Make a Debt Reduction Plan that is Doable

- A debt reduction plan takes patience and perseverance.

- For some, debt reduction plans are easy to make and keep.

- If you have debt problems, use professional help.

- Start your FREE debt assessment

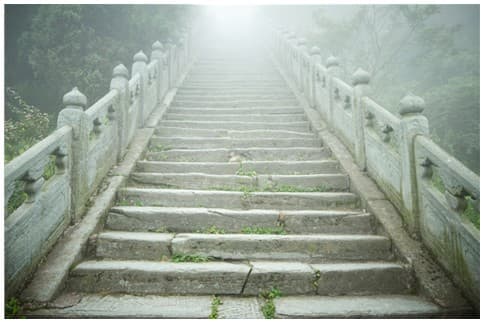

Debt Reduction Plan: 1,000,001 Steps to Debt Relief

Well, maybe not that many, but it can take many little steps to reduce your debt. For some it will be a short leap, and for others a long arduous path. The trick is to find the method most appropriate to your financial situation. Just as there is no manual to solve all auto, computer or health problems, so there is no one magical debt reduction plan.

The common point of all debt relief plans is to take the time to look at your problems and search for the answers. For some, the answer may be simple and take relatively little effort, whereas for others, professional help is called for.

There are many plans, five step, nine step, or just a list of common sense suggestions, like make more money, or pay off you debt quicker. No matter how you do it, your debt reduction plan is going to include these elements:

- Cleaning the Pathway - Analyze your situation and determine what can you afford

- Strategy: Set your Goals

- Tactics - Find a solution to meet your budget and goals

- Action: Take the little steps

Cleaning the Pathway - Analyze your Situation and Determine What you can Afford

If you have ample assets and good income, then debt reduction can be easy, by making larger payments on your loans and credit cards. For others, with less cash available, increasing the length of time of the loan to make more affordable payments will work best. No matter which debt reduction plan you choose, make it fit with your cash flow.

In order to begin, your plan needs to start with a comprehensive examination of your finances, and determine what you owe, what means you have to pay it back, and how much you can afford to pay each month.

Here are the general steps to take:

- Make a list of your debts, including the creditor’s name, balance, interest rate, monthly payment, and time to pay off debt. You can use Bills.com minimum payment calculator to help you calculate the payoff time for your credit card debt, using either the minimum declining payment schedule or a fixed payment schedule.

- Make a list of your assets, including its market value, loans associated with it, and liquidity.

- Make a list of you income and expenses. Keep a monthly budget that includes financial ratios to monitor your progress.

If you need help setting up your budget and financial analysis, then read Bills.com budget guide. If you find a do-it-yourself approach is too difficult, then seek professional budgeting counseling.

Strategy: Set your Goals

Looking at your situation helps you understand the debt of your problems and some of the tools available. Your next step in your debt reduction plans is to set your goals.

Setting your goals is a key to making a good debt reduction plan. Here are some examples of financial goals

- Pay off debt quickly

- Pay off debt cheaply

- Lower monthly payment

- Reduce financial stress and avoid lawsuits

- Maintain a good credit score.

Quick tip #1

Use Bills.com innovative tool, Debt Coach, to help you analyze your financial situation and recommend a debt reduction tactic most suited for you.

Tactical - Find a Solution to Meet your Budget and Goals

In order to achieve your goals, you will need to find a debt reduction tactic most appropriate to your situation. Here are the main debt relief options:

Maximize your payment schedule: If you have a positive cash flow and can afford to make larger payments then you can either accelerate payments on your installment loans (mortgages, student loans, auto loans) or make fixed payments on your credit card debt.

Loan Consolidation: If you have good credit then you can look into a personal loan as a means to pay off high expense debt. An unsecured loan is not cheap, although it offers the advantage of an installment payment, so you know that you finish with the debt over a 2-5 year period. If you also have equity in your house, then a cash out mortgage refinance is a means to get a low interest rate and/or low monthly payment. You can take a mortgage loan up to 30 years, and reduce your debt at a very slow pace.

Debt Management: A credit counseling and debt management program allows you to reduce your debt over a five-year plan. A debt management company negotiates lower interest rates and fees with your creditors, generally credit card companies. You pay back all your debt over a 5-year period. If you cannot make those payments, then don’t sign up for the program.

Debt Settlement: Debt settlement is a more aggressive way to deal with your debt, and is not appropriate for everyone. You stop paying back your creditors, and instead make monthly payments into a special designated account, in your name and control. The debt settlement company negotiates for a partial payoff of your debts. Once a settlement is negotiated, you pay your creditors and a fee to the debt settlement company. (Avoid upfront fees). It takes about 2-4 years to complete negotiations, so if you cannot afford to make monthly payments equaling about 1/42 of 70% of your debts don’t begin the program. Your credit will be adversely affected and your some creditors may try to contact you.

Quick tip #2

Get a professional no obligation consultation from one of Bills.com prescreened debt providers.

Two Examples

Example #1: Here is an example of a reader who sent in a question. They have pension income only, a house worth $285,000 with a mortgage balance of $137,000. They had unexpected credit card debt of $22,000 and cannot make the minimum payments. Their goal is to lower monthly expenses, even if their overall financial cost is higher. They are fortunate that they have steady income, good credit, and sufficient income to take a cash out refinance.

Example # 2: Another couple sent in a question as follows. Their income is barely enough to meet their monthly bills. They have credit card balances over $70,000 due to medical expenses. Their minimum monthly payment is $1,900. They want to pay off the debt as quickly as possible, even if their credit is ruined. They need to analyze their situation. A debt settlement debt reduction plan would allow them to pay off those debts over a 42-month period with $1100 per month payments.

Successful Debt Reduction Plan - Take the Little Steps

Debt reduction plans involve many small steps. It doesn’t help to analyze your financial situation, set your goals, and choose a debt reduction plan tactic, if you don’t follow through. Setting up a budget is great, but won’t help if you don’t follow through and monitor it. That means gathering documents, and bills, entering numbers in charts, and verifying that you are on course. It also means, not taking out new credit while reducing the current debt.

For some, with great credit and good assets, it is easy to make and keep a debt reduction plan. For anyone struggling or delinquent in payments, there are sometimes no great solutions. Seek professional help to analyze your finances, and find the debt relief option best for you.

Quick tip

Contact one of Bills.com's pre-screened debt providers for a free, no-hassle debt relief quote.

Free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Actual client of Freedom Debt Relief. Client’s endorsement is a paid testimonial. Individual results are not typical and will vary.