Home Affordability | Price, Income and Home Opportunity

- Median Prices and Income vary greatly across the U.S.

- Some areas have more affordable housing.

- Las Vegas hit high Price to Income ratios during the housing crisis.

Buying a Home? Look at Local Home Affordability!

Editor's Note: This is the second article of a two part series about measuring home affordability. This article will show how the index varies by region, and then offer some practical examples of home affordability. The first article includes an overview and an analysis of a national home affordable index.

Recap: The National NAHB/Wells Fargo HOI Index

The NAHB/Wells Fargo Index tracks home affordability based on median home prices, median income, and mortgage interest rates. Their data includes a national index and regional based indices. The Ist Quarter 2013 index was 73.7, which according the NAHB press release means that:

"In all, 73.7 percent of new and existing homes sold between the beginning of January and end of March were affordable to families earning the U.S. median income of $64,400. This is down slightly from the 74.9 percent of homes sold that were affordable to median-income earners in the final quarter of 2012."

The National Home Affordability has been holding steady for the last couple of years.

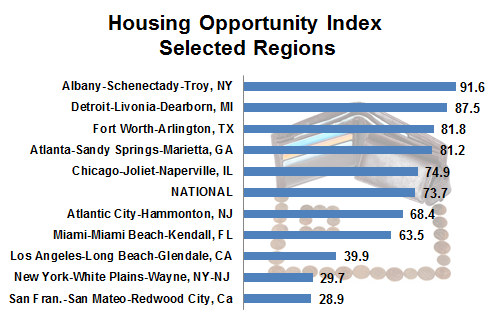

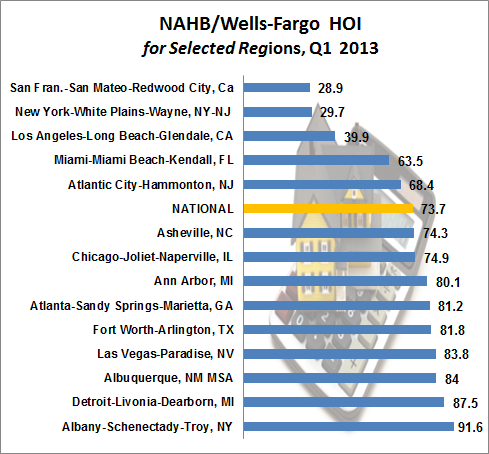

Home Affordability: Varies by Region

As you check home opportunity for different regions, you will see that there are big differences. In San Francisco for example only 29% of the population could afford the median priced homes, whereas in Detroit 88% could afford the median priced home.

The following graph gives a clear picture of how home affordability is affected by housing prices and income. The blue columns represent the Q1 2013 HOI for the different regions. The red line (scale on right side) shows the Price-to-Income ratio for each area.

You can clearly see that when home prices are much more than 3 times the median income, very few people can afford to buy homes. The San Francisco/San Mateo/Redwood City area in California has the highest prices and the lowest HOI index, with less than 29% of the population able to afford the median home price.

| NAHB/Wells Fargo HOI by Regions Home Affordability by Housing Prices and Income Q1 2013 |

The next chart shows the median home prices and median income for the different regions.

Home Affordability: Varies over Time

Alert image and text: One big lesson that all borrowers can learn is not to take on too much debt relative to their income. (If you are a borrower with weak income, but large compensating factors, then work out your financial plan before taking a mortgage).

As the HOI index dropped during the period of 2005-2007, the Price to Income Ratio increased. As the housing market bubbled, more and more borrowers took out mortgages and higher Price-to-Income Ratios. The result was a bubble that burst, leaving many borrowers left with unmanageable loans.

Make sure that you can qualify for an affordable mortgage. Get a mortgage quote from a Bills.com mortgage provider.

Mortgage Affordability: Las Vegas

Las Vegas is one region that was hit particularly hard by the financial crisis. Housing prices plummeted and many underwater borrowers could not afford their mortgage payment and were unable to sell their home.

The graph below shows the changes in median home price, median income and the price to income ratio over the last 10 years in the Las Vegas region. The rise in prices wasn't accompanied by a proportionate rise in income, causing very high Price-to-Income ratios in the crisis years.

| Chart: Las Vegas From Q4 2003 - Q1 2013 Median Home Price and Median Income (thousands of $) and HOI Index |

Source: NAHB/Wells-Fargo HOI Data

Image Alert: A high price-to-income ratio is a warning sign that housing is unaffordable. High-risk loans that artificially lower the beginning payments (interest only, teaser rates, home equity lines) may look affordable when they are not. Unless you are sure that your income will rise, avoid high-risk loans.

Bills Action Plan

Before you buy a home and take out a mortgage, carefully review your overall financial situation. Mortgage loans are long-term commitments. Here are some of the first steps to take:

- Prepare your finances by creating and keeping a budget.

- Keep your debt-to-income ratio low.

- Pay your bills on time.

- Study your local housing market.

- Learn about mortgage rates and avoid high-risk-loans.

- Save for a down payment and don’t overextend yourself.