Finding a Credit Card Debt Elimination Program

- Don't neglect your credit card bills, they will not just go away.

- Set the foundations to eliminate credit card debt with a budget.

- Pick a debt elimination program, based on you financial situation.

- Start your FREE debt assessment

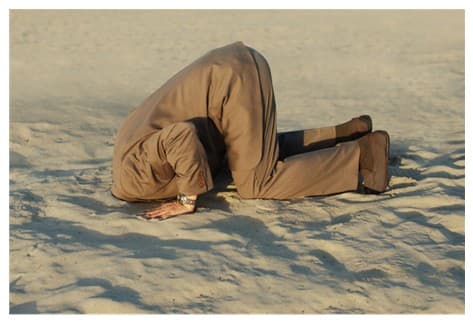

Credit Card Debt: Ignoring Doesn't Eliminate!

Burying your head in the sand, covering your ears, or putting on a blindfold are good tactics to ignore a problem, not eliminating one. One credit card debt elimination plan that does not work is ignoring it. Receiving a credit card bill, default notice, collection letter or court summons and throwing them in the trash bin does not eliminate the credit card debt.

There are ways to deal with your situation and credit card debt elimination programs do exist. In order for you to deal with your credit card, take the following steps:

- Create the Foundations for a Credit Card Debt Elimination Plan

- Choose a Credit Card Debt Elimination Program

- Keep on the Path and Avoid Scams

Credit Card Debt Elimination Plan - The Foundations

Being proactive, learning about your financial situation, and setting your goals are the first steps in your credit card debt elimination plan. If you don’t know what you owe, then you will not be able to figure out the best way to eliminate it.

Using credit cards wisely, can help you purchase items or pay for emergency expenses in installments. However, a wise use of credit cards means that you have figured out how to pay the debt back. You have set up your budget that includes costs for servicing debt, paying monthly expenses, and (if not immediately, then as a long-term goal) putting money in a rainy day fund, as well as building investment and retirement accounts.

Two essential parts of a credit card debt elimination plan are:

- Figuring out where the funds are coming from to pay off the debt.

- Avoiding new unaffordable debt.

By writing down all your debts and setting up your budget, you have prepared yourself to choose the best credit card debt elimination program.

Quick tip

The Coach gives you a big Thumbs Up for paying attention and not ignoring your problems. Use Bills.com Debt Coach to get an evaluation, based on your financial situation, of debt relief options appropriate for you.

Choose a Credit Card Debt Elimination Plan

The pace that you can pay off your debts will depend on the funds you have available and the type of credit card debt elimination program you use. Since you have already evaluated your financial situation, you know exactly how much you can afford to pay. You also know what kinds of assets you have available to utilize towards paying off your debts.

The chart below shows five different ways to eliminate your debt, based on your financial situation, going from a strong financial position to a weak financial position (strong hardship). Although simplified, it will point you in the direction that will help you eliminate credit card debt.

Choose the program right for you by looking at the chart below:

| Your Financial Position | Debt Elimination Plan | Debt Elimination Program |

|---|---|---|

| Strong asset position and Strong cash flow | Lump sum or accelerate payments | Use your own funds |

| Strong asset position and Medium cash flow | Trade credit card debt for other debt | Cash-out mortgage refinance |

| Weak asset position and Passable cash flow | Negotiate payoff terms on a five year term | Credit Counseling |

| No assets and struggling to pay | Negotiate settlement to pay off reduced balances and make payments during 2-3 year period | Debt Settlement |

| Some Assets and can't meet payments | Chapter 13 (five years) or Chapter 7 (immediate) bankruptcy | Bankruptcy |

Here is a brief outline of each Program:

Use Your Own Funds: The easiest plan to eliminate credit card debt is to take money out of the bank or sell an investment, and pay off your credit cards. (Don’t close the credit card accounts so as not to hurt your credit score). If you don’t have the assets, or prefer not to sell them, then make large fixed payments on all your accounts. Check out Bills.com minimum payment calculator to see how fast you can eliminate credit card debt through your do it yourself credit card debt elimination program.

Loan: Obviously, you are trading debt for debt. Although your long term financial costs will be high, you benefit from a structured affordable monthly payment and a lower interest rate. If you have good credit and equity in your house, you can eliminate expensive credit card debt with a lower interest rate cash out refinance mortgage. Be careful not to run up your credit card debt. Your house is an important source of equity. Make a long-term goal to be mortgage free at retirement age.

Credit Counseling: If you do not have assets to use to pay off the debt, your credit is fair, and you can manage to make fixed payments over a five-year period, then negotiating lower fees and interest rates is a good solution. Although you can do it alone, credit counseling and a debt management program is a good credit card debt elimination program. You will benefit from professional budget and financial instruction and a professional negotiating team. You consolidate all your credit card debts into one payment to the debt management company, who pays off your creditors each month. You have two benefits, lower financial costs and a structured payment plan.

Quick tip

If you need more help in finding the best debt elimination program, then contact one of Bills.com's pre-screened debt providers for a free debt relief quote.

Debt Settlement: If you do not have assets, are facing credit problems, but can manage to make payments over a 2-3 year period, a debt settlement program can negotiate a settlement for significantly less than what you owe. Make sure that you get a detailed free consultation to help you determine that you qualify for a debt settlement program and you can maintain your payments. You stop paying your credit card bills and make monthly payments into a special designated account in your name. When the debt settlement company reaches a negotiated settlement, you pay off the creditor and a fee to the debt settlement company. Make sure that you do not pay upfront fees.

Bankruptcy: Bankruptcy is a credit card debt elimination program for hardship cases. If you qualify for a Chapter 7 bankruptcy, your credit card debt will be almost immediately discharged. A chapter 13 bankruptcy sets up a court approved payment plan protecting your from creditors and discharging debt after a 5 year period. The details of a bankruptcy are complex. If your credit is severely damaged and you cannot afford to pay your creditors, then consult with an experience bankruptcy lawyer.

Avoid Scams & Stick With the Plan

Finding credit card debt elimination plans and programs can be easy. There are a lot of advertisements, fliers, and spam mail promising you quick and easy credit card elimination programs. Avoid any company that makes preposterous claims, such as these:

- Legally, you don’t have to pay back the credit card companies.

- You can immediately wipe out your debt without hurting your credit score.

- Banks are violating federal laws and won’t sue you.

Fraudulent credit card debt elimination companies have no problem lying to you AND taking fees without providing any services. By focusing on your problem, setting up a plan, choosing a program most appropriate you your financial situation, you can find reach your goal of eliminating credit card debt.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.