Alternative Credit Data - More Opportunities

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 4 min read

- Millions of consumers have no or under three tradelines on their credit report.

- Traditional credit scores do not take into account many financial transactions.

- Alternative credit data and scores can help millions of consumers gain access to credit and loans.

- Start your FREE debt assessment

Alternative Credit Data Can Benefit Many Consumers

Do you have a low credit score? Or maybe you don’t use a lot of credit? You are not alone.

When you are shopping for a mortgage, auto loan, personal loan, or credit card, then you know that a lender will pull your credit and look at your credit score. Lenders have minimum credit score standards. If your credit history has late payments, delinquencies, or judgements, then you might be unable to get credit. However, maybe you pay on time, but just don’t utilize credit. Your credit score might be too low to be considered a good credit risk.

According to a recent Experian webinar graph, about 41% of the US population over 18 have a "thick" credit profile that has under five tradelines. These people can easily be evaluated using the traditional credit report and standard Credit Scoring models such as the FICO score or the Vantage Score. Another 25% of the US consumers over 18 have a "thin" file, with only 1-3 trades. There are 7% who have alternative data, but show up as "No Hits" on the traditional credit report, and close to 1 in ten consumers (9%) are "invisible" with no credit entries.

For many borrowers, especially non-prime and subprime borrowers, alternative credit data can open the market for more financial products and at lower costs.

Check Your Credit

Do you monitor your credit report? Do you know your credit score?

Make sure that you monitor your credit report by getting one free report each year from each CRA at AnnualCreditReport.com. If you want to more closely monitor your credit report, and also see your credit score, then sign up, for a free trial period, for a credit report with credit score.

What is Alternative Credit Data? What Alternative Credit Data is collected?

Credit Reporting Agencies (CRA), such as Experian, Transunion, and Equifax, collect data from mainstream banks and lenders regarding consumers credit history. This includes your tradelines, and any public records and bankruptcies. That information is collected and compiled on your (traditional) credit report. That information is the basis for the popular credit scores.

However, what if you don’t use credit cards or take out loans? Or maybe you have taken out payday loans, paid rent (that might be recorded), utilities, or taken out other financial products that are not reported to the CRA. Alternative credit data is any other form of financial data, or public records (such as rental history), that is not included in your credit report.

Here are some of the sources of information for alternative credit data:

- Non-traditional lenders: Online and storefront short-term unsecured personal loans, installment loans, and lines of credit. Rent to own. Title loans.

- Traditional Underbanked Financial Services: Non-prime and secured credit cards. Non-prime auto loans, Retail installment and POS credit, Finance company installment.

- Other Sources: Prepaid credit card, check cashing, debt collection, wireless producers.

Who Collects Alternative Credit Data?

In a 2016 report the CFPB issued a report about Credit Reporting Agencies. They mention four companies that collect alternative credit data for low income and subprime consumers: Clarity Services (Experian), CoreLogic Teletrack, FactorTrust (Transunion) and MicroBilt / PRBC.

These companies will provide a free credit report once every 12 months, freeze your consumer report (subject to state laws) if you request it., and allow you to dispute negative items. Experian, for example, stresses the fact that they are compliant with FCRA regulations, which help keep transparency and protect consumer privacy.

The other big CRA, Equifax, also offers alternative data services.

Minimum Credit Scores: Possible Boast with Alternative Credit Data

As anyone with a low credit score (near prime or less) knows, getting approved for a loan can be very difficult. Even if approved, the rates might be very high.

But, what if you took out payday loans to cover an emergency expense, such as an auto repair, or a medical bill, and your track record is impeccable. Suppose you can show that you pay your rent on time. Your utility bills are never late. Shouldn’t all that responsible behavior count for something?

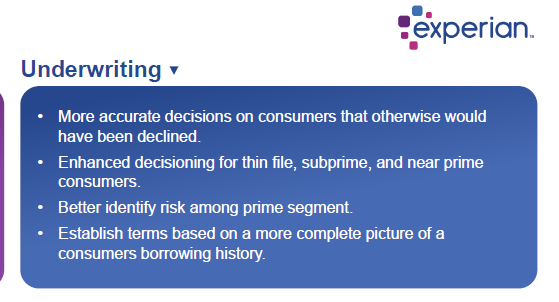

Here are some of the uses Experian claims that lenders can benefit from:

According to Experian, lenders who use alternative data, can increase their potential customer base, within the same level of risk. They claim that with the near prime population, instead of approving 10% of their population, lenders can increase that by 60%,

If additional information can help lenders make better decisions, then you the consumer will benefit. To truly benefit from alternative credit data, you will still have to show the lender that you take your financial commitments seriously and pay your bills on time. While, it is unlikely that alternative credit will help you get a mortgage, due to strict minimum credit score requirements, it can possibly help you get personal loans and access to other credit.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836