PMI: Buying a home with a low down payment

- Prepare yourself to take a mortgage loan.

- It is possible to buy a house with a small down payment.

- PMI: Private Mortgage Insurance can help you buy a house.

PMI: A Solution to Buying a House with a Small Down Payment

If you are a first-time homebuyer or looking to buy a house, then you most likely have asked the question: "When should I buy a house?" Qualifying for a mortgage loan requires planning and preparation. Many times the problem of an insufficient down payment is a barrier to buying. However, there are solutions, including a low down payment mortgage, or close to a no down payment loan.

One such solution is PMI or Private Mortgage Insurance. This insurance reduces the lender’s risk and lets you take a larger size mortgage loan, with a low down payment. With the meltdown of the housing and mortgage market, lenders have tightened their underwriting standards. However, to the right borrower, lenders are willing to offer a high LTV loan.

Taking a Mortgage Loan

Bills.com offers many valuable resources in helping you buy a house and take a mortgage loan, including a mortgage affordability calculator to help you determine a ballpark figure of what you can purchase, based on your down payment, income, and general debt.

Preliminary Steps:

Before looking into getting PMI, your first step is to analyze your financial situation and develop your housing goals. To buy a house, you must be able to have a large enough down payment and enough stable income to meet your long-term obligations.

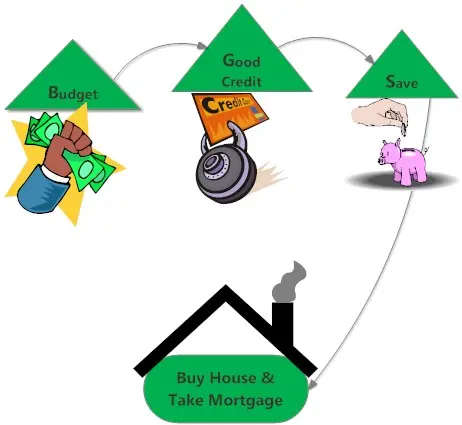

The Bills.com plan to buy a house:

First, check your financial status by following these three steps:

- Budget: Prepare you budget, know your cash flow, and manage your debts. (Pay attention to your Debt to Income Ratios).

- Good Credit: Monitor your credit report, and build up a good credit score.

- Save: Put money away in a rainy day account, saving for your retirement, and saving for your down payment.

It takes careful planning to accomplish these goals. Bills.com assists you with the free budget guide. Take time to use the budget guide. That is a good investment.

Example: Buying a House With a Low Down Payment

You wish to buy a house for $250,000 and need a mortgage loan. You have:

- A rainy day fund of $30,000 (about 6 months of living expenses).

- $10,000 saved toward buying a home.

- Total monthly gross income is $7000

- Current debt payments (auto, credit card) are $500.

- Credit scores around the 750 mark.

- Budgeted $1,000 toward your monthly savings for a home purchase.

Get a Mortgage Quote Now

When you are ready to shop for your mortgage and find the best mortgage rate, shop and get a Bills.com Quick Quote to be matched with some of the best lenders in the country based on your unique situation and needs.

With $10,000 saved for a down payment, you will be able to buy a house worth about $100,000. If you wish to buy a $250,000 house then you will need to save up enough for a low payment of at least $12,500.

| Down Payment | Need to Save Additional: * | Months to Save | Total Mortgage Loan | Monthly Payment (based on 30-year fixed, 4% interest |

|---|---|---|---|---|

| 20% | $40,000 | 40 | $200,000 | $955 |

| 10% | $15,000 | 15 | $225,000 | $1,074 + PMI costs |

| 5% | $2,500 | 2.5 | $237,500 | $1,134 + PMI costs |

| * Does not include closing costs for purchase and loan, meaning you need to save an additional 10% of the purchase price to cover your expenses. | ||||

If you wish to buy a house in just a few months, then you can do this with 95% financing using PMI.

Rent vs. Buy a House

This is not a one-time question, but one that you should review periodically, as your financial situation changes, and as the housing market changes. Buying a house is an important investment, and a long-term savings vehicle. However, it brings with it, like any investment, risks. If you need to sell at a time that the market drops, you may be subject to a larger loss. In addition, your flexibility in terms of moving is reduced. Rent, on the other hand offers flexibility in terms of moving, but due to job or school considerations, and due to economic considerations, such as a loss of income.

For more details read Bills.com article about renting vs. buying.

Buying a House: Options With a Low Down Payment

Once you have evaluated your financial situation, and determined that buying a house is the right decision, you now can look at the alternatives for taking a mortgage loan with a low down payment.

Here are three major alternatives:

- Subprime or Hard Money Loans: These loans are almost extinct in today's market. Even when they are available, they come at a high cost, both in terms of high interest rates and high origination and lender fees.

- VA or Homepath Loans: These are specific programs with very restricted eligibility requirements.

- Mortgage Insurance: Mortgage Insurance comes in different forms as follows:

- PMI (Private Mortgage Insurance): For conventional loans

- MIP (Mortgage Insurance Protection): For FHA loans. For more details, read the Bills.com articles FHA loans and MIP

- LPMI (Lender Private Mortgage Insurance): Like PMI but the lender arranges it and passes the cost to you through higher interest rates and/or fees. Read the Bills.com article about LPMI to learn more.

Private Mortgage Insurance

Private Mortgage Insurance is a confusing name to the borrower. We are all familiar with different types of insurance, like home insurance, auto insurance, life insurance and health insurance. All of those insurances help reduce risks that we face. Private Mortgage Insurance is different. Here is what it is and what it is not:

Private Mortgage Insurance is:

- A financial tool to help you buy a house with a small down payment.

- An alternative to bringing more cash to the purchase, letting you increase your LTV.

Private Mortgage Insurance is not:

- An insurance policy to cover your risk if you cannot make your payments.

- A policy that protects you against default and a deficiency balance.

PMI protects the lender's risk, so it can give you a low down payment loan. The lender has to pay to cover his risks, and those costs are passed on to you, the borrower.

It is Possible to Buy a Home with a Low Down Payment Using PMI

It is possible to buy a house with a low down payment. The lender takes more risks by giving a low down payment mortgage loan. The lender passes this risk to you, the borrower, in the form of a higher interest rate and/or fees (in a LPMI) or a "mortgage insurance premium" (in a conventional loan or a FHA loan). Remember, this premium is just another financial cost.

Before you consider taking a low down payment loan, prepare your finances. Make sure you use the Bills.com plan: Budget, Good Credit, and Save. Make sure that you have a steady cash flow that will meet all of your future obligations.

For more information on the costs and mechanics of Private Mortgage Insurance (PMI) see the Bills.com article: Cost of Mortgage Insurance.