Finding a Mortgage You Can Afford

Can You Afford a Mortgage: Budget, Income and Debt

If you are renting or looking to buy a bigger home, then you will need to consider how much money you can afford to pay each month toward your housing expenses. Don’t account only for the principal and interest payments on the new mortgage. Include your monthly costs for will include your mortgage payments, property tax, homeowner insurance, and possibly mortgage insurance and homeowner association fees.

Tip

Keeping a budget takes time and preparation, but will aid you in reaching your financial goals. Check out Bills.com budget guide for help in starting and/or maintaining a monthly budget.

Here are some of the things you need to consider before you decide if you can afford the mortgage and monthly payments:

- Income: How much are you making each month on a regular basis? Is your income stable? Do you rely on overtime pay which might not always be available?

- Expenses: How much are your monthly expenses? Don’t forget to include seasonal and non-regular expenses. Some bills are not paid monthly, but need to be accounted for in your monthly budget.

- Debt: How much are your monthly debt payments? This includes your credit card debt, auto loans, student loans, personal loans and court ordered payments. If you have loans that are in deferment, then will you be able to afford the full payment together with your mortgage payments?

- Savings: Do you have an emergency fund? Do you have sufficient funds saved for a down payment and closing costs?

Quick tip

Learn today’s mortgage rates and offers through Bills.com mortgage rate tables. You can get a personalized quote based on your financial situation.

Can I afford this Mortgage? - From the Mortgage Lender’s Eyes

Feeling comfortable with your monthly payment is important. Never take a mortgage unless you’re confident that the monthly payments fit within your budget. Mortgage payments are not flexible and must be paid on-time each and every month. Your lender is going to take a snapshot of your current income and expenses. Lenders don’t account for future financial plans that will impact your ability to make your payment, such as college expenses or private schooling for your kids. That’s your responsibility.

It isn’t enough that you feel comfortable with your mortgage and monthly payments. You need to be able to pass the various tests and rules that mortgage lenders use to qualify you for a mortgage. Here are some of the basic questions that a lender will ask to verify if you can afford the mortgage:

- Income: Do you have stable income? Usually lenders look to see that you have two years of steady employment. If you just changed jobs, then bring this up with the lender. Changing professions might require a new two year period.

- Debt: Are you paying your debts on time? Is your debt level rising? Are you using up more of your credit lines? Be careful not to take on new debt or even apply for other credit, while you are in the mortgage application process.

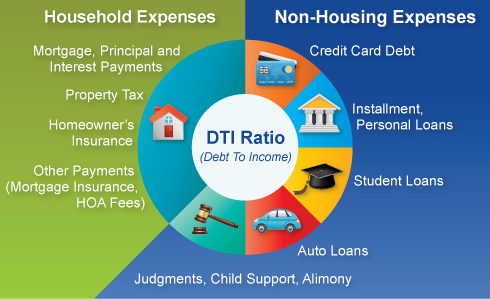

- Debt-to-Income ratio (DTI): What is your debt-to-income ratio (DTI)? There are many different DTI rule,s depending on the specific mortgage loan program you apply for and the lender’s own rules. A general rule of thumb is that your housing expenses (mortgage payment, mortgage insurance, property tax, homeowners insurance) should not be over 20-25% and your total debt payments (housing expenses and other monthly debt payments) should not be over 36%.

- Savings: Do you have down payment money saved and can you show where it came from? If it is gift money, your lender is going to ask you to document how long ago your received the gift. Do you have savings (reserves) to cover a few monthly payments? (Check with the lender what they require, but it is always a good idea to have an emergency fund).

Tip

The image below shows you the components a lender looks at to determine your monthly debt load. For more information read the Bills.com article about mortgage and creditworthiness.

Quick tip

Get a mortgage quote from a Bills.com mortgage provider.

Can I Afford This Mortgage - Your Checklist

Here is a handy checklist to help make sure that you are taking into account all the factors that determine if you can afford the mortgage:

| Complete? | Category | Tips | Your Information |

|---|---|---|---|

| Savings (or qualified gifts) for a Down Payment | All FHA loans require mortgage insurance; however with a 20% down payment, you can avoid Private Mortgage Insurance on a conventional loan. | ||

| Emergency Fund Savings | Make sure that you have at least 6 months of living expenses to cover emergencies. | ||

| Monthly Debt (includes auto loans, credit cards, student loans, and court ordered payments) | Pay off your credit cards monthly and avoid taking on new debt at the time you are applying for a mortgage. | ||

| Housing Expenses (check for the rates that are relevant for the area and property you are interested in purchasing). | Property Tax Homeowners Insurance Homeowner Association Fee (or other costs) |

Mortgage affordability checklist. Source: Bills.com

Bills.com is preparing a detailed mortgage affordability calculator. In the meantime, take advantage of Bills.com mortgage affordability worksheets. You can choose between:

- Can I afford this mortgage? Based on a specific home price.

- Can I afford this mortgage? Based on your income and your desired down payment/loan to value ratio.

Bills Action Plan

Plan, prepare, and make sure you buy a home with a mortgage payment you can afford. With mortgage rates rising, be extra careful. A house and mortgage payment you can afford today may become unaffordable if rates continue to rise.

Here are some steps to help you prepare:

- Prepare your budget.

- Keep your debt payments as low as possible, avoiding the minimum payment cycle.

- Learn how to qualify for a mortgage and Get pre-approved for a loan.

- Learn about mortgage rates today

Quick tip

Get a mortgage quote from a Bills.com mortgage provider.

5 Comments

I found a home, but interest rates went up. Can I still afford a mortgage? (Ch)

Should I allow my DTI to go as high as 45%.

Not such a good idea. I suggest that you check your Budget.