify why you overspent or why you budgeted the wrong amount. Remember that continuing to compare what you planned and what you actually spent will, over time, improve your projected budget’s accuracy and strengthen your discipline for sticking to your planned budget.

A helpful way to view this comparison is demonstrated by the chart below. It illustrates one family’s projected versus actual monthly expenses. Note that the family exceeded its projected budget in housing, household expenses, and unsecured debt.

The next step for this family, and for you as you compare your expenses, would be to:

- Carefully review any areas in which the actual expenses exceed the budget projections.

- Review the section “Allocate Your Money Wisely.” in "Creating a Personal Budget"

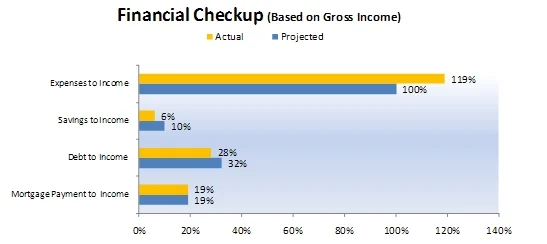

Because home expense is most people’s largest expense, the following chart focuses on home debt as a percentage of income. Revolving and unsecured debt is also included, because those debts are also used to determine your debt-to-income ratio, when applying for a mortgage. Savings are included because everyone needs to devote funds to savings, for short and long term needs. Use these indicators to help you analyze your cash flow and make the appropriate changes in your spending habit.

| Financial Parameter | Rule of thumb (should be indicated in your projected budget) |

|---|---|

| Total Monthly Cash Outflows to Gross Income | 100% |

| Saving to Gross Income | 10% |

| Total Monthly Debt Payments to Gross Income (includes mortgage, credit cards, auto loan, student loan) | 44% |

| Monthly Mortgage Payment to Gross Income | 31% |

This graph illustrates the family’s actual performance in the same categories.

Paying Down Debt and Building Savings

By creating your personal budget, you have fine-tuned your cash flow management, improved your financial position and increased your cash flow. You can then use the money to pay down debt, save money in a rainy-day fund for emergencies, or build an investment portfolio. Proper savings and investments allow you to plan for and realize expensive goals such as a buying a home, paying for a college education, or building a solid retirement fund. While this may seem complicated at first, it really boils down to four relatively simple steps:

- Spend less than you make.

- Have at least 4 months of your net income set aside in case of emergency or sudden loss of income or illness.

- Invest your available cash flow in assets that appreciate to create long-term wealth.

- Continually evaluate and re-assess, so that your financial strategy remains intact.

Very few people tread financial water; they either are moving forward or they are drowning. With proper budget management, you increase your chances for leaving debt behind and building a solid financial future.

Sticking to your personal budget

Developing your budget is only the first step towards an improved financial situation. Once you have set how much you plan to spend each month, the hardest part will be sticking to your plans. Take the following steps to help you stay on track:

- Continue to track how much you spend

Just because you’ve calculated the amount you spent before, does not mean you should stop tracking your expenses. Continue to monitor your spending and see if you are tracking towards the goals you set. Make monitoring your financial health part of your routine.

- Use online budget tools and bill pay Tracking all your expense, bills and receipts can be cumbersome. While the old-fashioned manila envelope system works, it makes sense to leverage today’s technology and use online bill pay and online budget tools which will automatically record your transactions online for you. This can save you time and improve your organization. Look at tools such as Mint, Mvelopes, Buxfer, or Budget Tracker.

- Set reasonable goals Don’t expect to change your spending habits overnight. Set reasonable goals you think you can achieve. If you spent $100 on movies each month before, aim for $75 instead of $10 at first. If you find your initial goal too easy, set a harder goal for yourself next month. By achieving your goals, you’ll begin to gain momentum and build the motivation you need to change your financial lifestyle and then to keep it in good shape.

- Reward yourself From time to time, reward yourself for meeting certain milestones. This helps keep you motivated. Of course, do not reward yourself excessively and dissipate your savings. For example, if you had saved $200 by dining out less, treating yourself to a $200 meal as a reward will leave you in the same position you started in.

Other money saving tips to help you reach your budget goals:

- Use cash or a debit card instead of credit cards to avoid spending more than your income

- Use a shopping list and purchase only the items you planned to buy

- Compare prices, especially for expensive items

- Use coupons

Back: Your Budget Worksheet Next: Eliminating Unhealthy Debts

Download the Bills.com Personal Budget Guide & Budget Worksheets

Get the full printable Bills.com budget guide:

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.